Features > Property News & Insights > Housing Trends

New home value and rent records for some regional property markets

KEY POINTS

- Home values in 19 of Australia’s 50 largest regional markets have hit new record highs, led by strong growth in coastal WA and regional Queensland

- CoreLogic says home value growth in Regional Australia outpaced growth in the capital cities in the three months to April

- Rents are also at record highs in 37 of the 50 largest regional property markets

New data shows that home values in around 40% of Australia’s largest regional markets have hit new record highs and in some cases are outpacing price growth in capital cities.

The figures show that nearly 4 out of 5 of these markets have also reached new median rental price records.

However, the CoreLogic data shows growth in home values is uneven across the country, and weighted heavily towards booming markets in Western Australia and Queensland.

Top regions for value growth

CoreLogic says home values in its Combined Regionals measure rose 2.1% in the three months to April 2024, the fastest quarterly growth rate in almost two years.

As a point of comparison, CoreLogic’s Combined Capital Cities index rose 1.7% in the same period.

The figures were compiled by economist Kaytlin Ezzy, who says the recent growth in home values saw the regions record a nominal recovery in March and then reach a new record high in April.

“After falling 5.8% between May 2022 and January 2023, regional home values have seen a slower recovery compared to capital city values but have now regained the losses from the downturn to reach a new record high,” Ms Ezzy says.

The data shows that 19 of the nation’s 50 largest non-capital city Significant Urban Areas (SUAs) are at a record high.

The SUA is a measure used by the Australian Bureau of Statistics and adopted by economists and demographers.

Coastal Western Australia is home to some of the best performing regional markets.

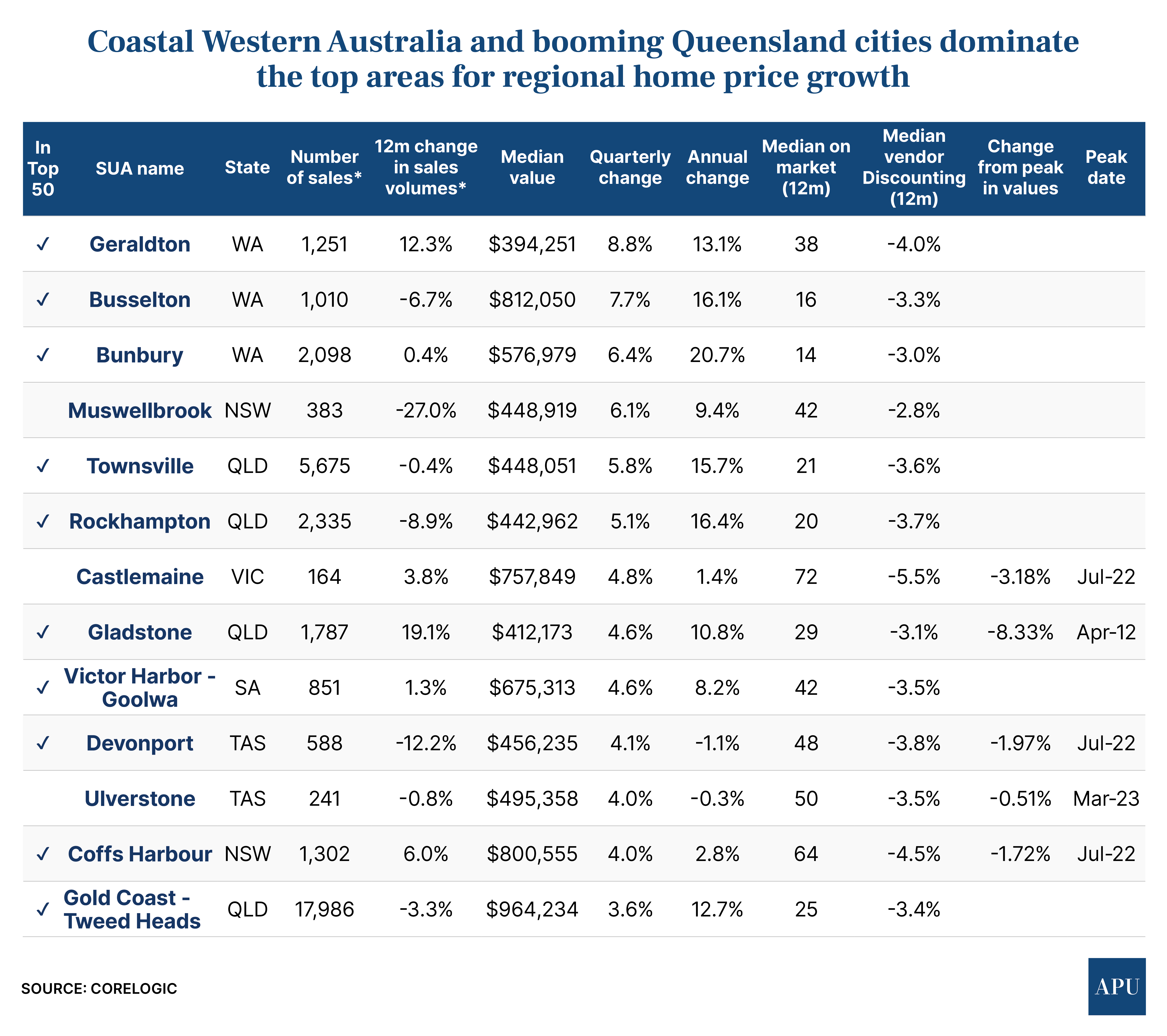

The large regional centre of Geraldton, 400 kms north of Perth, saw the largest gains over the three months to the 30th of April, up 8.8%, followed by Busselton (7.7%) and Bunbury (6.4%).

Bunbury, two hours drive south of Perth, boasted the largest growth over the past year, up 20.7%, and properties there saw the fastest selling time - just 14 days.

Townsville, Rockhampton, Gladstone and the Gold Coast in Queensland were four of the top 10 SUA’s for quarterly growth, while Victor Harbor in South Australia, Devonport in Tasmania and Coffs Harbour in New South Wales rounded out the Top Ten.

The towns of Muswellbrook in New South Wales, Castlemaine in Victoria and Ulverstone in Tasmania also came in towards the top of the list, but these three are not markets in Australia’s 50 largest non-capital regions.

“The diversity in economic activity across these parts of regional WA and Queensland including agriculture, tourism, ports and mining would be contributing to the strength of these markets, along with their higher levels of interstate migration, relative affordability and low supply levels,” Ms Ezzy says.

With the exception of touristy Busselton, and the large centres of Coffs Harbour and the Gold Coast, the best performing of the 50 largest non-capital city SUA’s were marked by relative affordability, with most markets offering homes with a median price of less than $600,000.

CoreLogic says the worst-performing regional markets were in Victoria and New South Wales, with Ballarat and Port Macquarie both down 2.0% over the three months to April.

Ballarat also saw the largest annual drop in values, down 4.2%.

Markets in the Southern Highlands & Shoalhaven regions of New South Wales had some of the worst selling conditions in the country, with Batemans Bay offering the highest vendor discounts at 6.5% and Bowral-Mittagong recording the highest median time on market at 75 days per property.

Top regions for rental growth

CoreLogic’s Combined Regionals measure shows rental growth continued to accelerate, with rents rising 6.3% over the 12 months to April, up from 4.9% over the year to January.

At the same time, annual rental growth across the Combined Capitals index eased from 9.6% to 9.4%.

CoreLogic says 37 of the 50 largest non-capital SUAs have rents at a record high, with almost all recording rent increases over the past three months (47 markets) and past year (48).

After recording rental declines throughout 2023, the New South Wales coastal resort of Batemans Bay saw the largest quarterly increase in rents, up 6.0% or $32 per week over the three months to April, followed by WA’s Bunbury (4.7%) and Queensland’s Sunshine Coast (4.4%).

Bunbury also had the largest annual rental growth, up 16.4%, while the mining hub of Kalgoorlie – Boulder had the highest gross rental yield in Regional Australia at 9.4%.

In terms of price, Tasmania’s Burnie – Somerset region saw the most affordable rental market at $419 per week, while the Gold Coast – Tweed Heads border region was the most expensive at $827 per week.

The take out

There’s no doubt the larger urban areas in Regional Australia have recovered some of the ground they lost when interest rates started to rise and bosses started demanding workers return to the office as the COVID-19 pandemic started to unwind.

In fact, just under 2 in 5 of the Top 50 non-capital SUAs are now at new record highs.

Like most of Australia, rental accommodation is also scarce in many of these regions, with nearly 4 out of 5 regions in the Top 50 seeing record rents.

However, CoreLogic economist Kaytlin Ezzy says the outlook for property in Regional Australia is uncertain.

“Housing affordability has continued to deteriorate through the start of 2024 for tenants and prospective home buyers alike,” she says.

“The outlook for regional housing markets will heavily depend on demographic trends, housing supply, localised economic drivers and the outlook for interest rates.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)