Features > Property News & Insights > Market updates

RBA lifts rates and won’t rule out further rises

KEY POINTS

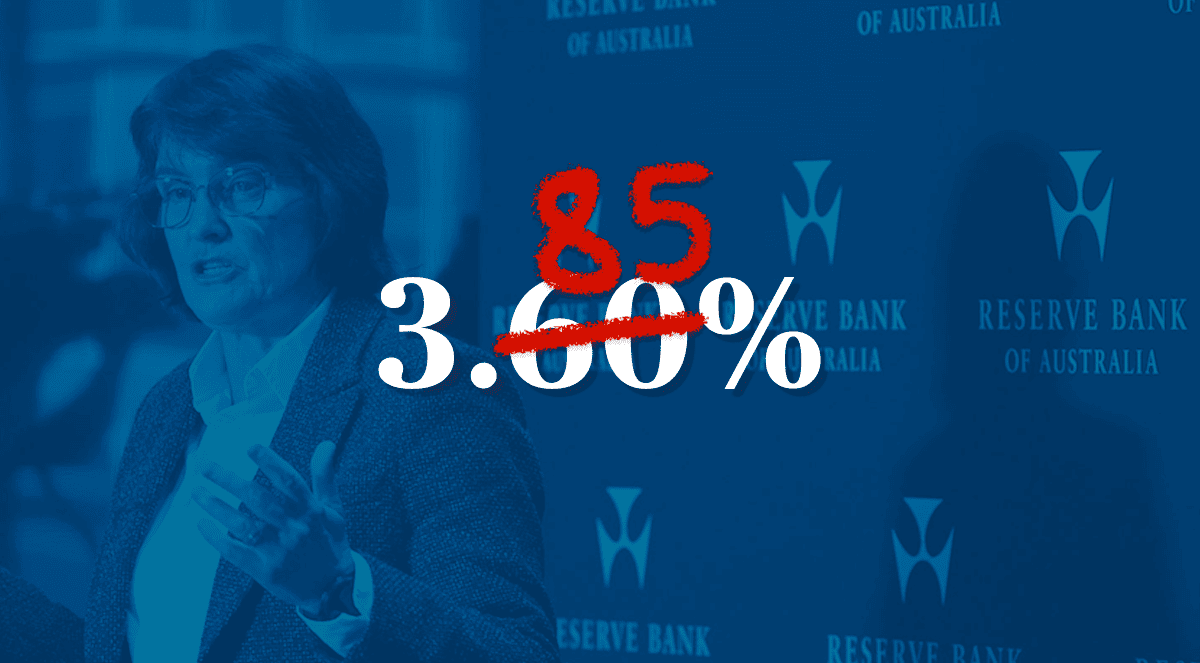

- The Reserve Bank of Australia lifted the cash rate by 0.25% to 3.85%, the first rate hike in two years, after higher-than-expected inflation and a tight labour market

- Governor Bullock gave no “forward guidance” on the likely path of future rates and did not rule out further rises but RBA forecasts suggest rates may need to reach 4.3% to return inflation to target by mid-2027

- Property economists expect home prices to keep rising in 2026, supported by low unemployment, population growth, first-home buyer incentives and tight supply

As widely expected, the Reserve Bank of Australia has raised interest rates for the first time in two years at its February 2026 board meeting, following renewed concerns about inflation and a strong employment market.

The RBA Governor, Michele Bullock, has also not ruled out raising rates again if needed.

The 0.25% rise in the cash rate to 3.85% comes just six months after the central bank lowered rates to 3.6%.

While the Governor wouldn’t be drawn at a media conference on how high interest rates may have to go, the RBA’s latest forecasts show the bank is assuming it may have to lift rates to 4.3% in order to get inflation back in check.

The details

The Reserve Bank of Australia says it was a unanimous decision among its monetary policy board members to lift the cash rate to 3.85% at its first meeting for 2026.

In a media release accompanying the decision, board members indicated that they had been surprised by the recent pick-up in inflation.

Quarterly data released last week by the Bureau of Statistics showed both headline (3.8%) and core inflation (3.3%) measures rising in late 2025.

“A wide range of data over recent months have confirmed that inflationary pressures picked up materially in the second half of 2025,” the media release says.

“While part of the pick-up in inflation is assessed to reflect temporary factors, it is evident that private demand is growing more quickly than expected, capacity pressures are greater than previously assessed and labour market conditions are a little tight.

“The Board judged that inflation is likely to remain above target for some time and it was appropriate to increase the cash rate target.”

The RBA is mandated to aim to keep inflation in Australia in a 2-3% target band - preferably at 2.5% - using interest rates as a tool to try to achieve this.

Cherelle Murphy, Chief Economist Oceania with EY, says the decision by the RBA to reverse course on interest rates just six months after cutting the cash rate is “quite unusual”, but she says it’s a stretch too far to say the bank’s last cut in August 2025 was a "mistake".

“To be fair to the Reserve Bank, that was not obvious at all at the time,” she says.

“In fact, it looked like the inflation numbers had been coming down quite nicely.

“Now, obviously, that's not turned out to be the case,” Ms Murphy says.

“It looks like they did certainly underestimate how bad those inflation pressures were.”

Cherelle Murphy says going forward, the RBA will be adjusting its inflation forecasts to take account of the underlying strength in the economy.

Indeed, the RBA’s latest Statement of Monetary Policy document, released simultaneously when the rate decision was handed down, seems to indicate the central bank now expects inflation not to return to the higher end of the 2-3% target band until mid-2027.

Accompanying that forecast is an “assumption” that the cash rate may have to be raised as high as 4.3% to bring inflation back to target over the medium term.

Implications for housing

If retail banks pass on the RBA’s 0.25% rate hike in full, variable mortgage customers on an average-sized loan of $700,000 stand to see an increase of around $110 in their monthly repayments, while those with a $1 million mortgage will have to make around $160 extra in repayments.

“I do understand that for mortgage holders, this isn't a great outcome,” RBA Governor Michele Bullock said at a press conference after the rate decision was handed down.

“Having said that… what's also not great for them or for anyone else is if inflation remains elevated, because every time they go to the shop, every time they go to buy their groceries, every time they go to get personal services… medical… if inflation is high, (prices are) going to keep going up.

“Ultimately, it is best if we get inflation under control, and our instrument is the interest rate.

“I understand that people with mortgages find that hard, but the alternative is potentially even harder,” the Governor said.

Despite a gloomy outlook for Australians with a mortgage, Angus Moore, the Senior Economist at REA Group - the company behind PropTrack and realestate.com.au - says he still expects home prices “to grow across 2026 on the back of last year's cuts and strong economic and housing fundamentals.”

“The unemployment rate remains very low, and population growth is solid amid relatively constrained new supply.”

However, he believes the higher interest rate climate will slow price growth, when compared to the 8.4% rise in dwelling prices PropTrack recorded over the past year.

Gerard Burg, the Head of Research at rival data house Cotality, also believes the housing market is unlikely to go backwards in the face of higher interest rates.

“Australian housing markets will be impacted by a range of headwinds and tailwinds in 2026,” he said.

“Affordability and serviceability pressures – only exacerbated by the rate hike – and slower population growth should temper demand to a degree, however, first-home buyer benefits have been extended and housing supply is likely to remain constrained.

“Construction and labour costs, along with labour availability, is limiting the new supply of housing across the country, with interest rates unable to influence this trend,” Mr Burg says.

He also points to listings of homes for sale remaining well below trend, “with uncertainty unlikely to draw potential sellers from the sidelines.”

Following the RBA’s move to raise the cash rate, money markets have increased their bets of another rate hike as early as May.

“It’s hard to avoid the conclusion that the RBA has in mind at least one more rate hike - consistent with current market pricing - because even under this scenario inflation is expected to remain uncomfortably high for the foreseeable future,” says Betashares Chief Economist David Bassanese.

However, ANZ’s head of Australian Economics, Adam Boyton, has a more optimistic view.

“We suspect, however, that the RBA may end up (marginally) pleasantly surprised on the inflation front,” he says.

“As a result, while the RBA’s base case might be that another hike is more likely than not, we think that today’s action from the RBA Board should end up being the only move this year.”

Let’s hope the latter view is right.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)