Features > Property News & Insights > Housing Trends

The suburbs where home buyers are paying in cash

KEY POINTS

- Cash buyers, comprising 28.5% of homes purchased in 2023 across eastern states, drive demand, shielding the housing market from downturns despite rising interest rates

- Retirees and asset-rich individuals dominate cash purchases, favouring sea or tree change locations for retirement, while affluent owner-occupiers and investors drive inner-city purchases

- However, cash buyers may potentially complicate the Reserve Bank’s regulation efforts, delaying rate cuts amid ongoing property price increases.

More than a quarter of all homes sold across NSW, Victoria, and Queensland in 2023 were purchased entirely with cash by buyers immune to interest rate rises, likely shielding the housing market from a potential downturn, PEXA’s Cash Purchases Report shows.

Cash buyers splurged $129.6 billion scooping residential properties in the eastern states, accounting for 28.5 per cent of all home sales last year.

The cash buyer market has expanded further, with the volume of cash transactions increasing by 1.5 per cent and the share of cash buyers widening by 2.9 per cent from the previous year.

Queensland recorded the largest portion of cash settlements at 29.6 per cent, followed by NSW at 27.7 per cent and Victoria at 25.2 per cent.

Influence of cash buyers on the housing market

Julie Toth, PEXA chief economist said this interest-rate proof buyer segment was becoming a powerful force on the overall demand for residential properties.

“Cash buyers are changing the dynamics of the residential property market and the relatively large size of this group helps explain the property market’s resilience in 2023 despite rapid rises in interest rates,” she said.

“The growth of this cash buyer cohort at over a quarter of all residential property buyers across the eastern states suggests the rate rises of the past year have not affected this segment’s ability to purchase property.

“I think the size of this group who are not necessarily affected by the increased costs of mortgages suggests that going forward, the housing market may be more resilient against interest rate shocks than previous modelling might indicate.”

Cash buyers are likely to be retired, asset-rich homeowners who accumulated savings and superannuation to fund their next property purchase according to PEXA.

Those buying in sea change or tree change locations were likely dominated by retirees seeking cheaper areas to retire.

By comparison, those paying in cash for inner-city properties were likely a combination of wealthy owner-occupiers who were downsizing or upgrading, as well as local and international property investors looking to capitalise on the surging rents.

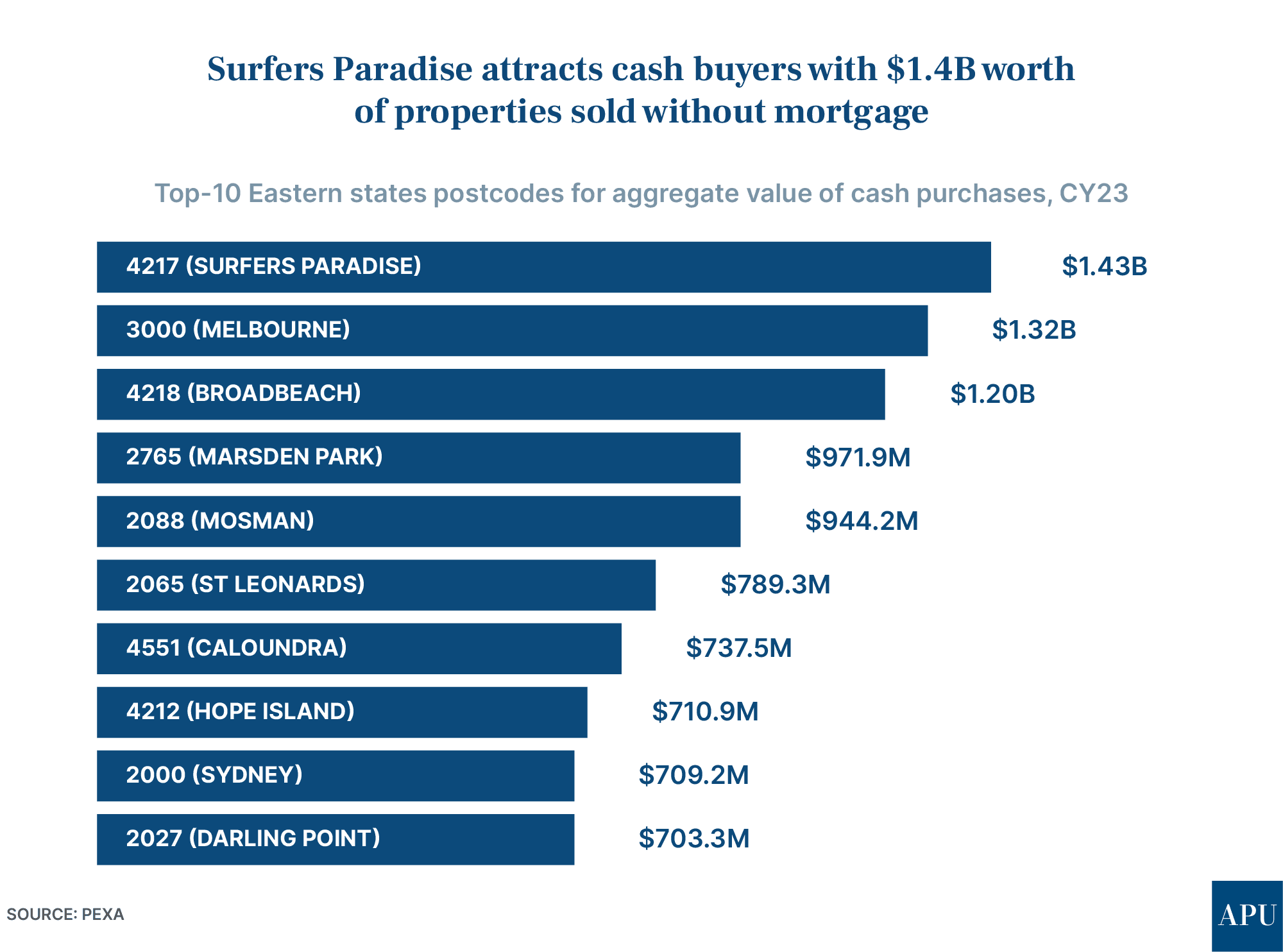

Where cash buyers converge

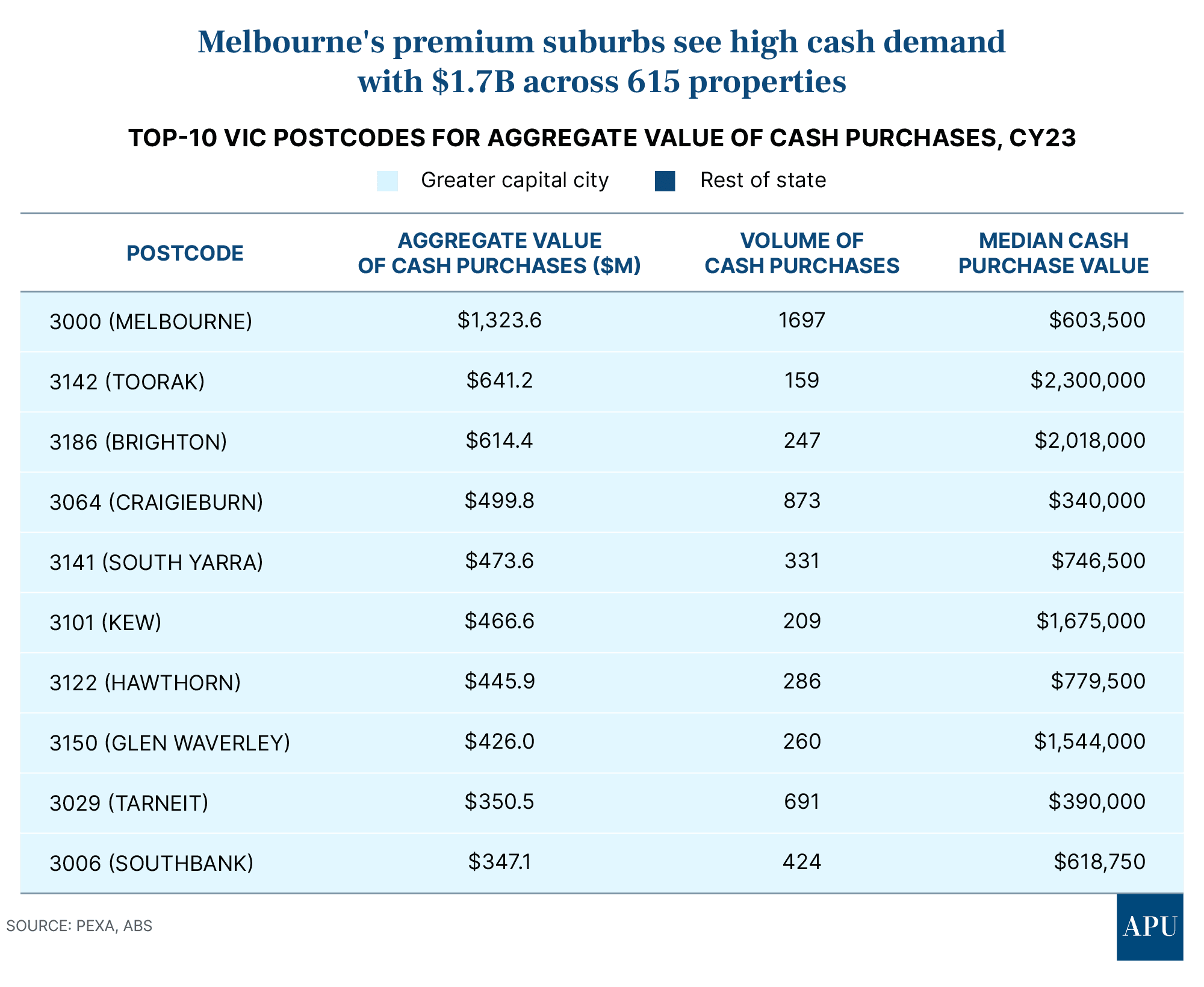

Cash buyers flocked into Central Melbourne (postcode 3000), snapping up 1,697 apartments worth $603,500 apiece on average, for a total of $1.3 billion - nearly twice as much compared to the previous year. Over half of the total residential sales in the postcode were cash purchases, likely by local or international investors according to PEXA.

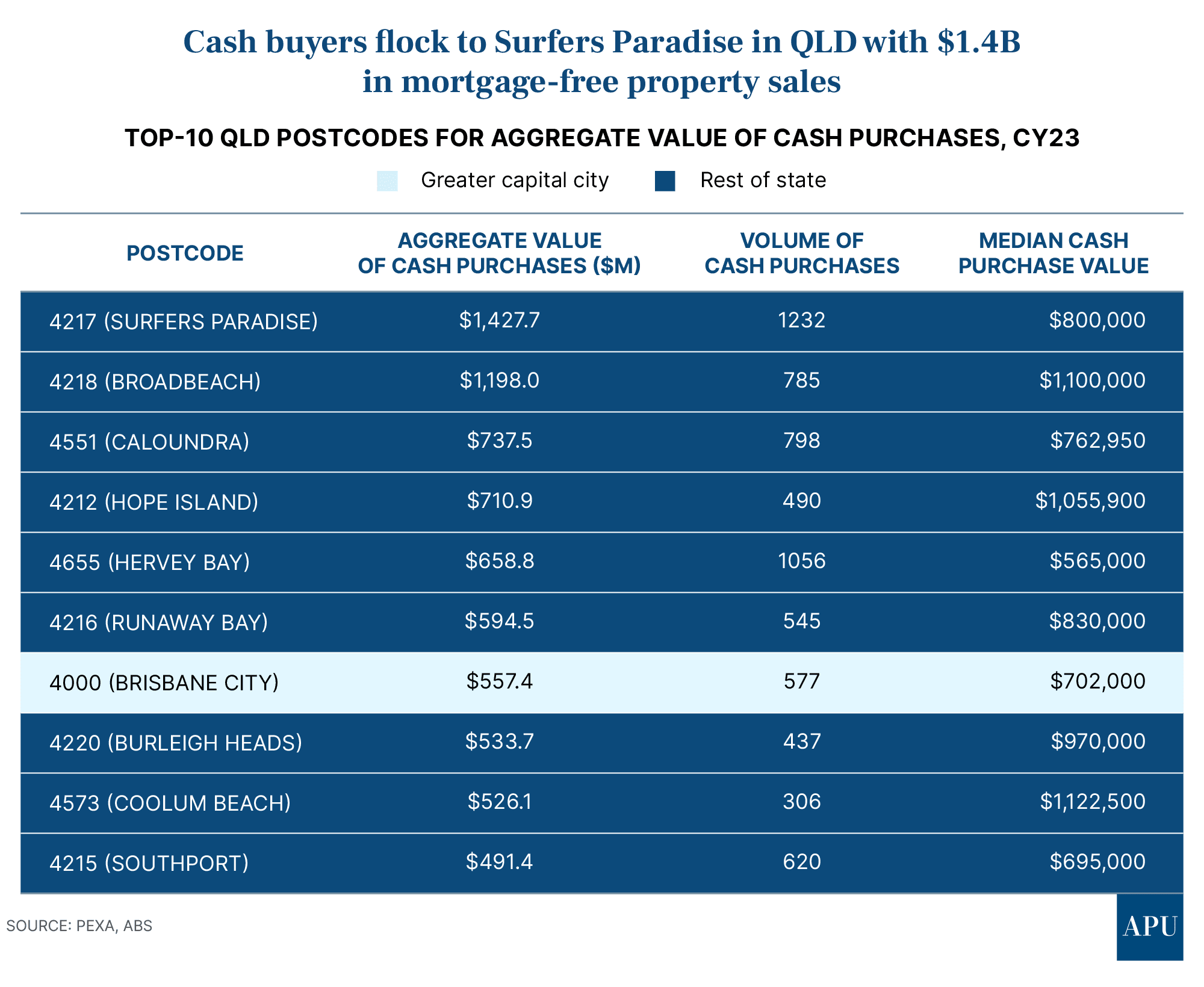

Broadbeach, which topped the leaderboard last year posted, 785 cash sales at $1.1 million each on average for a total of $1.2 billion.

A large contingent of cash buyers also snapped up 1,104 properties in Caloundra and Coolum Beach on the Sunshine Coast for a total of $1.3 billion.

Cash buyers also stormed the more affordable coastal markets such as Hervey Bay, snagging 1,056 properties at $565,000 apiece on average for a total value of $658.8 million.

“I think a lot of existing homeowners are probably cashing out on some pretty phenomenal capital gains in the past few years and using that cash to buy in more affordable cities such as Brisbane,” said Carlos Cacho, Jarden chief economist.

“For retirees, they’re probably selling the family home and moving to more affordable lifestyle locations such as the Central Coast, Gold Coast or Sunshine Coast.”

“There’s also a high chance that the excess cash from the sale of the family home is gifted to their children to help them with the deposit or buy outright.”

The prevalence of buyers immune to interest rate rises could provide a buffer for the housing market if the economy turns, said Shane Oliver, AMP chief economist.

“To some degree, cash buyers actually acted as a bit of a shield to price falls,” he said.

“Whether it continues to provide a source of support remains to be seen, but if it does, then it’s going to make the Reserve Bank’s job of slowing the economy harder.

“If property prices continue to rise like they did so far this year, then the increasing number of cash buyers could delay rate cuts this year.”

Regional distribution

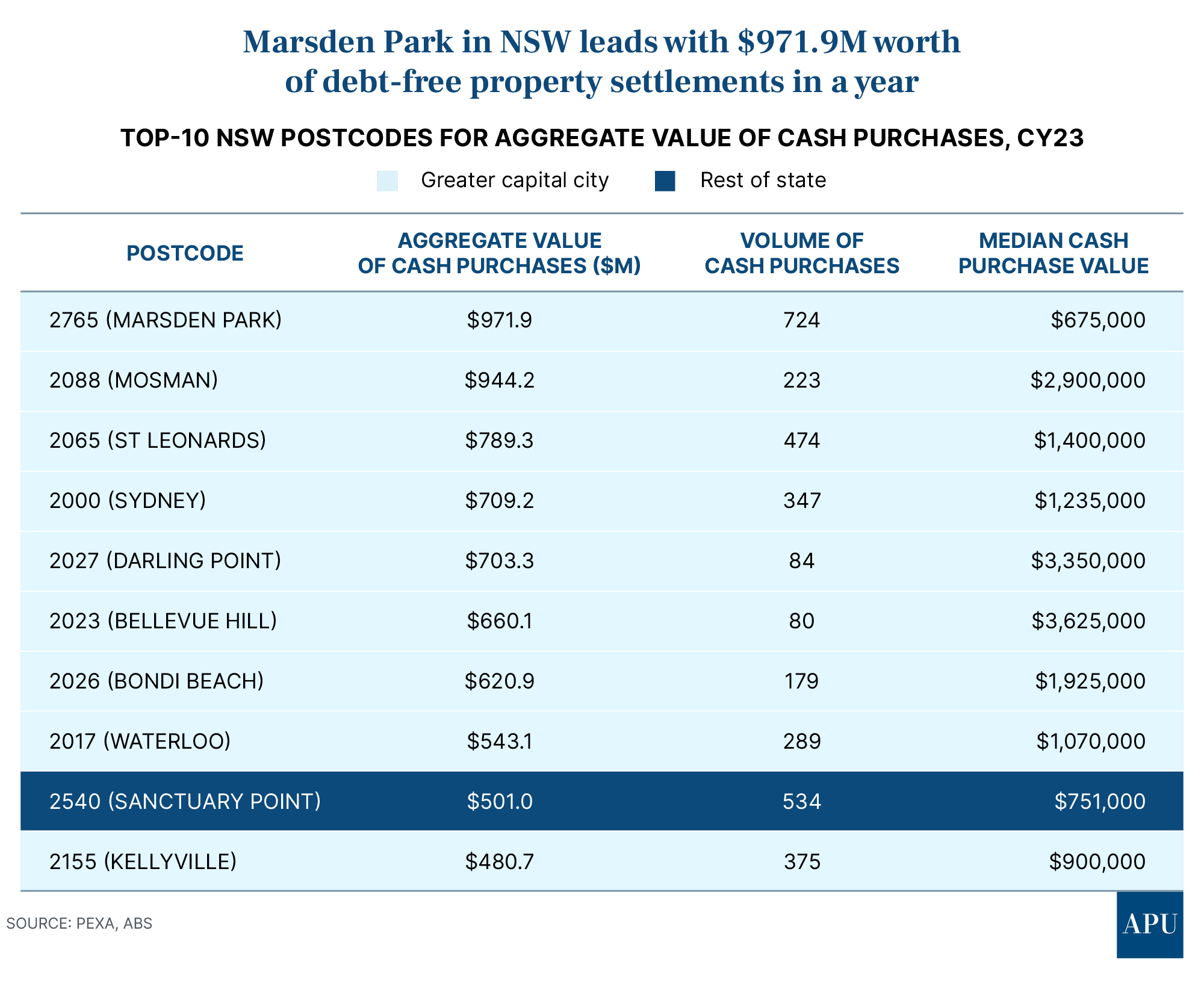

Marsden Park (postcode 2765) recorded the highest aggregate value of cash sales last year, at $971.9 million, after 724 residential properties settled without debt.

Sanctuary Point and Kellyville were also highly sought-after by cash buyers, with 909 properties worth a total of $981.7 million transacting mortgage-free.

Well-heeled buyers paid cash for 84 properties worth $3.35 million apiece in Darling Point (postcode 2027) for a total of $703.3 million in 2023. In Bellevue Hill, buyers splashed $3.63 million each on average across 80 properties, spending a total of $660.1 million in cash.

Mosman continued to lure buyers who paid an average of $2.9 million each in cash across 223 properties worth $944.2 million.

In Melbourne, premium suburbs Toorak, Brighton, and Kew were in high demand from buyers who paid $1.7 billion in cash across 615 properties.

Regional Queensland posted the highest proportion of cash purchases last year with a total of 33,055 residential properties bought without a mortgage in those locations, helped by their affordable home values.

Tara, a small rural town located 299 kilometres west of Brisbane, racked up the largest share of cash sales with 86 per cent of all properties purchased at a median sale price of $82,500, settling without a mortgage.

Gloucester in the NSW mid-north coast recorded the highest share of cash sales at 63.9 per cent of all property settlements in the state.

In metro areas, Milsons Point (postcode 2061) in Sydney, Carlton (postcode 3053), and central Melbourne (postcode 3000) attracted the largest portion of cash sales at 52.6 per cent, 52.3 per cent, and 50.6 per cent, respectively.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)