Features > Property News & Insights > Market updates

AUKUS to provide long-term boost to Perth property prices

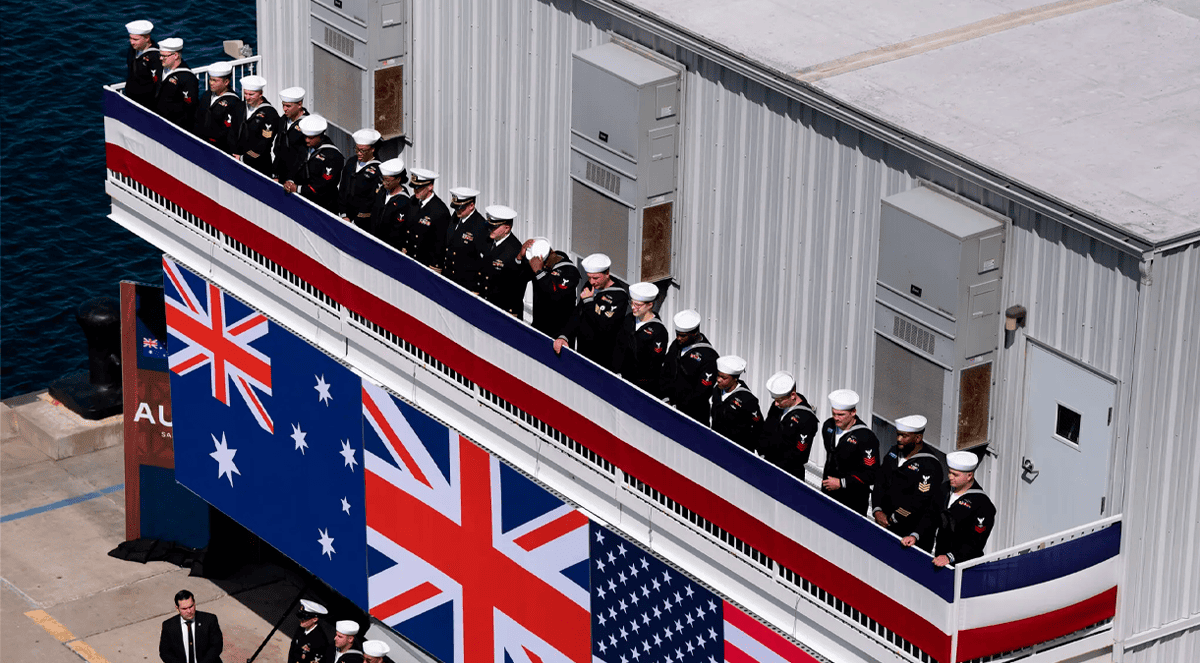

Image from The New York Times/Haiyun Jiang

KEY POINTS

- The AUKUS defence partnership is set to add long-term housing demand in an already tight Perth market

- AUKUS is set to inject more than $20 billion into WA’s economy and create over 13,000 Perth-based jobs, boosting demand in a market already marked by strong price growth, low vacancies and limited supply

- Unlike past mining booms, AUKUS will concentrate housing demand in Perth’s southern suburbs over decades, rather than arriving as a short, sharp surge

AUKUS - the massive defence partnership bringing together Australia, the United States and Britain - is emerging as a new source of long-term housing demand in Perth, adding more pressure to a market that has already been running hot for several years.

Despite doubts about the US’ commitment to the project, Australia’s Deputy Prime Minister and Defence Minister Richard Marles says meetings he had in Washington last December with Trump Administration officials confirm the ambitious nuclear submarine program will proceed as planned.

A recent analysis by a leading economist reveals AUKUS is unlikely to trigger a mining-style boom, but shows it will have a long-lasting impact on keeping housing demand strong in the West Australian capital, particularly in Perth’s southern suburbs.

The study, by Ray White’s Chief Economist Nerida Conisbee, is yet another piece of evidence that refutes claims by so-called “property experts” that Perth is already “cooked” as a housing investment destination.

The details

Ray White’s Nerida Conisbee says the scale, location and longevity of AUKUS means it is likely to push housing demand higher, particularly in Perth’s south-west corridor.

“Perth’s housing market has been running hot for several years, driven by population growth, tight supply and strong local economic conditions,” Ms Conisbee says.

“Now a new demand driver is emerging — AUKUS.”

More than $20 billion is set to flow into Western Australia over the next decade through upgrades to the Henderson shipbuilding precinct and HMAS Stirling.

The investment is expected to create more than 10,000 construction and shipbuilding jobs, along with another 3,000 roles linked directly to the submarine base.

While this will look very different from the fly-in, fly-out workers that characterised past mining booms in the west, Ms Conisbee says the size and the permanence of the workforce will have a long-lasting impact.

“This is a very different type of workforce to FIFO mining labour, but it is a sizable number, and importantly, it is long-term and metro-based,” she says.

Perth’s housing market is already under strain, with years of strong price growth colliding with some of the tightest rental conditions in the country.

Vacancy rates remain historically low, rents have risen sharply and construction activity is failing to keep pace with population growth.

“Against this backdrop, any additional labour inflow, even a modest one, has an outsized impact,” Ms Conisbee says.

Unlike previous resource cycles, the housing impact of AUKUS is expected to be highly concentrated rather than city-wide.

Mining booms have tended to spread pressure across the entire Perth metropolitan area and deep into regional WA.

Defence-related demand, by contrast, will be clustered close to key facilities.

“Demand will cluster around Rockingham, Kwinana, Cockburn and Fremantle, areas already under pressure and with limited short-term supply flexibility,” Ray White’s Nerida Conisbee says.

“The localised effect means the impact may feel large on the ground, even if the overall magnitude is smaller than past resources cycles,” Ms Conisbee says.

Another key difference is pace.

Mining booms tend to arrive quickly, bringing sharp spikes in population growth and investor activity, before often coming to an abrupt end.

AUKUS, however, will roll out gradually, with spending and employment building over decades.

“This reduces the likelihood of a sudden price surge but creates a steady, persistent pull on housing that becomes more noticeable as supply struggles to keep pace,” Ms Conisbee says.

That supply constraint looms as one of the biggest risks.

Construction pipelines remain thin, fewer new projects are entering the system and building costs are still elevated, limiting Perth’s ability to respond just as demand begins to lift again.

Taken together, Nerida Conisbee says AUKUS is more likely to reinforce existing housing pressures than create an entirely new growth cycle.

“AUKUS is unlikely to deliver a mining-style boom, but it does add another layer of demand to an already tight market.

“With long-run housing supply falling short of population needs and rental conditions remaining extremely constrained, the AUKUS workforce will reinforce existing pressures rather than create new ones,” she says.

It’s good news for Perth homeowners, but a grim outlook for renters and those trying to buy into the Perth market.

“AUKUS won’t redefine the market,” Ms Conisbee says, “but it will nudge it further along the same trajectory — steadily, structurally and for many years to come.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20154.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20Cost%20of%20Living%20Crisis%20Has%20Reached%20a%20Breaking%20Point%20(Millions%20Will%20Be%20Homeless)%20Scott%20Kuru%20DPU%20154.jpg)

%20Scott%20Kuru%20DPU%20153.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Exposes%20Australia%E2%80%99s%20Oil%20Crisis%20Far%20Worse%20Than%20Expected%20($50%20Billion%20Lost)%20Scott%20Kuru%20DPU%20153.jpg)

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)