KEY POINTS

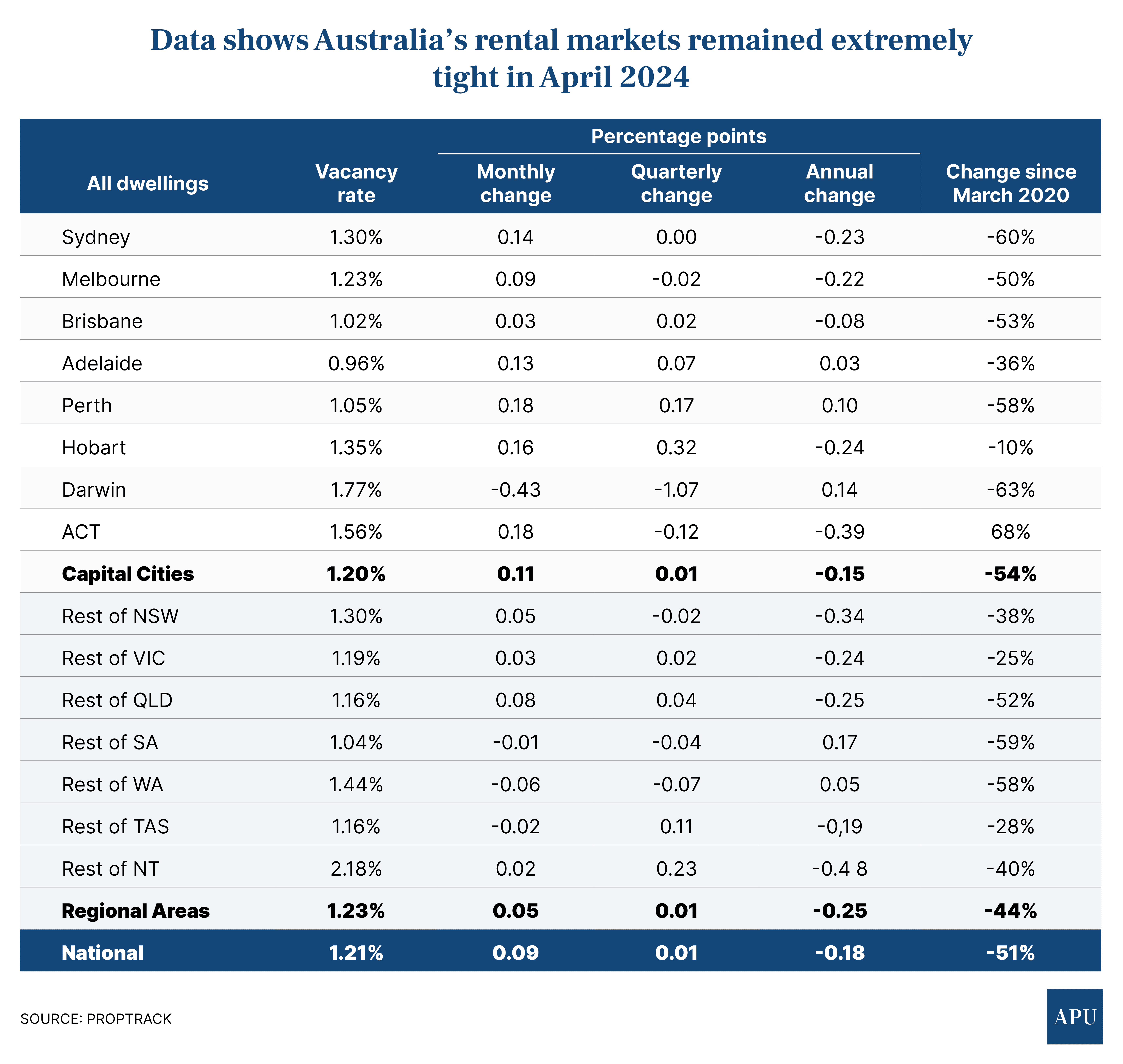

- National rental vacancy rates only eased slightly in April, with PropTrack saying the situation remains “incredibly tough” for tenants

- PropTrack’s national vacancy rate measure rose just 0.09% to 1.21%

- The data analytics firm says it expects competition for the small number of rental properties that are available will continue to drive up rents

New data from REA Group’s PropTrack shows that conditions for tenants eased only slightly in April, with the firm’s national rental property vacancy rate measure increasing less than one-tenth of 1 percentage point.

PropTrack says the situation remains “incredibly tough” for renters.

The data analytics firm says strong competition between prospective tenants for the properties that are actually available, means weekly rents are “still set to edge higher”.

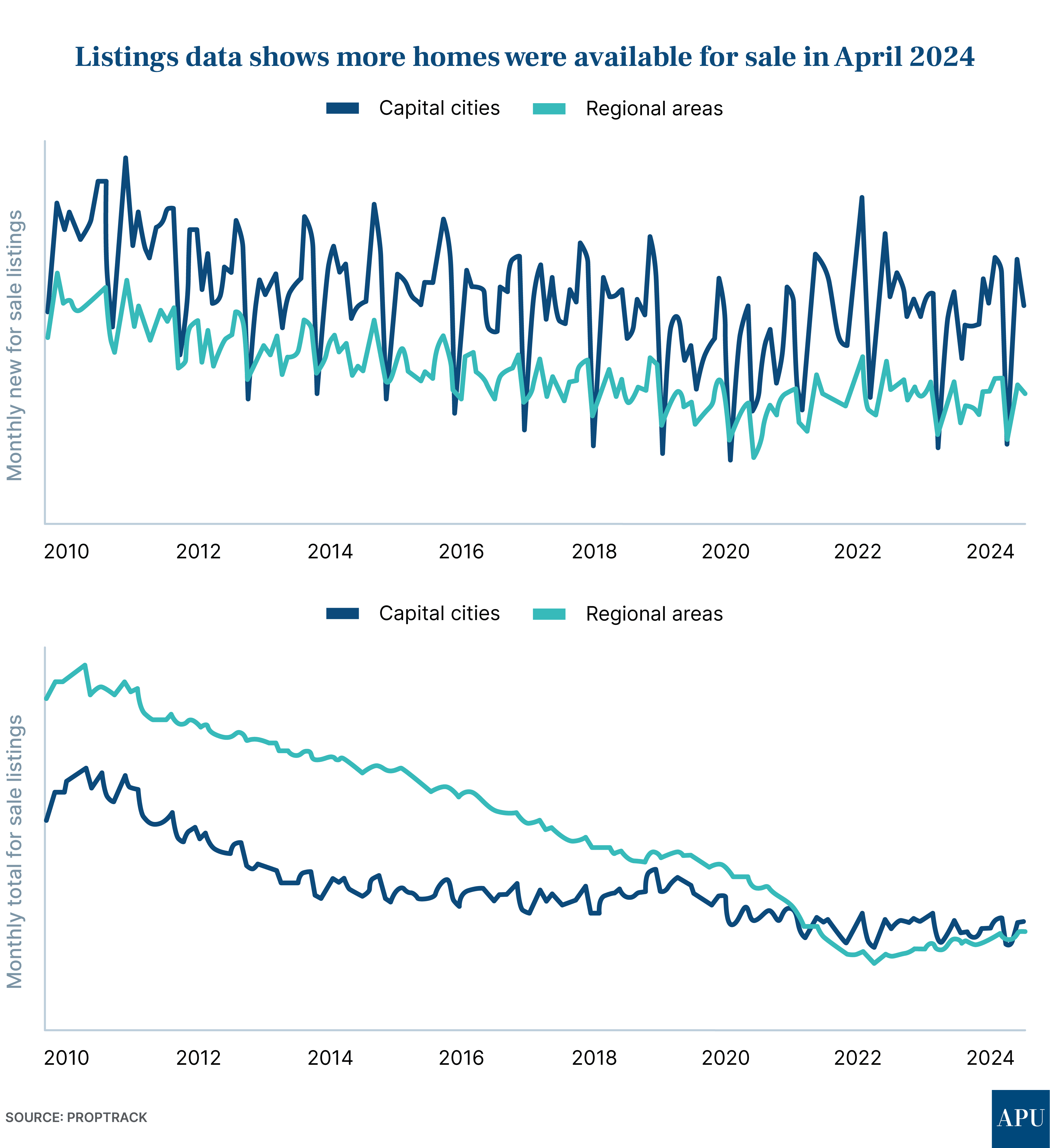

PropTrack has also released separate data on the number of existing properties for sale.

It shows that while listings were up more than 40% last year in the capital cities, demand remains strong, suggesting home prices will continue to grow.

The details

PropTrack has characterised its April rental numbers as data that shows “Australia’s renters finally get some relief”.

I’d argue that’s seriously over-egging some pretty dismal numbers, at least if you are in the market for a rental property.

What the data actually shows is that the number of vacant rental properties increased ever so slightly in April, with the national vacancy rate rising just 0.09 percentage points to 1.21%.

That’s margin-of-error territory, and I’ll bet if you asked someone looking at properties to rent whether there had been noticeably more properties to choose from in April, rather than March, the answer would be a firm “no”.

Even PropTrack economist Anne Flaherty, who compiled the numbers, is frank.

“While vacancy eased in April, conditions remain incredibly tough for renters, with just 1.21% of rental properties sitting vacant over the month.”

PropTrack also points out the national vacancy rate has fallen 0.18 percentage points over the past year, and “remains at less than half the level considered a healthy rate of vacancy.”

The deterioration in rental conditions over the past 12 months has been more pronounced in regional areas, with vacancy down 0.25% compared to a 0.15% drop in the cities.

A 3% vacancy rate is generally considered a “healthy” or “balanced” market, where tenants have a good selection of properties to choose from, while landlords are still guaranteed a good rental return on their investment.

Perth and Canberra saw the largest increases in rental vacancy rates over the month, each up 0.18 percentage points to 1.05% and 1.56%, respectively.

This is the first time Perth has seen a vacancy rate above 1% since July 2022.

Hobart was up 0.16 percentage points, while Sydney’s rental vacancy rate eased 0.14 percentage points to 1.30%.

Melbourne experienced only a small rise during April, up 0.09 percentage points to 1.23%, while Brisbane was largely unchanged at 1.02%.

Adelaide had the lowest vacancy rate of any market in April, with just 0.96% of rental properties sitting vacant, despite seeing a rise in availability of 0.13 percentage points.

“Adelaide has cemented its place as the most difficult city to find a rental and was the only capital to see its vacancy rate sitting below 1% in April,” PropTrack’s Anne Flaherty says.

In good news for investors, Ms Flaherty also says rental price growth is unlikely to slow down.

“With vacant properties scarce, homes that do come up for rent are continuing to see high levels of competition, which is driving rent prices higher,” she says.

New listings data

Separate PropTrack data also shows the selling activity of existing homes picked up in April.

Nationally, new listings on REA Group’s realestate.com.au were up 32% from April 2023, while total listings were up 7.7%.

PropTrack says that marks the strongest April for new listings since 2021 and total listings since 2020.

Much of the growth came in the cities, with new listings up 40.4% on April 2023 across PropTrack’s combined capital cities measure, with new for-sale listings higher in each capital city market.

“Following a pullback in new listings in March due to Easter, we saw a strong lift in new listings in April, indicating ongoing vendor confidence,” says PropTrack’s Director of Economic Research, Cameron Kusher.

“Although home prices have remained buoyant in early 2024, the surge in new listings has seen the total number of properties advertised for sale mounts, particularly in Sydney, Melbourne and Canberra.”

But Mr Kusher indicates more properties on the market doesn’t mean there’s a spate of vendor discounting, pushing prices lower.

“Despite the increase in properties available for sale, other indicators signal that buyer demand remains strong, such as median time on market declining and overall enquiries rising compared to a year ago.”

While there’s now a general expectation that interest rates will remain higher for longer, Cameron Kusher warns that many buyers do not see high mortgage rates as a barrier to purchasing a home.

“Although rate cut expectations have now pushed into 2025,” he says, “they remain stable and at historically moderate levels.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)