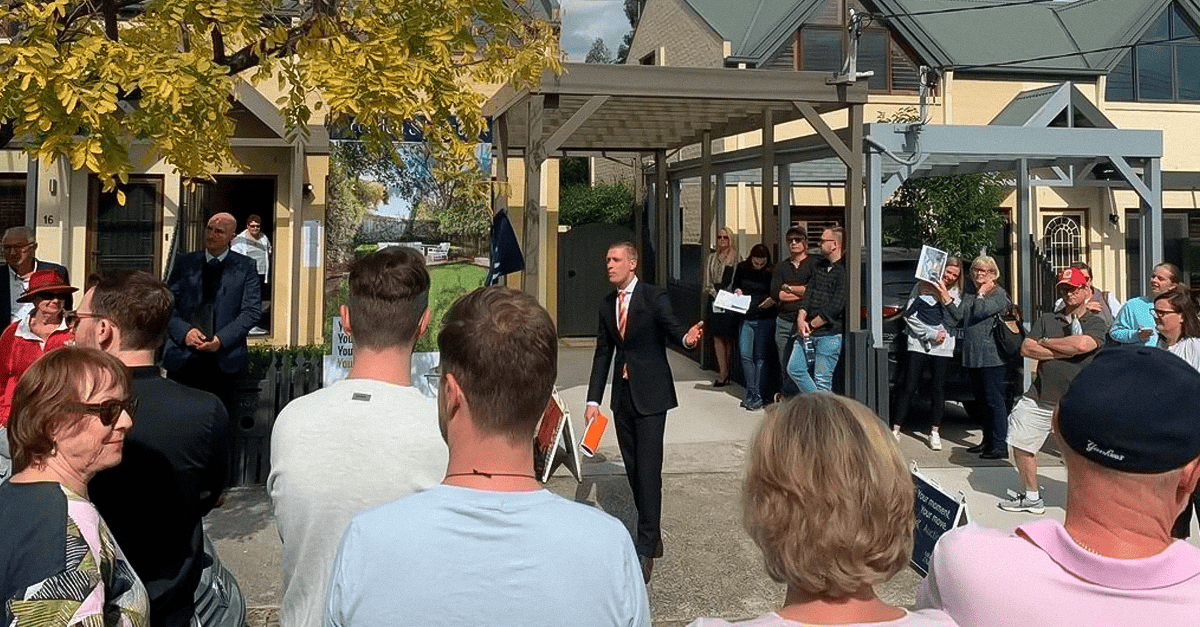

Image from realestate.com.au

KEY POINTS

- Australia’s largest home mortgage lender, Commonwealth Bank, says conditional home loan pre-approval applications jumped 12% nationally this year after the RBA’s February and May cuts

- The CBA says the average pre-approval amount climbed 13% to $733,000, while first-home buyers sought an average of $546,000 (+11%)

- Analysis by Commonwealth Bank and Canstar shows the three RBA cuts so far this year have boosted borrowing capacity by around 7%

New data from Australia’s biggest home mortgage lender shows Australians are gearing up to buy homes in growing numbers, just as the property market’s busy Spring season arrives.

The Commonwealth Bank says conditional home loan pre-approval applications jumped 12% this year, following the Reserve Bank’s first two rate cuts in February and May.

The bank says the average pre-approval application amount also rose 13% compared to the same period in 2024, reflecting increased borrowing power in a falling interest rate environment.

With another 0.25% p.a. rate cut for CommBank customers having taken effect on Friday, 22nd August 2025, the bank says it expects even more Australians to get their finances in order before entering the property market.

The details

CommBank says conditional pre-approval gives customers clarity on how much they can borrow before they start house hunting.

It says applications rose strongly after the RBA’s second rate cut in May, climbing 12% nationally year-on-year.

Potential buyers in New South Wales led the surge with a 25% increase, followed by Queensland with a 16% rise, while Victoria remained steady.

“The Aussie dream has long been anchored in home ownership, and this rise in conditional pre-approval activity reflects a renewed sense of optimism as borrowers respond to lower interest rates and increased borrowing power,” says Marcos Meneguzzi, Executive General Manager Home Buying at CommBank.

“Conditional pre-approval is one of the very first steps when buying a home,” Mr Meneguzzi says.

“Buyers get a sense of their budget and that helps them act quickly when the right property comes along.”

CommBank says the May rate cut not only boosted activity but also pushed up the average amount Australians were seeking to borrow.

The average conditional pre-approval amount climbed to just over $733,000 — a 13% increase year-on-year.

First-home buyers were more conservative, applying for an average of $546,000.

However, that’s still a significant 11% increase on last year.

“With our latest variable rate reduction coming into effect from 22 August, this trend could continue as buyers look to leverage the current downward rate cycle,” Mr Meneguzzi says.

CommBank also points out that three successive 0.25% p.a. variable rate interest cuts in February, May and August have lifted customers’ borrowing capacity by around 7%.

Canstar’s view

Commonwealth Bank’s claim that the 3 rate cuts so far in this RBA easing cycle could see a potential 7% increase in borrowing capacity tees up with recent analysis by financial comparison platform, Canstar.

Following the RBA’s decision to cut the cash rate by 0.25% in August, Canstar calculated that a single person on the average wage could see their borrowing capacity increase by $12,000 - from $521,000 to $533,000.

The scenario is based on a single-income owner-occupier taking out a 30-year variable rate loan at 5.50% and assumes minimal expenses, no debts and no dependents.

When you add up the impact of the rate cuts in February, May and August, Canstar estimates that an average wage earner (on a salary of $104,592 p.a. according to the Australian Bureau of Statistics) would have seen their borrowing capacity increase by $35,000 - from about $498,000 to $533,000.

“This third cash rate cut is also likely to encourage more buyers into the (property) market, with further confirmation the days of higher interest rates are now firmly in the rear-view mirror,” says Canstar’s Data Insights Director, Sally Tindall.

Canstar has also cast its eyes forward to what would happen to borrowing capacity if predictions about further interest rate cuts over the next year should come to pass.

Taking that single average wage-earner seeking a 30-year term, variable owner-occupier home loan, that would see them able to borrow between $47,000 (1 more 0.25% rate cut) and $74,000 (3 more 0.25% rate cuts), compared to what they could have borrowed in January 2025.

Canstar’s Sally Tindall says the three RBA cuts so far this year are already “helping push new loan sizes to eye-watering levels.”

Pointing to ABS lending data, she says, “the average new owner-occupier loan is now $678,000 – that’s $18,000 more than it was just three months ago – that’s an increase of $198 a day.”

“When the cost of borrowing falls, some buyers use it to bid higher at auction, particularly in sought-after property hotspots.”

Canstar says new loan sizes are now at record highs in the 5 most populous states.

It’s worth noting these ABS figures don’t include new loans written in July 2025 or in August, when the RBA cut the cash rate again.

However, given that Australia’s largest bank is bracing for yet more conditional pre-approval applications and given the ABS Lending data collected after just two rate cuts, I think it’s a safe bet to say that this Spring will see plenty of cashed-up buyers pushing property prices up at auctions and average loan sizes ballooning to record new levels.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)