Features > Property News & Insights > Housing Trends

The locations where valuers see value in Australian property

KEY POINTS

- Property giant CBRE says a majority of professional valuers are seeing “strong to very strong” demand for residential real estate across Australia, with demand to purchase particularly strong in Perth, Adelaide, and metro Brisbane

- CBRE says 2/3rds of valuers report that demand is coming from first-home buyers and people “upgrading” to bigger or more expensive dwellings

- Nearly 80% of valuers surveyed expect house values to increase in the next 12 months, with Perth, metropolitan Sydney, and Adelaide leading the way

- Markets where valuers expect most apartment price growth are in the Brisbane metro, the Gold and Sunshine Coasts, and the Sydney metro areas

These days you can buy all sorts of analytical tools, computer programs, and algorithms to supposedly give you an indication of where the residential property in Australia is going to boom, flatline or decline in value.

For their part, economists will factor in population growth, potential interest rate movements, employment prospects, economic growth, inflation, consumer confidence, and past market performance to make their price growth predictions.

But it’s often worth listening to what the people at the coalface, buying, selling, or valuing real estate in their local areas every day, have to say.

For example, at the start of last year, when many economists were predicting large price falls in many of the capital cities, local real estate agents probably would have told you that they had intense buyer interest for whatever listings they did have and that queues for rental inspections were out the door and around the corner.

In real estate, as in most other things, strong demand = higher prices.

According to CoreLogic, dwelling prices across Australia rose 8.1% in 2023, vindicating the “local view”.

So the question is, how do you pull all those individual experiences together to get an overall picture of the on-the-ground prospects for real estate?

Well, international real estate experts, CBRE, do just that.

Each quarter, CBRE surveys professional property valuers right around Australia.

“With insight from expert valuers on local market trends, we gain a comprehensive understanding of Australia’s dynamic residential real estate landscape,” the company says.

The findings

CBRE’s “Residential Valuer Insights” for the first quarter of 2024 has just been released.

The Texas-based company received 189 responses to its latest survey, which found that 6 times as many valuers are seeing “strong to very strong” demand for residential real estate compared to those who see “soft or very limited” demand.

Demand to purchase is particularly strong in Perth, Adelaide, and metropolitan Brisbane.

“In contrast, softer demand is evident in the ACT, outer Melbourne and Melbourne metro,” according to CBRE.

In terms of types of properties, CBRE reports that “valuers see demand as being the strongest for houses and recently renovated properties.”

“Softer conditions prevail for unrenovated properties and vacant land.”

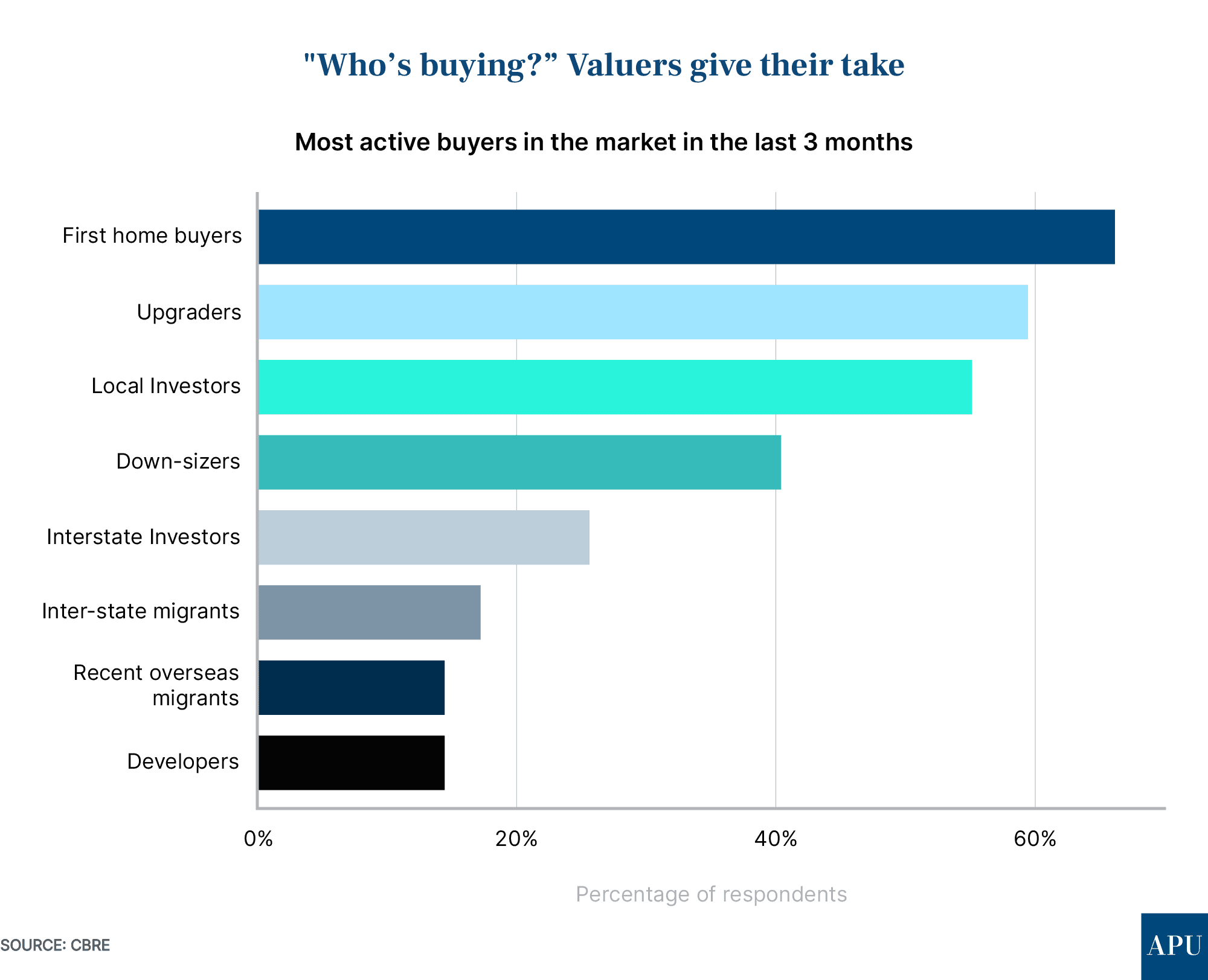

In terms of who is buying, CBRE says “2/3rds of valuers reported that demand is from first home buyers and upgraders.”

“Local and interstate investors are also active, alongside down-sizers.”

First home buyers were particularly active in the Melbourne metro area, Adelaide, and the ACT, while “upgraders” were most active in the ACT, Sydney metro, and outer Sydney regions.

Interstate investors were most active in Perth and outer Brisbane.

An anonymous valuer from North East Perth told CBRE:

“The market is very strong in all my areas, with a strong influence from interstate investors.”

Prospects for home values and demand

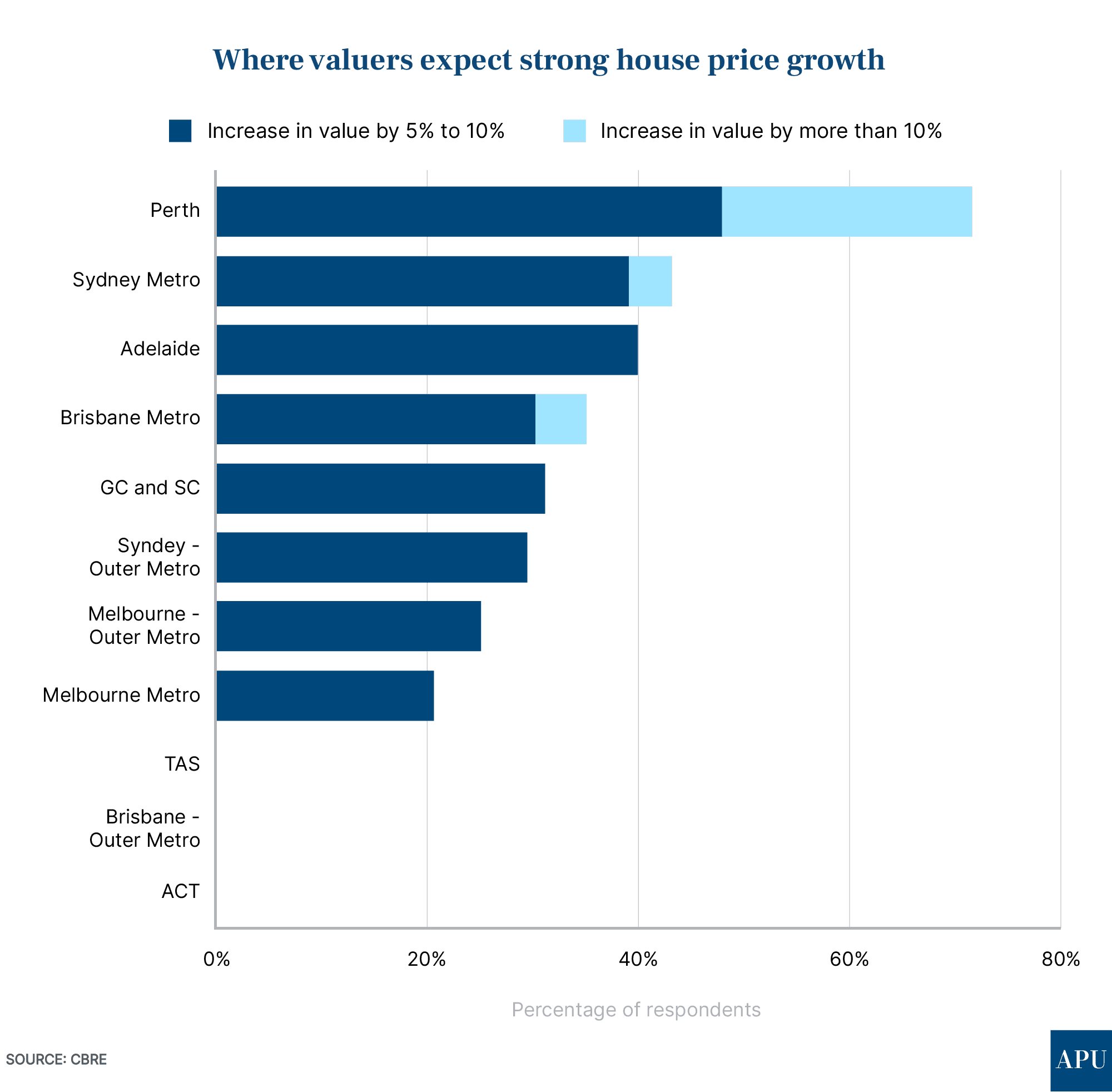

CBRE’s “Residential Valuer Insights” says 78% of valuers surveyed expect house values to increase in the next 12 months.

“Perth, Sydney metro and Adelaide were nominated as locations for most of this expected growth.”

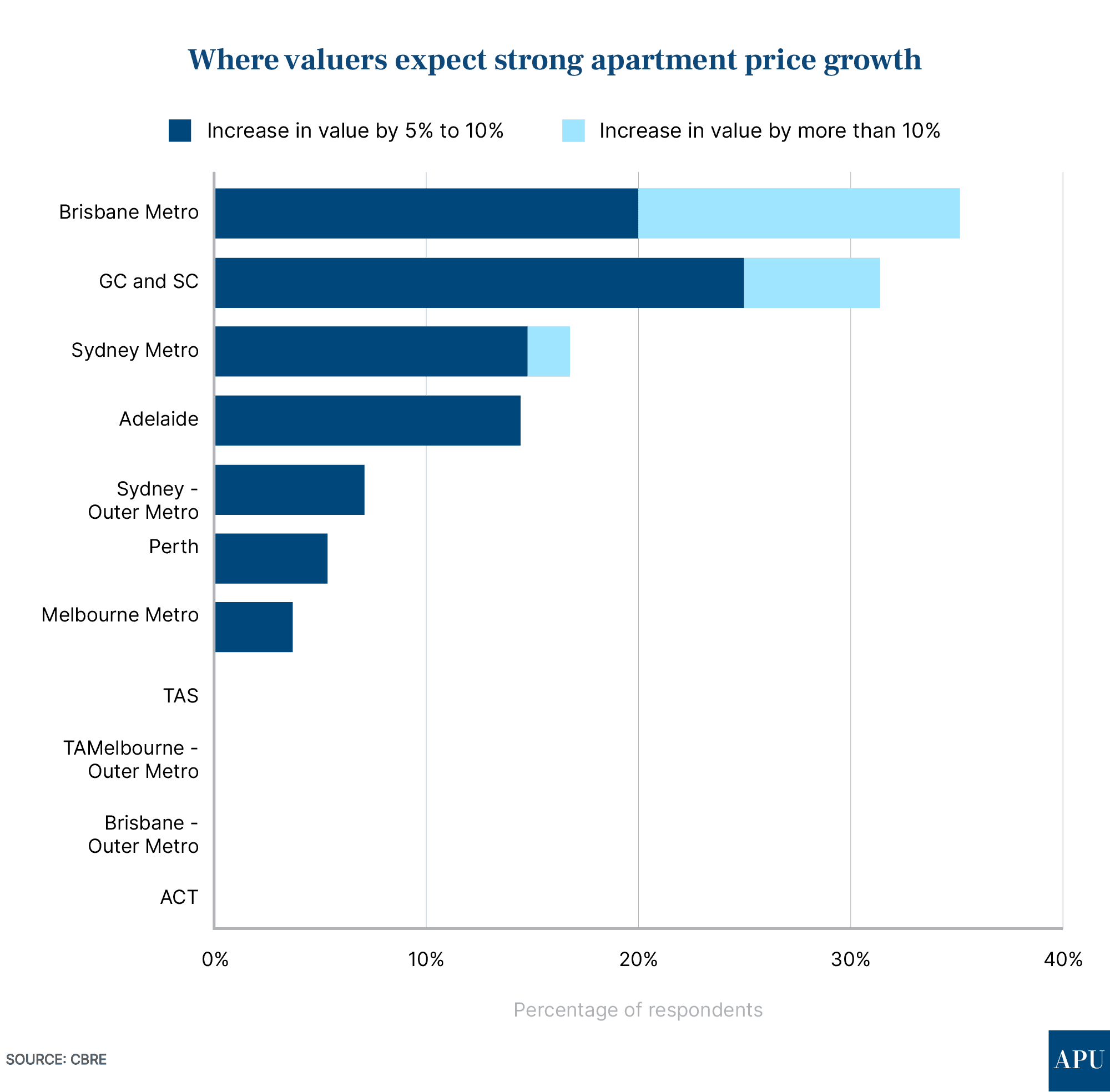

It’s a different story when it comes to apartments.

CBRE says 44% of valuers expect apartment values to increase over the next year, with 15% expecting more than 5% price growth and 45% saying they thought prices would remain stable.

“Markets where most apartment value growth is expected are Brisbane metro, the Gold and Sunshine Coasts, and Sydney metro.”

Nearly 3/5ths (57%) of valuers expect demand to increase “slightly” or “significantly” in the next 12 months, according to CBRE, and when you dig down into where this demand growth is expected, it’s in the ACT, outer Melbourne, and Sydney metro areas.

This finding is particularly interesting, in light of at least two of the “big 4” banks recently downgrading their price growth forecasts for Melbourne.

As one anonymous Melbourne valuer told CBRE, “Work from home continues to affect the local market, with an increase in demand for dwellings in (the) outer south-western suburbs, with residents knowing they do not have to commute every day.”

Maybe banks with their fancy econometric modelling have been too quick to write off the home price growth prospects of the Victorian capital and should talk to the people at the coalface more.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)