Features > Property News & Insights > Market updates

Government mulls tax “fix” that could worsen the housing crisis

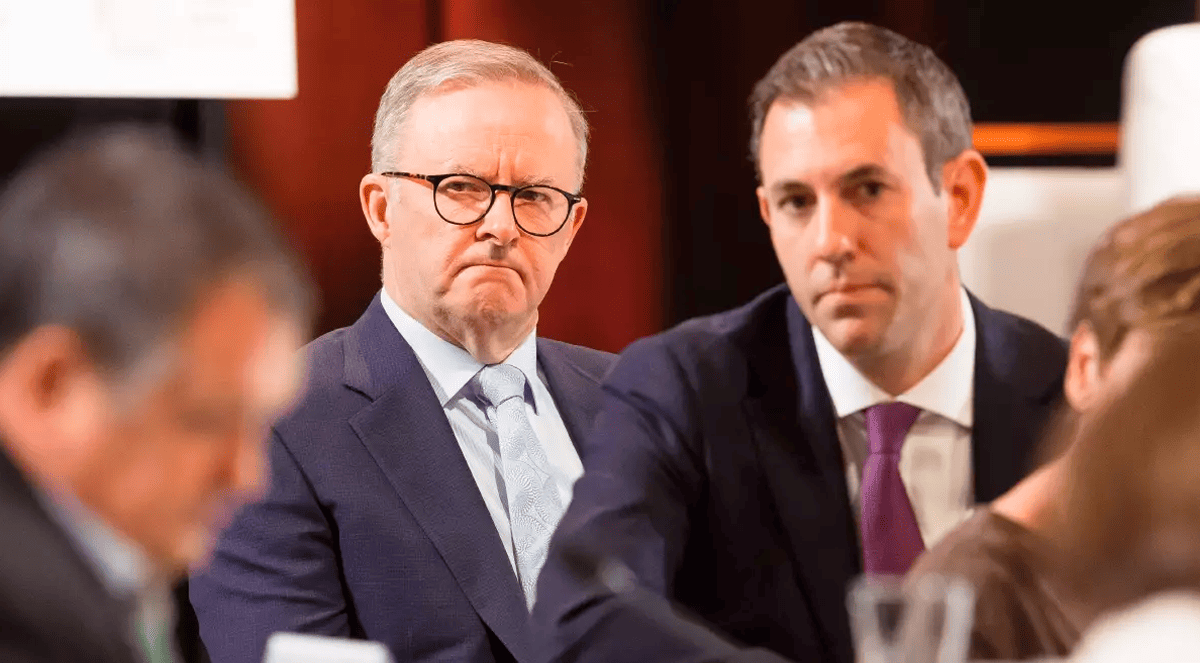

Image from The Canberra Times/Sitthixay Ditthavong

KEY POINTS

- The Federal Labor government is reportedly weighing up changes to the 50% Capital Gains Tax (CGT) discount ahead of the May Budget

- Advocates for change say the discount, especially when combined with negative gearing, has fuelled price growth and crowded out first-home and lower-income buyers

- Critics counter that changing the rules risks driving investors out of the market, shrinking supply and driving rents higher, exacerbating the existing housing crisis

Anthony Albanese’s Labor government is reportedly considering scaling back the 50% Capital Gains Tax (CGT) discount.

The government is under pressure from unions, the Greens and welfare groups, and has also been advised by a number of leading economists, think-tanks and housing commentators to wind back the concession.

A key claim is that the generous tax break benefits property investors at the expense of first-home buyers and lower-income Australians, helping to drive up the cost of housing.

However, any changes to the 50% discount - which was introduced in its current form 27 years ago - could likely have significant impacts on housing supply - particularly for the third of Australians who rent.

The details

Government sources have been briefing political journalists that the Albanese government is actively considering changes to the 50% CGT discount in the lead-up to the May Federal budget.

Labor last considered changes to CGT while in opposition, as part of its unsuccessful campaigns at the 2016 and 2019 elections, which also involved changes to negative gearing.

It’s understood that the tweaks Labor is now considering do NOT include negative gearing - which allows landlords to deduct any property losses against their taxable income.

There’s speculation the CGT changes could involve reducing the discount to 25% or 33%, limiting the existing scheme to new properties, or to just one property in an investor’s portfolio.

The government won’t publicly comment, but Treasurer Jim Chalmers has pointedly refused to rule out changes to CGT.

He told the Australian Financial Review this week that the government has a focus on what the paper says is “tackling intergenerational inequality in housing”.

Mr Chalmers emphasised the government’s efforts to boost housing supply and forthcoming personal income tax cuts.

“Any steps beyond would be a matter for the cabinet,” the Treasurer told the AFR.

Mr Chalmers has previously asked Treasury for internal advice on changes to the CGT rules, while the Greens are currently leading a Senate inquiry into how the tax operates.

The terms of reference for that inquiry pointedly include “the contribution of the capital gains tax (CGT) discount to inequality in Australia, particularly in relation to housing” and “the role of the CGT discount in suppressing Australia’s productivity potential by funnelling investment into existing housing assets.”

How the CGT discount works

The current 50% discount, introduced by John Howard’s Coalition government in 1999, applies to any income-producing asset held for more than a year.

It replaced a less generous and complicated scheme that made deductions for inflation during the time a person held an asset.

This is an example given by the Australian Tax Office on how the current 50% CGT discount works in practice:

“Justin, an Australian resident, buys a block of land.

“He owns it for 18 months and sells it, making a profit of $10,000.

“He has no capital losses.

“Justin is entitled to the 50% CGT discount for the land.

“He will declare a capital gain of $5,000 in his tax return.”

The public justification by the Howard government for introducing the 50% CGT discount was that it would encourage more Australians to invest in local companies via the stock market, as the scheme applies to all income-producing assets.

However, critics such as the leading financial journalist Alan Kohler argue that when the 50% tax deduction is paired with negative gearing, it has served to “super-charge” the gains from property investment, driving up the cost of residential property more broadly and locking more and more Australians out of home ownership.

“In 2000, house prices went from increasing at roughly the same rate as both incomes and the economy, to double that rate, or an average of 6-7% per annum, compound,” he says.

Alan Kohler says two charts - one which tracks dwelling prices and wages and one which tracks house prices and per capita GDP growth - clearly demonstrate that from about the Year 2000 onwards, owning your own house started to become a distant dream for many Australians.

The danger of fiddling with the CGT discount

While we should all want more Australians to be able to own their homes, I believe tinkering with existing housing policies, be it the existing CGT regime or negative gearing, could have unintended consequences that our politicians haven’t properly thought through.

While there’s no doubt a mixture of CGT and negative gearing are attractive tax breaks, any tweaks to the existing rules could see a mass exodus of investors from the property market, even if they don’t stand to be personally affected by the changes.

We’ve seen this in Victoria recently, where changes to land tax, vacancy rules and other reforms have led to the perception that the state is “anti-landlord”.

That’s led to a decrease in the number of rental properties available for tenants, keeping upward pressure on rents and vacancy rates lower than they probably need to be in a big city like Melbourne.

There’s also the question of how much more affordable homes would be if some property tax breaks were curbed.

Treasury revealed last year that it believed winding back tax breaks for property investors would only lower home prices between 0.5% and 4.5%, and that was only if there were changes to both the CGT discount and negative gearing.

The government’s key economic department indicated increasing supply would have a much greater impact on slowing the strong rate of growth in residential housing prices.

However, supply is a vexed issue.

With the overwhelming bulk of new housing in Australia being built by private individuals or companies - not governments - any uncertainty about the future direction of home prices could have a chilling effect on new construction.

Dwelling approvals figures released by the ABS this week underlined the parlous state of new home building, with new approvals falling just under 15% in December 2025, led by a 30% plunge in apartment approvals.

Despite Australia’s current housing shortage - estimated at between 200,000 and 300,000 homes - many developers are already choosing not to proceed with projects - especially larger apartment complexes - because they are not confident they can cover their costs and make a profit.

Mark Bernberg, Ray White’s Managing Director for Projects in Western Sydney, recently revealed he knows at least five Sydney developers who have lost more than $2 million each because they underestimated building costs and what buyers were willing to pay for apartments.

These developers were clearly burnt by their expensive experience and are going to be a lot more cautious in the future.

Adding to building industry caution by paring back a key incentive for property investors is likely to make a dire situation even worse.

The Albanese government is already on track to fall well short of its 5-year goal to see 1.2 million new homes built by mid-2029.

Changes to the CGT regime will ensure that the “aspirational target” drifts further and further out of reach.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)