Features > Property News & Insights > Market updates

Property prices set to go “another leg higher” in Spring

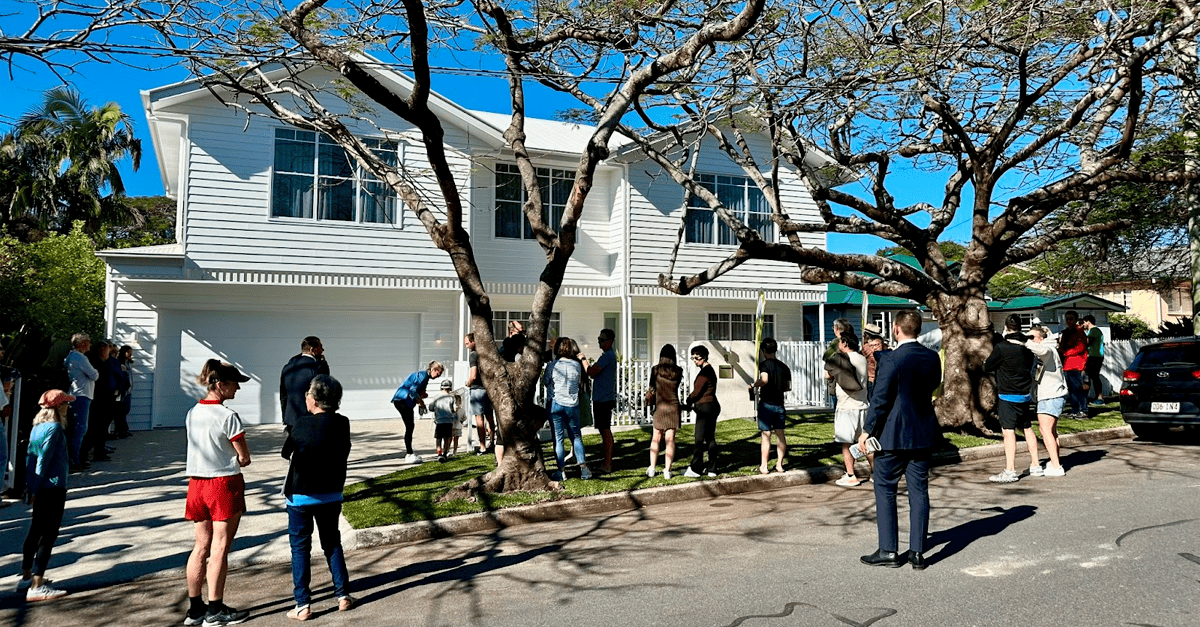

Image from realestate.com.au

KEY POINTS

- Both the REIA and PropTrack show consistent June-quarter 2025 gains: REIA’s national weighted median house price rose 1.9%, while PropTrack puts dwelling value growth at 1.3%

- The REIA says rentals softened slightly – house rents up 0.7%, unit rents down 0.6% – yet vacancies tightened to 1.8%, well below the 3% industry benchmark

- PropTrack says price momentum is building heading into Spring, boosted by three RBA rate cuts in 2025, which have lifted borrowing capacity and buyer sentiment

Australia’s housing market recorded steady price growth across most capital cities in the June quarter, according to the latest data from the Real Estate Institute of Australia and REA Group’s Proptrack.

While the REIA remains cautious about the outlook, PropTrack has indicated the housing market is set to step up a gear as the busy Spring selling season gets underway, setting the scene for an acceleration in price growth.

REIA

The Real Estate Institute of Australia’s latest Real Estate Market Facts report finds the national weighted median price for houses rose 1.9% over the three months until the end of June 2025 to $1,098,671, while “other dwellings” - the category which includes apartments - increased 1.7% to $713,438.

The REIA says Sydney remains the country’s most expensive city to buy a property, with a median house price of $1,722,443 and a median unit price of $834,791 - 56.8% and 17.0% above the national averages, respectively.

At the other end of the spectrum, Darwin continues to be the most affordable capital, with houses averaging $600,000 and units $405,000.

Darwin also stood out for the strongest growth over the quarter, with house prices climbing a whopping 6.8% and unit prices 6.4% in just three months, while Canberra and Hobart saw little movement.

The REIA’s President, Leanne Pilkington, says the results reflected a steadying property market.

“We’re seeing modest price growth in most capital cities,” she says.

Rental markets

The REIA says rental conditions were “more subdued” than the previous three months, but varied according to location.

The national median weekly rent for three-bedroom houses lifted slightly by 0.7% to $633, led by Darwin with a large 4.8% rise, while two-bedroom units recorded a national median of $644 per week, down 0.6% for the quarter.

Unit rents increased modestly in Sydney, Adelaide and Darwin, remained stable in Perth and Hobart, but according to the REIA, slipped in Melbourne, Canberra and Brisbane.

REIA says its weighted national average of vacancy rates from the eight Australian capital cities decreased to 1.8% over the quarter, a tightening of 0.1%, but still an improvement on the 1.6% recorded a year ago.

“The industry benchmark vacancy rate is 3.0%, yet the national average currently sits at 1.8%,” the Real Estate Market Facts report says.

“Over the quarter, vacancy rates increased in Brisbane, Adelaide and Perth, remained stable in Melbourne, and decreased in Sydney, Canberra, Hobart, and Darwin.

“Adelaide has the tightest rental market with a vacancy rate of 0.8%.”

The REIA also says annual rental yields ranged from 1.8% to 5.2% over the quarter, depending on accommodation type and market.

PropTrack

The Real Estate Institute of Australia’s Market Facts report makes an interesting contrast with the latest data from REA Group’s PropTrack.

PropTrack’s latest Home Price Index report finds national dwelling prices (homes and units combined) grew 0.5% over August, and 1.3% over the quarter, pushing them 5.3% higher than a year ago.

The data analytics firm says this represents annual home price growth of $47,900 nationally over the past year.

Across capital cities, home prices rose 0.5% in August, led by a big 0.8% jump in Darwin (1.27% increase for the quarter), followed by a sizable 0.7% in Sydney (1.3% for the quarter), 0.6% in both Perth (1.3% for the quarter) and Brisbane (1.3% for the quarter).

Prices in Melbourne rose 0.3% in August (0.8% over the June 2025 quarter) and are now just 0.6% below their previous 2022 peak recorded by PropTrack, almost fully recovered after several years of underperformance.

PropTrack says Hobart was the only capital city to see home prices fall in August, dipping 0.5% over the month, but recording a positive 0.5% over the quarter.

Annually, all capital cities saw gains, with Darwin (+10.4%) and Brisbane (+9.6%) leading.

Home prices in regional areas also hit a new peak in August, lifting 0.3% month-on-month, bringing them up 6.6% over the year.

REA Group Senior Economist Eleanor Creagh says the 0.5% price lift measured by PropTrack in August 2025 is a new record high and “marks eight straight months of growth as the housing market gains momentum following the series of interest rate cuts this year.”

Ms Creagh says those cuts in the cash rate by the Reserve Bank of Australia, in February, May and August, “have boosted borrowing capacities, improved sentiment and drawn buyers back into the market.”

“As a result, the housing upswing, once narrowly led by a handful of cities, is broadening.

“Demand has re‐accelerated in Sydney and Melbourne, marking a turnaround from the slower conditions observed in late 2024,” she says.

“Melbourne is closing in on its 2022 peak, with relative affordability and strong population growth restoring its appeal.

“By contrast, Adelaide and Perth are still growing briskly, but at a slower pace compared to the same period last year,” the REA Group Senior Economist says.

The outlook

Looking ahead, Eleanor Creagh says the combination of lower interest rates, increased borrowing capacities and improved consumer sentiment is expected to continue to drive demand in the housing market.

She also points to the constrained supply of new housing, continuing strong population growth and the expansion of the Albanese government’s Home Guarantee Scheme from the 1st of October, maintaining upward pressure on home prices.

“As we enter spring, the housing market appears poised for another leg higher, albeit strengthening in some capitals while normalising in others,” she says.

The outlook from the REIA is considerably more measured.

“While affordability pressures remain acute in Sydney, the consistency of price increases across much of the country shows resilience in the housing sector, despite ongoing economic headwinds,” REIA President Leanne Pilkington says.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)