Features > Property News & Insights > Housing Trends

The areas where every home seller scored a hefty profit

KEY POINTS

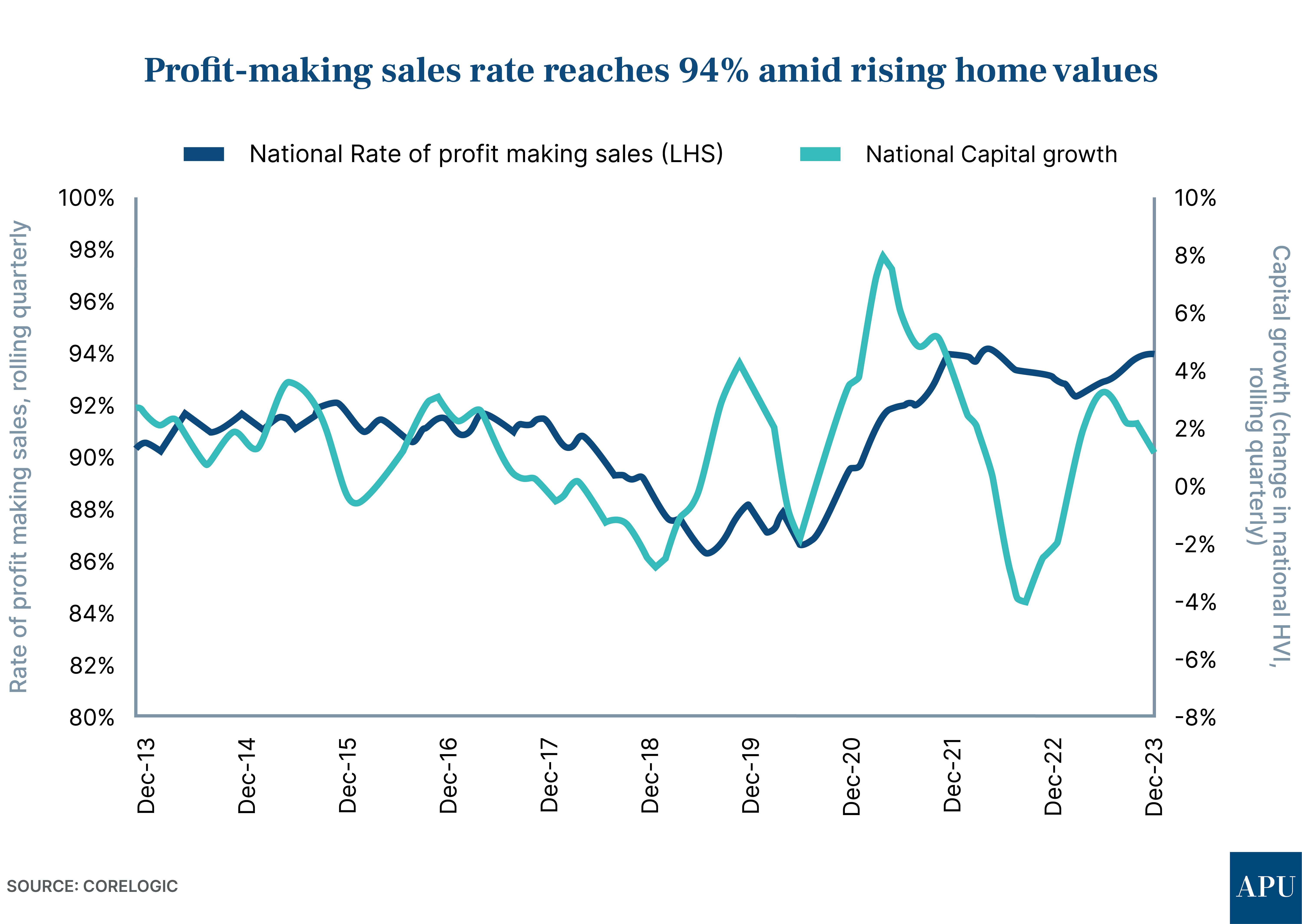

- Profit-making home sales rose nationwide, lifted by the notable recovery in home values despite higher interest rates and soaring costs of living according to CoreLogic.

- Adelaide topped the most profitable capital city for the fifth quarter in a row, with 98.5 per cent of all homes sold delivering nominal gains.

- The number of local government areas where all houses and units were sold for profit has more than doubled from the previous year's quarter.

Every house and unit seller in more than 300 local government areas (LGAs) nationwide scored up to $1 million in gross profits during the December quarter, powered by the remarkable upswing in the housing market in the past 13 months, CoreLogic’s Pain and Gain report shows.

That is a sharp rise from the previous quarter when only 137 LGAs recorded 100 per cent profitability for houses and units sold.

Regional areas dominated the most lucrative markets for vendors with houses sold in 145 regions and units in 126 areas delivering substantial gross profits.

Across the capital cities, houses in 27 LGAs and units in 31 areas were all sold for profits during the same period.

Profit-making sales on the rise

This comes as the portion of profitable home sales nationwide lifted by 40 basis points to 94 per cent, while the median profit achieved lifted by 7 per cent to $310,000 in the December quarter, in line with the ongoing increases in dwelling values through the end of the year.

Eliza Owen, CoreLogic head of research, said the improving profitability underscored the housing market’s resilience despite higher interest rates and surging costs of living.

“Rising home values mean more sellers are making a profit, and that’s good from a financial stability perspective,” she said.

“This means fewer homeowners will fall into defaults or negative equity, so it’s very fortunate that housing values have continued to rise as we transition from low-interest rates to the current high rates.

“It’s safe to say profitability will rise again in the coming quarters based on the sustained increases in housing values since the start of the year.”

Home values nationwide lifted by 1.3 per cent in the December quarter, followed by a further 1 per cent in the first two months of the year.

Adelaide held on to its title as the most profitable capital city market for the fifth consecutive quarter with just 1.5 per cent of transactions recording a nominal loss.

Brisbane had the highest proportion of profitable house resales at 99.3 per cent while Perth posted the sharpest reduction in the rate of loss-making sales across the capital cities, where it fell to 8.4 per cent from 9.6 per cent in the September quarter.

Most lucrative house markets

In Sydney, every house sold was profitable and racked up more than $1 million in median gross profits across Ku-ring-gai, Inner West, Strathfield and Botany Bay in the three months to December.

Canada Bay, Rockdale, Lane Cove, North Sydney, Willoughby and Woollahra were also lucrative for sellers, where all houses sold in the December quarter earning healthy gains.

Nearly all vendors (99.5 per cent) in Hornsby, Ryde (95.9 per cent) and Northern Beaches (98.1 per cent) also scored $1 million median profits during the same period.

In Melbourne, all houses sold in Moorabool were profitable and notched up $$335,250 median gross profit. Meanwhile, 96 per cent of all sales in Boroondara delivered more than $1 million median profit.

All houses sold across Somerset in Brisbane made a profit, and nearly every sale in the Brisbane (99.2 per cent) and Redland (99.1 per cent) LGAs produced more than $400,000 median gross gains.

Burnside, Walkerville, Unley and Holdfast Bay were among the most profitable LGAs in Adelaide, with each house selling substantially higher than their original purchase price. In those LGAs, vendors pocketed between $650,000 and $732,000 median gross profits.

Perth’s ongoing boom also delivered large gains of up to $875,000 for sellers in affluent areas such as Mosman Park, Subiaco, Nedlands and Cottesloe, where every house sold in those areas was profitable.

Regional New South Wales led the most profitable areas outside the capital cities nationally, with all houses sold in Kiama, Bega Valley, Nambucca, Dungog and Singleton delivering vendors a windfall of up to $897,000 median gross gain.

In Victoria, the Surf Coast topped the most profitable market in the state with all houses selling for profit and making a median gross gain of $715,000.

Meanwhile, all house vendors across Toowoomba in Queensland reaped a $235,000 median gross gain during the same period.

Most profitable unit markets

In the unit market, Camden and Wollondilly in Sydney’s outer fringe were the most lucrative where all units sold bagged a median gross profit of $185,000.

Across Melbourne, all units sold in Nillumbik, Melton and Macedon Range achieved nominal gains of up to $186,000 as were those in Redland, Scenic Rim, Lockyer Valley and Somerset in Brisbane where vendors pocketed similar gains.

Unit vendors in Adelaide LGAs Mitcham, Holdfast Bay and Onkaparinga also reaped a windfall as every unit sold delivered a median gross profit of up to $215,000.

In Perth, Mundaring, Murray and Peppermint Grove were the most rewarding for unit vendors, while Hobart, Glenorchy, Brighton and Derwent Valley were also profitable.

Units gain ground

Houses continued to achieve higher rates of profit-making sales at 97 per cent compared to 88.2 per cent for units, however, the gap has been narrowing, indicating a potential shift in market dynamics including affordability along with supply constraints, Ms Owen said.

“Profitability in the unit sector has improved faster than houses in the December quarter and will likely keep rising in the coming months,” she said.

“The relatively large premium on house values has put them out of reach for many, particularly first-home buyers and lower-income households. As units become increasingly attractive to buyers, the price gap between detached housing and medium to high-density homes will close and profitability of units will improve.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)