Features > Property News & Insights > Housing Trends

Interpreting Australia’s housing affordability report card

KEY POINTS

- ANZ and CoreLogic’s latest report says a median household would need to spend half of their income on servicing a mortgage on a median-priced Australian home at current interest rates

- The Housing Affordability report also finds renters would need to spend just under a third of their household income to service the median rent - a new high

- However, ANZ and CoreLogic’s report contains some key findings for property investors about possible trends in “rentvesting” and investment destinations

Housing affordability in Australia has deteriorated for buyers and is getting worse, while those at the bottom end of the rental housing market are being hit harder by comparatively larger rent rises.

Those are some of the gloomy conclusions from the latest ANZ-CoreLogic Housing Affordability report.

However, if you read between the lines of some of the findings, it’s also possible to find some bright spots, many of which augur well for savvy property investors.

Home buyer scenarios

The April 2024 ANZ-CoreLogic Housing Affordability report says the rapid increase in the RBA’s cash rate since May 2022 and the subsequent rise in retail mortgage rates have squeezed borrowing capacity and affordability for prospective home buyers.

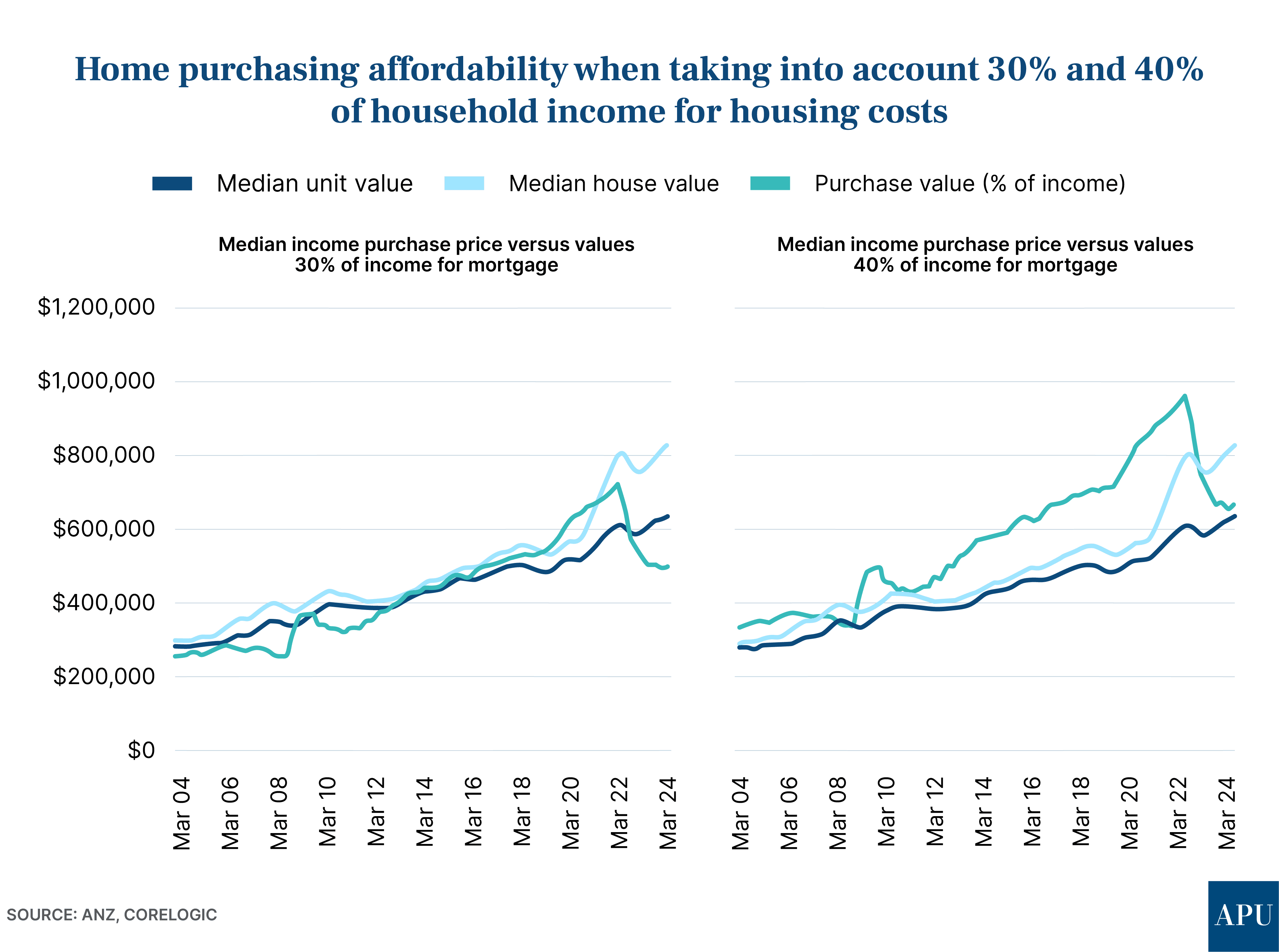

Using a widely accepted metric that putting aside around 30% of income for housing costs avoids household budgets falling into “stress”, ANZ and CoreLogic say an affordable dwelling purchase for a median-income Australian household would be around $503,000.

However, with soaring property prices, this is well below the actual price of most homes in Australia, with the median unit price around $640,000, and the median house price around $834,000.

In fact, CoreLogic estimates that only 17.4% of dwelling stock in Australia is valued below $503,000.

If the proportion of household income put aside for housing is extended to 40%, the report says that under current interest rates of around 6.3% the dwelling price purchase level could be pushed to $670,000.

“CoreLogic estimates that almost 37% of housing stock has a value of $670,000 or less,” the report says.

“This is far from the median income household being able to afford the median dwelling value in Australia (which is currently $773,000).”

Actual home buyer position

So what if you actually calculate how much of a median household income you would need to service a new loan on a median-value home?

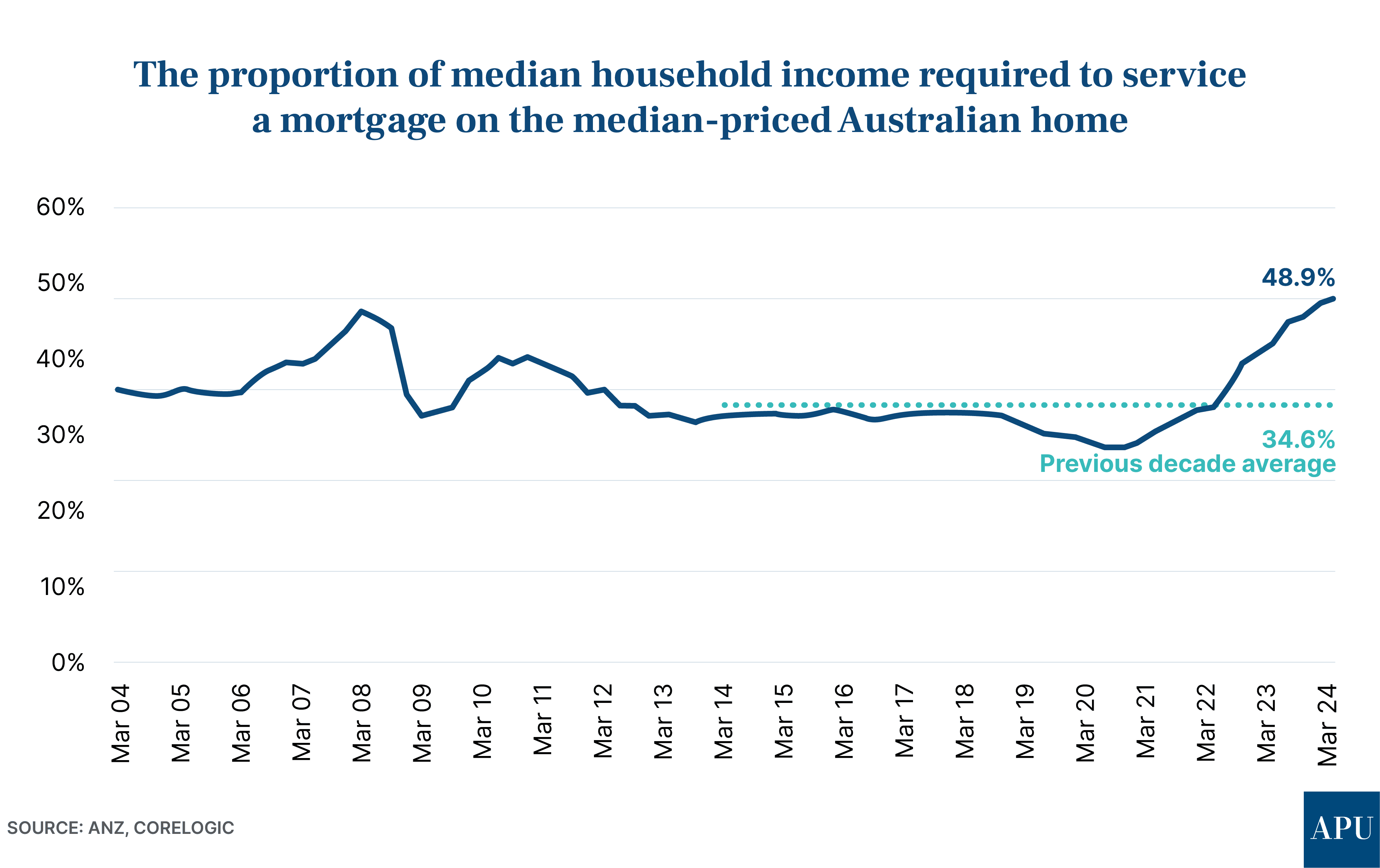

“With home values reaching new record highs in November last year, and the cash rate rising a further 25 basis points in the same month, the portion of median income needed to service a new loan on the median dwelling value reached 48.9% nationally,” the report says.

“This is a record high for the series, and sits well above the previous decade average of 34.6%.”

Basically, ANZ and CoreLogic are saying half a median household’s income is needed to service the loan on a median property.

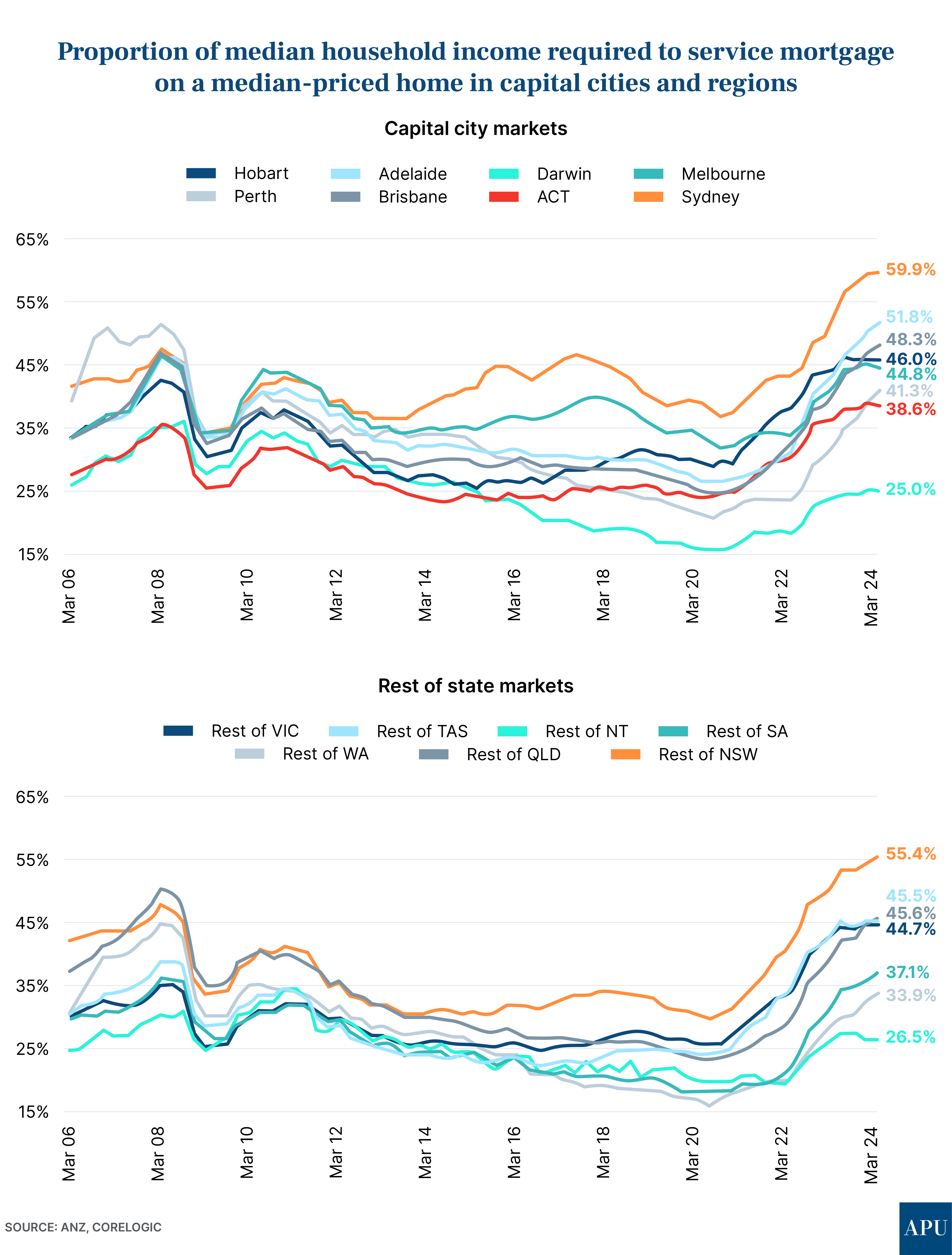

Not surprisingly, this proportion of income used to service a median dwelling is even higher in Sydney, the country’s most expensive property market.

Renting

In terms of monthly outgoings on housing costs, it’s usually cheaper to rent than buy.

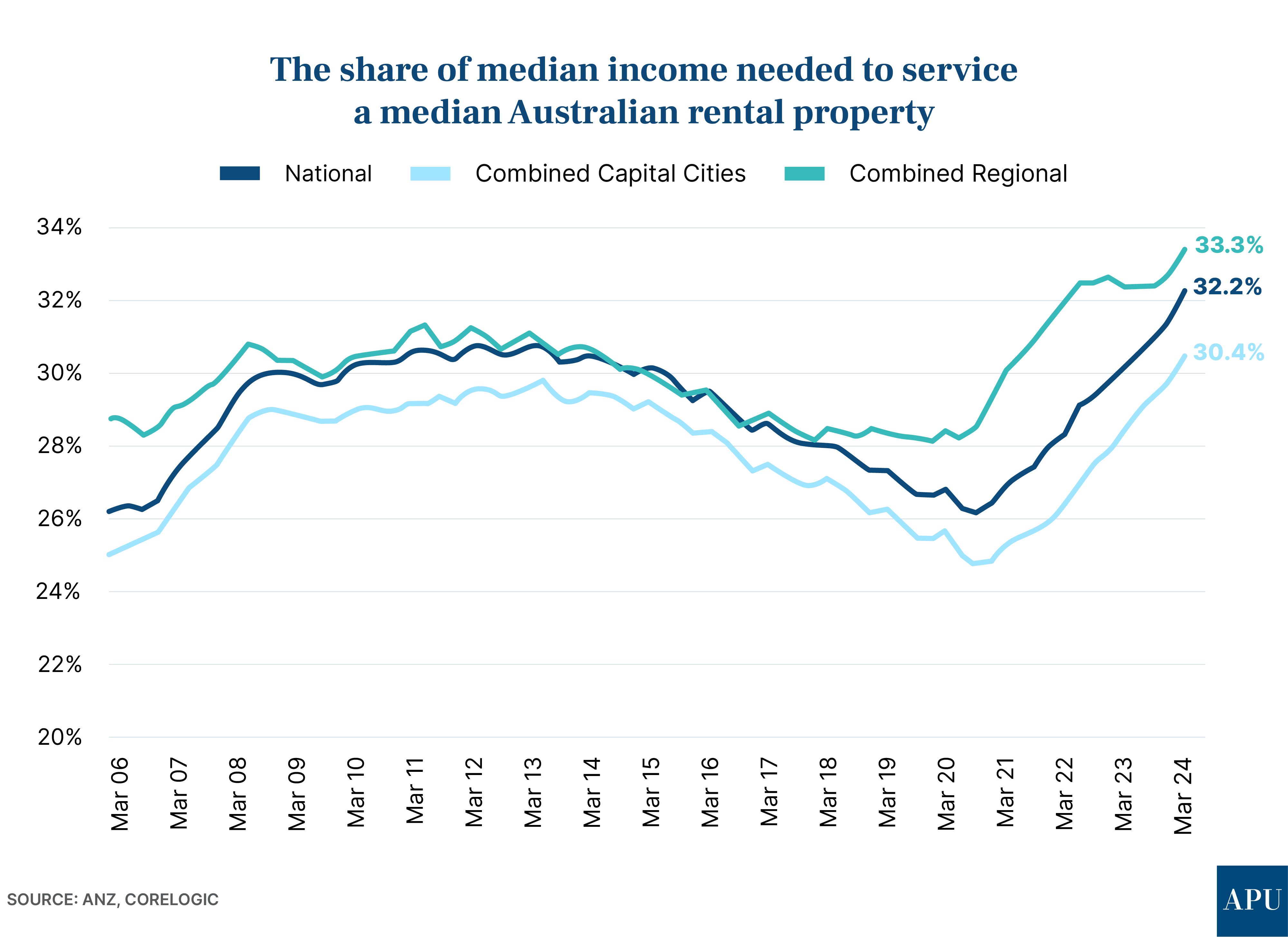

But the ANZ-CoreLogic Housing Affordability Report says there’s been a deterioration in rental affordability as well.

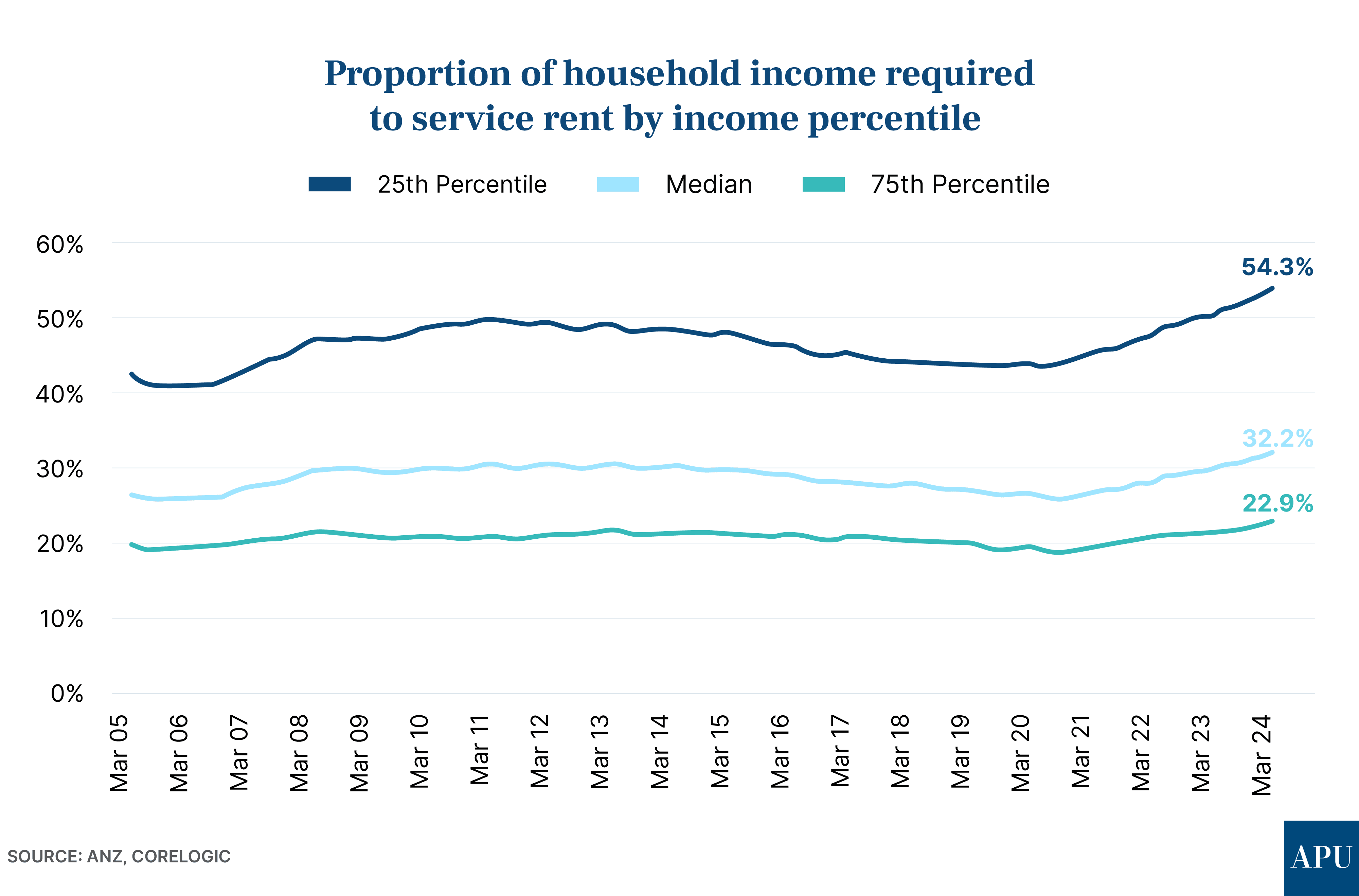

“The portion of median income required to service median new rents reached a series high of 32.2% in March 2024, as median new rents reached $621 per week”, the report says.

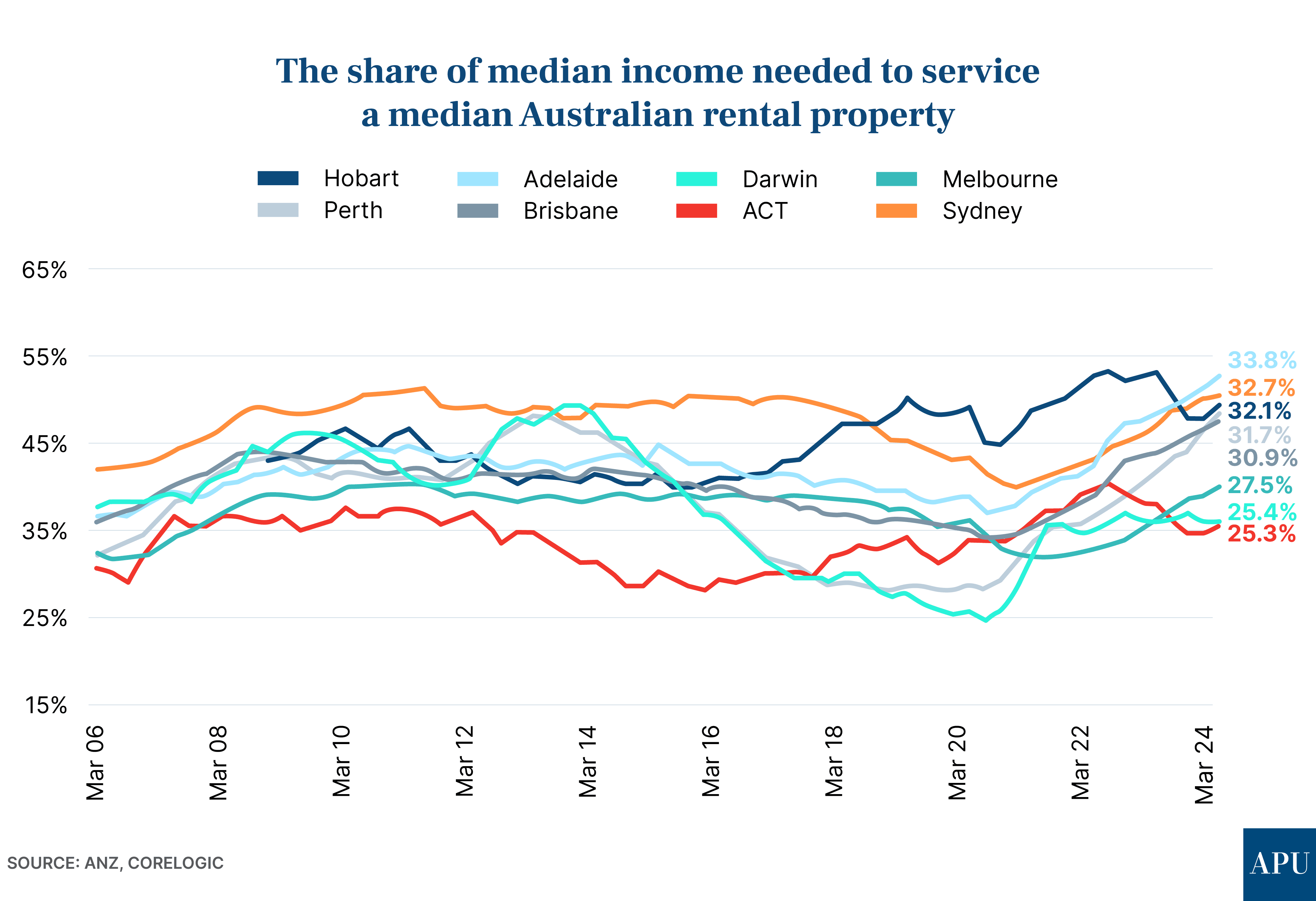

It turns out that Adelaide is actually the most unaffordable Australian city for a median-income household to rent in, followed by Sydney and Hobart.

Canberra and Melbourne are the cheapest places to rent, when compared to household income, according to the ANZ-CoreLogic report.

And it’s likely the proportion of household income that will have to be put aside for rent will continue to grow, with the report finding that since the start of 2024 rent growth is “once again gathering pace.”

“Nationally, annual rent growth has lifted from a recent low of 8.1% year-on-year in October 2023, to 8.6% year-on-year in March 2024.”

And unfortunately, the pressure of higher and higher rents seems to be falling disproportionally on lower-income households.

ANZ and CoreLogic say that “for a household at the 25th percentile of income nationally (earning an estimated $961 per week), the 25th percentile rent value ($521 per week) would require payment of 54.3% of income.”

“This is a series high for the low-income segment.”

A silver lining?

Launching the April 2024 Housing Affordability Report at a conference on the Gold Coast, ANZ Chief Economist Richard Yetsenga was asked if there was a “silver lining opportunity” or a “positive outlook” when it came to housing.

His answer was a short, sharp “No.”

But I’d argue that there are plenty of positives if you look closely at the ANZ-CoreLogic report.

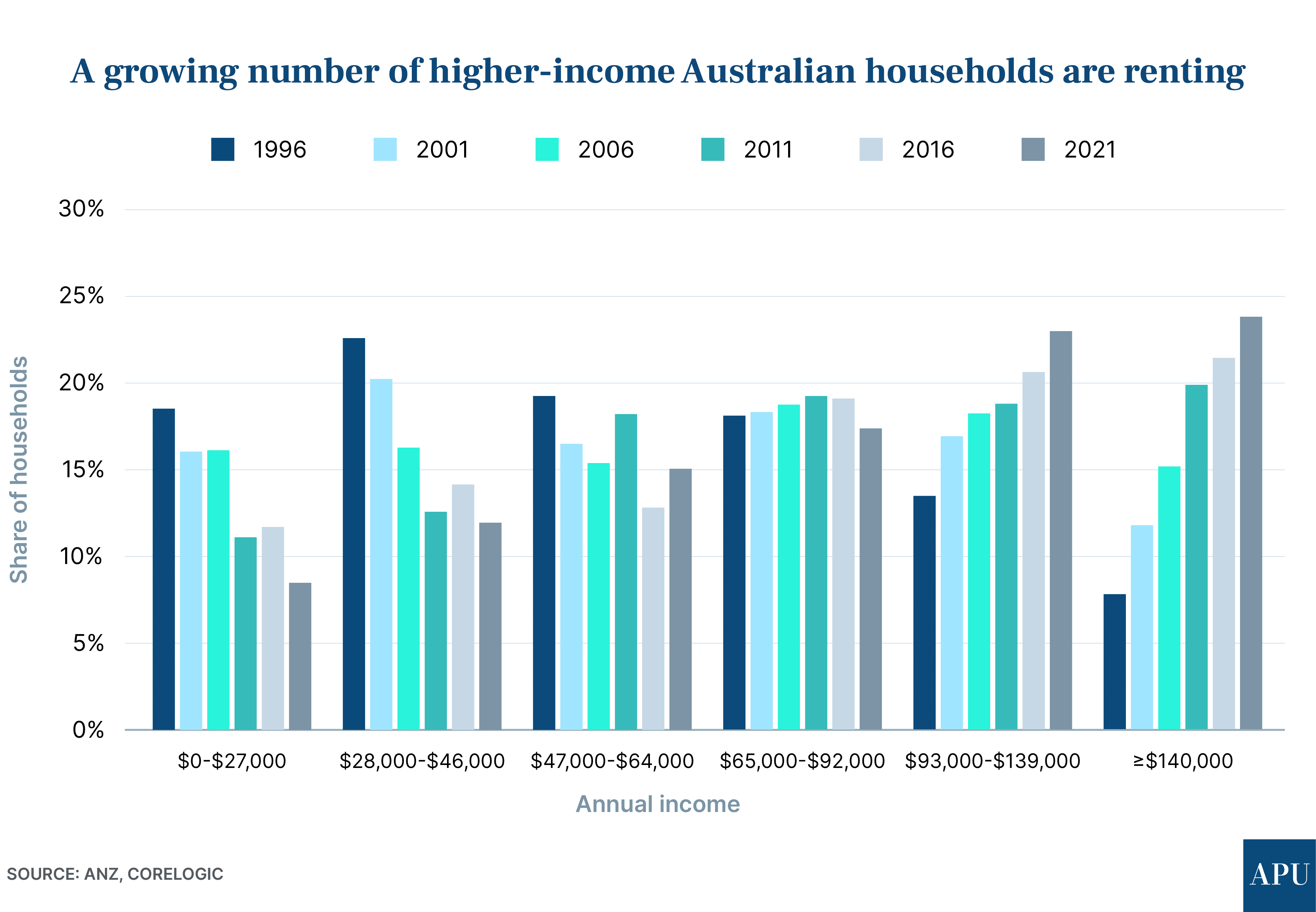

For a start, it cites research by the Australian Housing and Urban Research Institute (AHURI) from earlier this year, which examines the income distribution of renting households, and interprets this as “higher-income households are becoming reliant on the private rental market.”

I would interpret this as “higher-income households are choosing to be housed in the private rental market.”

There are reasons for this.

First, many first-time property owners are choosing to “rentvest”—buying where they can afford to purchase and renting where they want to live, which might be an inner-city location closer to work, public transport, and schools.

This is backed up by recent data from Australia’s largest mortgage lender, the Commonwealth Bank of Australia (CBA), which shows that 46% of new property investment loans written by it last year went to Millenials (the cohort of people born between 1981 and 1996). ABS figures also show that property investors were the key drivers of new lending last year, with lending growth to investors reaching 18.5%.

You can read more about that here: The surprising truth about property investors

Secondly, if you look at ANZ and CoreLogic’s own figures, the percentage of income spent by households in the 75th percentile (the richest 25% of households by distribution) on rent hasn’t changed much in the last twenty years.

It crept up slowly from around 20% in 2005 to 22.9% in March 2024, but that’s still a lot of income available in those rich households that they could use to buy a property if they chose to.

Perhaps those households are renting and investing their spare cash in the share market or other asset classes, or spending it on luxury goods, cars, expensive holidays or private school fees for their children.

What it does mean for investors is that there is a growing cohort of well-paid younger Australians who - for whatever reason - will choose to rent, and will require well-built, well-located and attractive properties in good locations for the foreseeable future.

The other really positive thing the ANZ-CoreLogic Housing Affordability Report notes is the appeal of Perth as a property investment destination, something I’ve been arguing strongly for some time.

“These serviceability indicators, alongside a strong labour market, also help to explain why Perth is so attractive to overseas and interstate migrants,” the report says.

“Despite Perth dwelling values sitting 56.0% higher than at the onset of the pandemic through to the end of March 2024, it has among the lowest portion of (household) income required to service a mortgage.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)