Features > Property News & Insights > Housing Trends

Melbourne & Perth set to outperform other capitals: BoQ

KEY POINTS

- Bank of Queensland says Melbourne house prices will climb by around 16% over the next two years

- The Brisbane-based bank says it expects house prices in the Victorian capital to soar because of their relative affordability at a time of strong population growth.

- BoQ is also predicting Perth’s recent run of strong price growth to continue, with houses in the WA capital forecast to grow 15% by the end of next year

Australia’s sixth largest bank is predicting that Melbourne house prices will grow by around 16% over the next two years, bolstered by their relative affordability.

The Bank of Queensland is also forecasting Perth to continue to grow strongly over the next two years, albeit at a slower pace.

“I expect that the biggest rise in standalone house prices in 2024 will be in Melbourne and Perth, the two cities that I think currently provide the best value”, says BoQ chief economist Peter Munckton.

To gauge “value”, Mr Munckton compares factors like “rental yields with the level of long-term interest rates.”

“Melbourne price performance last year was modest by capital city standards,” he says, while prices in Perth “will also be supported by constrained new housing supply, as well as WA having the second lowest state unemployment rate.”

Surprise pick

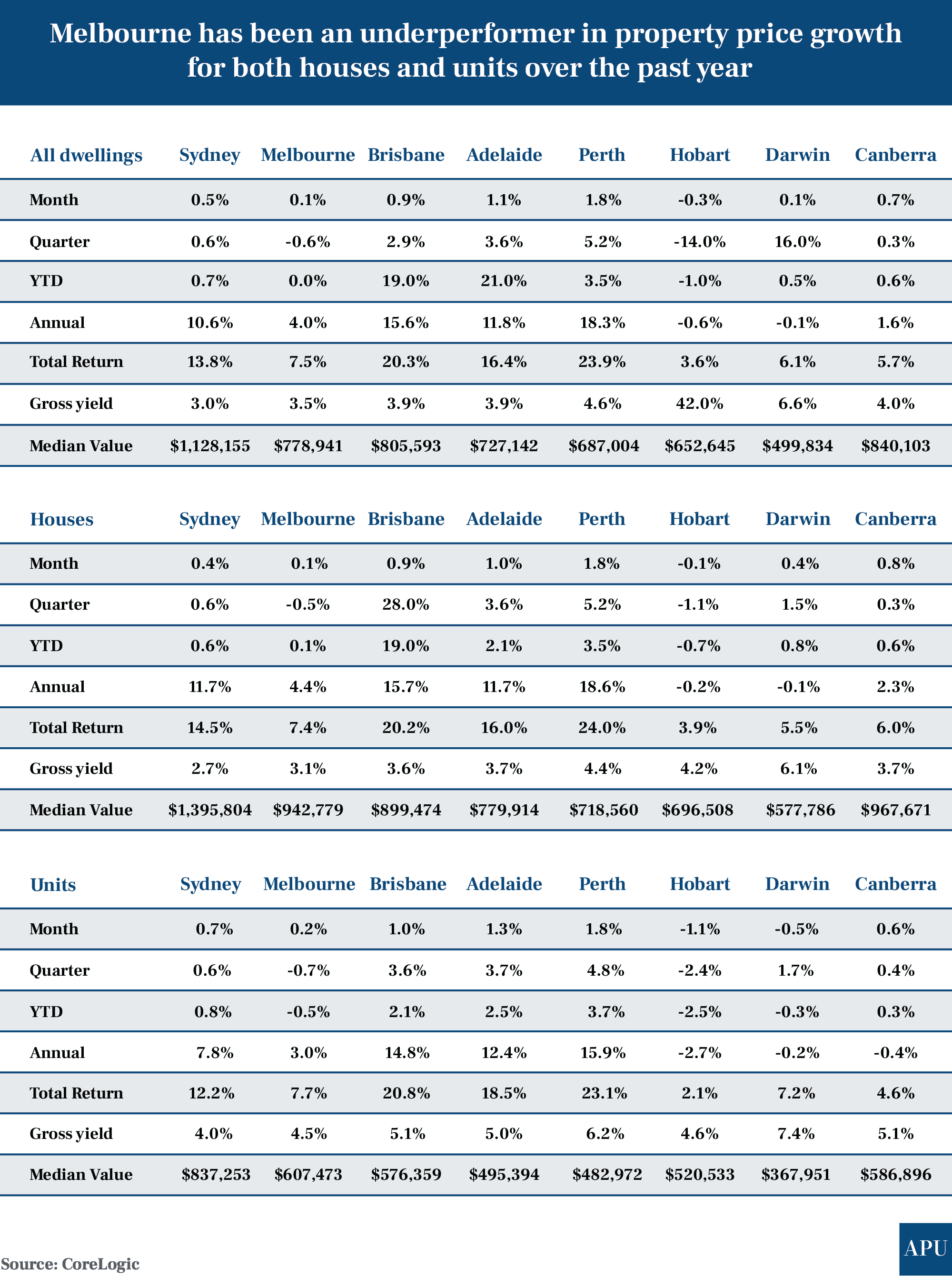

The prediction about Melbourne has surprised many observers, given the Victorian capital has experienced years of sluggish property growth, with CoreLogic figures showing houses grew by 4.4% in the year to the end of February 2024, while units could only manage price growth of 3%.

Compare that to Sydney, which over the same period has experienced 11.7% house price growth, Brisbane 15.7%, and Perth - a whopping 18.6%.

Recently, ANZ Bank downgraded its growth forecast for Melbourne dwellings for this year to 2-3% with a slight uptick to 4-5% in 2025.

“Price growth has fallen more than expected and that lack of momentum is something we expect to see in early 2024,” says ANZ senior economist Adelaide Timbrell, citing the impact of higher interest rates.

Westpac is predicting only 2% growth this year for all housing in Melbourne and 3% in 2025, while NAB has also slashed its price expectations by around half to 2.6% this year.

Marvellous Melbourne

BoQ, on the other hand, says Melbourne house prices should increase by 7% in 2024 and by another 9% in 2025.

“It will come down to population growth, which has been pretty decent in Melbourne,” BoQ chief economist Peter Munckton says.

Melbourne-based property valuer Greville Pabst is another who believes the southern city is poised to reverse its sluggish growth trend and return to its long-term 40-year growth rate of 6 to 7% annually.

“Should rates drop in the third quarter this year, growth could surge to an impressive 8 to 10%, marking a significant catch-up with Sydney,” he said.

“Investors, attracted by rising property prices and strong rental growth, are set to return.”

John McGrath, the head of the McGrath Estate Agents group, has also remained upbeat about Melbourne’s prospects, saying recent lower price growth gives “buyers more time to take advantage” of 2022’s price correction.

Data provided to Australian Property Update by CoreLogic shows that entry-level homes in Melbourne are now a relative bargain, growing by only 1.5% over the last year.

Related Article: Can you afford to buy a house AND eat smashed avo at a trendy cafe?

Recent changes to Victoria’s taxation of investment properties has spooked many investors.

Over the past 12 months to January, the number of investor-owned listings for sale surged by 52% according to property analytics firm, SuburbTrends.

But some analysts see this relative affordability as an opportunity.

“Melbourne is on track to have one-third of Australia’s entire population growth in the next decade, and overtake Greater Sydney for the title of Australia’s most populous city by 2031-32,” Mr. McGrath says.

“This growth story is expected to boost demand for Melbourne property in the medium-to-long term, with population pressure likely to outweigh any rise in interest rates”.

And continue to look west…

Perth has experienced extraordinary growth over the last 2 years, with new figures from Neoval (owned by the Ray White real estate group) showing houses in the West Australian capital shot up 17.5% in value in the 12 months to February.

As I mentioned before, the figures from CoreLogic to the end of February are even stronger, showing 18.6% annual Perth house price growth.

Going forward, Peter Munckton from BoQ expects that rapid rate of growth to slow somewhat, with Perth house values predicted to lift by 8% this year and by 7% by the end of 2025.

“Adelaide and Brisbane prices have moved substantially over the past couple of years and I would expect price movements in those two cities to be more in line with the national average this year,” he says.

“Hobart, Canberra and Darwin markets have been soft over the past couple of years.”

“I look for those three markets to do relatively better in 2024 although I think that another year of below-average growth is likely.”

Peter Munckton also says Sydney houses now look overpriced compared to Melbourne, and so are likely to underperform.

He’s predicting growth of only 3% in Sydney in 2024 and 5% in 2025.

However, Ray White’s chief economist Nerida Conisbee says there are currently “strong conditions” for houses in both Melbourne and Sydney.

Maybe experts have been too quick to write off the housing growth prospects of Australia’s two largest cities.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20154.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20Cost%20of%20Living%20Crisis%20Has%20Reached%20a%20Breaking%20Point%20(Millions%20Will%20Be%20Homeless)%20Scott%20Kuru%20DPU%20154.jpg)

%20Scott%20Kuru%20DPU%20153.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Exposes%20Australia%E2%80%99s%20Oil%20Crisis%20Far%20Worse%20Than%20Expected%20($50%20Billion%20Lost)%20Scott%20Kuru%20DPU%20153.jpg)

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)