Features > Property News & Insights > Housing Trends

Rents hit a new record as rental growth re-accelerates

Image from NCA NewsWire / Jeremy Piper

KEY POINTS

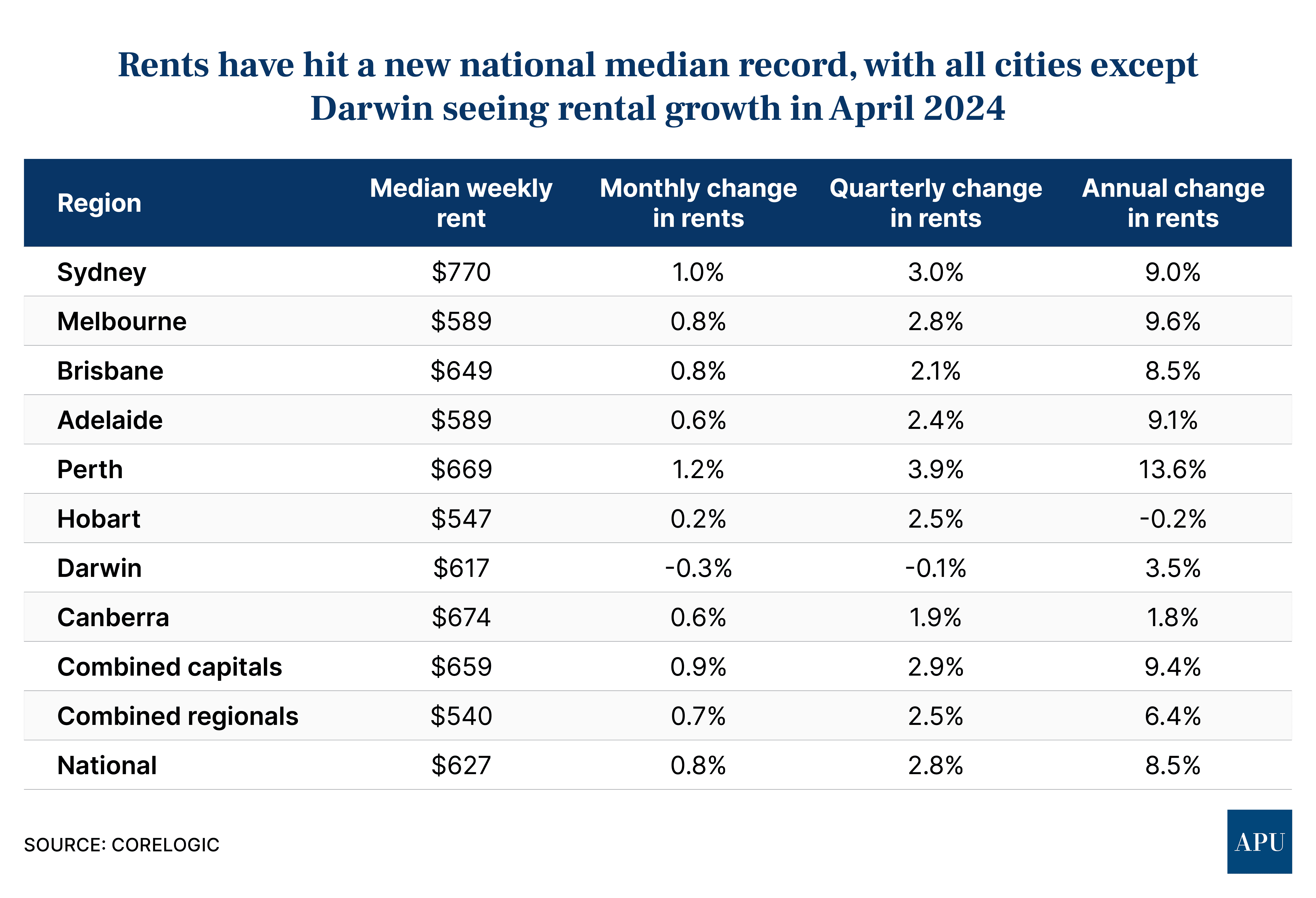

- CoreLogic says median weekly rents in Australia hit a new record of $627 per week in April 2024

- The data analytics firm says the annual pace of rental growth has also re-accelerated to 8.5%

- CoreLogic has found that rents in some outer suburban areas are currently growing at a faster rate than locations closer to capital city CBDs

New figures show the median weekly rent in Australia has hit a new record high of $627 per week.

Despite a cost-of-living crisis and a per capita recession, the data shows that rather than rent increases being limited by affordability constraints, annual rent growth has once again started gathering pace to now sit at 8.5%.

The latest CoreLogic rental market update also contains some fascinating and surprising insights into the suburbs in our capital cities where rental growth is fastest.

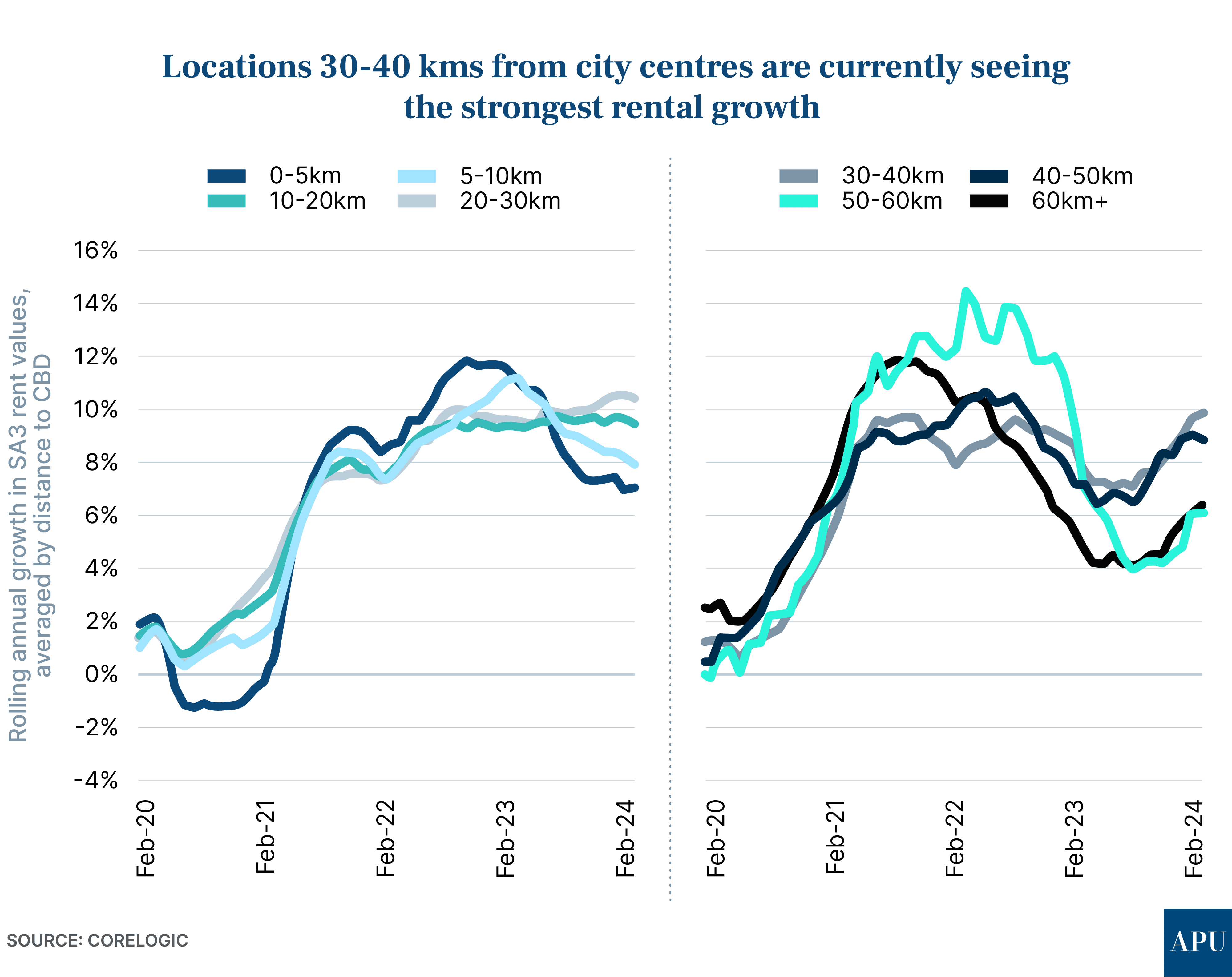

Contrary to conventional wisdom, they clearly show that rents in some outer suburbs are growing at a faster rate than locations closer to the central business district.

The CoreLogic data shows the median rent cost in Australia’s cities in April was $659 a week.

Sydney was the most expensive city to rent in (median rent $770 per week), while Hobart was the cheapest (median rent $547).

Perth saw the fastest rental growth, with a chronic housing shortage in the WA capital seeing median annual rents being pushed up by 13.6%, while Sydney (9%), Melbourne (9.6%), Brisbane (8.5%) and Adelaide (9.1%) all experienced strong annual growth.

Darwin was the only city in which rents eased in April (-0.3%), while Hobart was the only capital where rents had gone backwards over the past year (-0.2%).

“Even markets where rents had been falling are now showing values start to steady or increase again,” CoreLogic’s Head of Research, Eliza Owen says.

Ms Owen says rent growth is being bolstered by the continuing “supply and demand pressures” across Australia’s rental market more broadly.

On the demand side, she points out that net overseas migration in the year to September was just under 550,000, with temporary visa holders accounting for over 90% of this figure.

“This means overseas arrivals were particularly likely to skew to rental accommodation through the period,” she says.

“Considering an average household size of 2.5 people, net overseas migration levels implied new household formation of over 200,000 in the year to September.”

On the supply side, she points to continuing “constraints” in the building industry, with only 173,000 new dwellings completed during the same period.

Where rents are rising the fastest

In bad news for renters, Eliza Owen points out that the annual pace of rent growth increased from 8.1% in October last year to 8.5% in April.

“Part of the reason for the re-acceleration in rents nationally could be due to renters being forced into more affordable, peripheral housing markets as they become priced out of more desirable and central metropolitan locations,” she says.

“Areas, where rents are slightly lower, may offer more space for group households or have slightly less competitive rental conditions which are potentially being more targeted by prospective tenants.”

To illustrate this, CoreLogic has produced the chart above, which clearly shows annual rent growth falling in areas close to city centres, while growth is strong in the 20-30 kilometres and even stronger in the 30-40 km belts.

“Between October last year and April this year, growth re-accelerated most strongly in greater capital city areas within 30-40 km of city centres,” CoreLogic’s Eliza Owen says.

“In Sydney, this included Campbelltown, where annual growth went from 9.1% in October to 13.4% in the year to April.”

“In Brisbane, this included Jimboomba, where annual rent growth went from 3.8% to 6.4% in the same period.”

“Casey–North in Melbourne is also within this distance, where annual house rent growth went from 11.7% to 13.1% in the same period.”

It’s interesting to note that many of the areas currently experiencing the strongest rental growth are also leading the rise that we are continuing to see in Australian residential property values.

These are suburbs where it is often still possible to purchase an affordable property.

I’d suggest that some of the areas seeing strong rental growth may have a good number of properties that were recently purchased by “rentvestors”, who’ve bought where they can afford, but maybe renting closer to city centres to be closer to work, family, and friends.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20154.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20Cost%20of%20Living%20Crisis%20Has%20Reached%20a%20Breaking%20Point%20(Millions%20Will%20Be%20Homeless)%20Scott%20Kuru%20DPU%20154.jpg)

%20Scott%20Kuru%20DPU%20153.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Exposes%20Australia%E2%80%99s%20Oil%20Crisis%20Far%20Worse%20Than%20Expected%20($50%20Billion%20Lost)%20Scott%20Kuru%20DPU%20153.jpg)

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)