KEY POINTS

- Unit values are now outperforming houses in many inner city suburbs, bolstered by affordability and strong demand from homebuyers and investors

- A weak pipeline of apartment stock means the sector would continue to be undersupplied for the foreseeable future

- Apartment values are forecast to increase strongly over the next three years

Worsening housing affordability, chronic supply shortage, and rising demand are converging to fuel a strong and sustained rebound in apartment values after years of sluggish growth, experts say.

Apartments in the inner city suburbs across the capital cities led the charge, with values increasing by up to nine times faster than detached houses, according to data from CoreLogic.

Tim Lawless, CoreLogic research director, said unit values could strengthen further in the coming months.

“With fewer buyers able to purchase a home at the median value, we could see demand deflecting towards lower price points, potentially favouring outer-fringe detached housing markets and the multi-unit sector where price points tend to be lower,” he said.

“In addition to poor affordability in the detached housing sector, supply shortage in the medium to high-density housing has worsened in the past decade, and we haven’t seen any uptick in the supply pipeline given the high materials costs and labour shortages.

“So it sounds to me like supply in the apartment sector is going to be low or inadequate for some time which in itself would probably support price outperformance compared to houses as well.”

What’s driving the upturn in apartment prices?

Maree Kilroy, senior economist at Oxford Economics said the affordability gap that opened up between houses and units could power up the next growth spurt in apartment prices.

“The gap is quite stark and at its worst point in history, so if affordability is a concern, units are the logical option if you want to live in the city that you want to,” she said.

“At the same time, we have an undersupply of apartments on the market, and there’s no real short-term fixes for that because approval leads are very weak and it takes a long time to get that apartment supply onto the market.

“So you have an affordability issue that's pushing people into apartments but you've also got a fundamental lack of supply of new supply for apartments. So you're sort of planting the seeds for apartment price growth to outperform in the coming years.”

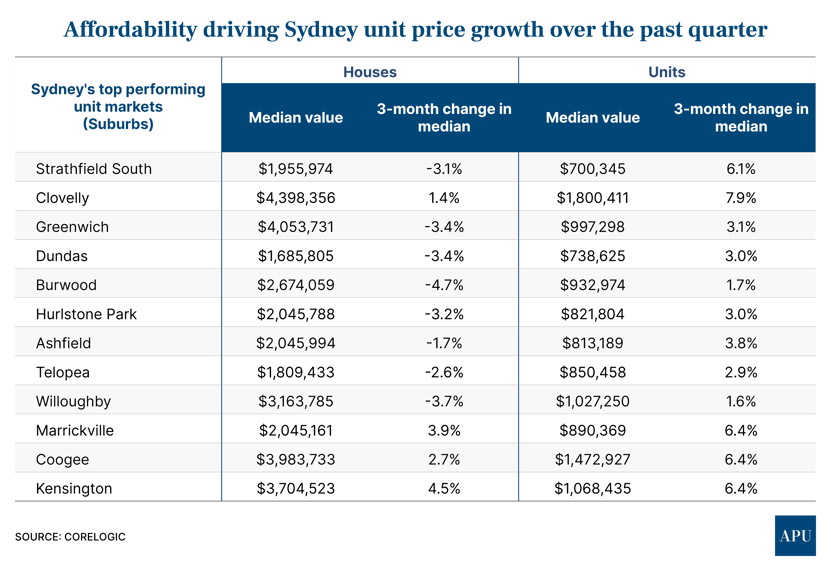

Unit values in some suburbs within Sydney’s Inner West, Eastern Suburbs, Lower North Shore, and Parramatta districts led the unit outperformers in the city over the past three months.

Unit values rising faster than houses

In the Eastern Suburbs, Clovelly units recorded the biggest gains with values jumping by 7.9 per cent over the quarter, compared to just a 1.4 per cent increase in house prices in the suburb.

Coogee unit prices rose by 6.4 per cent, more than twice as fast as houses in the suburb, while apartments in Maroubra climbed by 5.2 per cent, also more than double the growth in house values.

In the Inner West, unit values in Strathfield South climbed by 6.1 per cent - more than nine times faster than house prices, which fell by 3.1 per cent.

Unit prices in Burwood, Hurlstone Park, and Ashfield increased by 1.7 per cent, 3 per cent and 3.8 per cent, respectively. In comparison, house prices in Burwood fell by 4.7 per cent, dipped by 3.2 per cent in Hurlstone Park, and were down by 1.7 per cent in Ashfield.

Marrickville units rose by 6.4 per cent, while Petersham lifted by 5.1 per cent over the quarter. In contrast, house prices in those suburbs rose by a lower 3.9 per cent and 4.9 per cent, respectively.

Thomas McGlynn, chief executive of real estate agency BresicWhitney said demand for apartments had been increasing consistently over the recent months.

“I think apartments offer great value for money compared to houses and this is attracting strong demand from home buyers and investors as well,” he said.

“We’re seeing more first-home buyers, downsizers and investors all looking at apartments because of that big price difference and maybe they are starting to realise it’s not quite worth spending double the amount to buy a house.

“I also think affordability is driving a lot of people to look at apartments and some buyers are a bit worried about the extended period of high interest rates, and they don’t want to have a large mortgage.”

Widening gap between house and unit prices

Median house price in Clovelly sat at $4.4 million, which is more than double the unit's median value of $1.8 million, making units $2.6 million cheaper than an average house in the suburb.

In Strathfield South, units are fetching $700,000 on average, which is $1.3 million cheaper than houses at $1.96 million median value.

Across Burwood, Hurlstone Park, and Ashfield, units are cheaper by up to $1.7 million with houses worth twice as much as units in those suburbs.

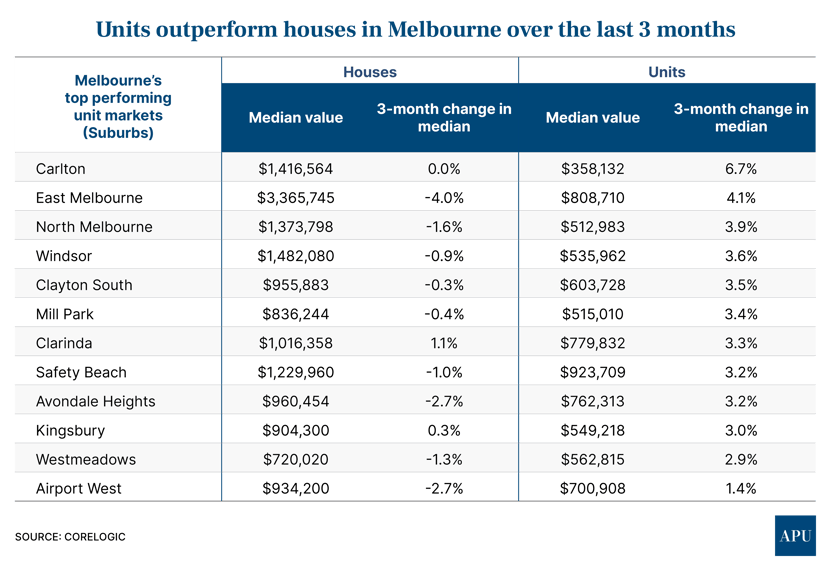

In Melbourne, apartments in Carlton, East Melbourne and North Melbourne notched up the biggest quarterly growth at 6.7 per cent, 4.1 per cent, and 3.9 per cent, respectively.

Unit values in Carlton lifted more than six times faster than houses in the suburb, they jumped more than eight times higher in East Melbourne and rose more than five times higher in North Melbourne.

Tim Lawless of CoreLogic said demand from investors looking to take advantage of the next growth phase could be driving the recent upward trend in apartment values.

“We've definitely seen investment demand kick up since early last year when we saw investor exodus, that seemed to have truly turned around,” he said.

Investors are back in droves

“Investors now represent 37 per cent of mortgage demand compared to a 10-year average of 34 per cent, so it does look like investors have become more active, and we know that investors tend to favour medium to high-density housing, so that's probably another key factor that's driving a better performance across the unit market.”

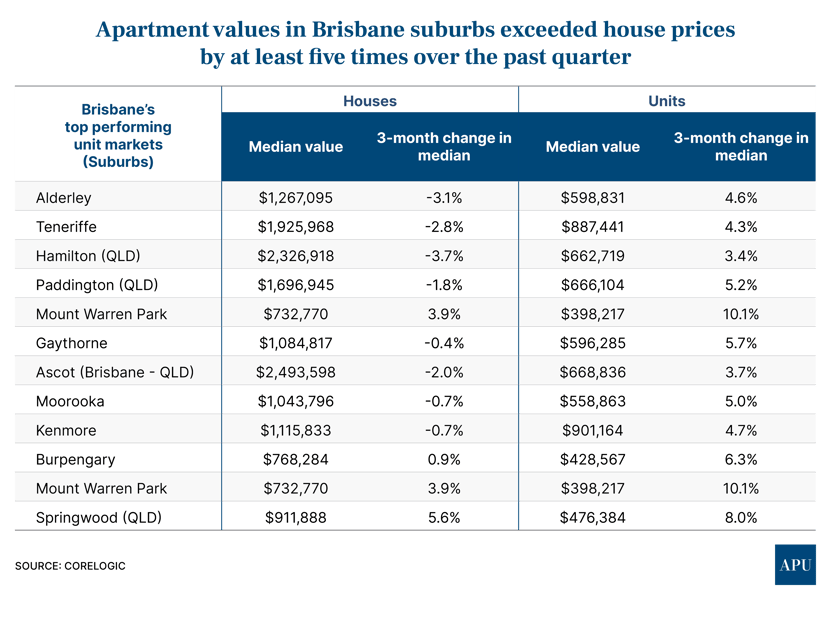

In Brisbane, units in inner suburbs Alderley, Teneriffe, Hamilton and Ascot recorded the largest increase in values over the quarter, increasing by up to 5.7 per cent.

This solid performance contrasts with house prices in those suburbs which fell by up to 3.1 per cent during the same period, which means apartment values have outpaced houses in their respective suburbs by at least five-fold.

Across Adelaide, units in Blackwood, Glengowrie and Morphettville in the south racked up more than a 10 per cent increase on average, boosted by their cheaper prices, which sat under $600,000. Units in those suburbs have outpaced house price growth by more than six-fold.

In Perth, the top performing unit markets were mostly located in the city’s southwest such as Baldivis, Kelmscott, and East Fremantle, where values jumped between 10 per cent and 12 per cent in the past three months, outperforming houses by more than five-fold.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)