Features > Property News & Insights > Housing Trends

Home prices reach new records, growth set to continue: Domain

KEY POINTS

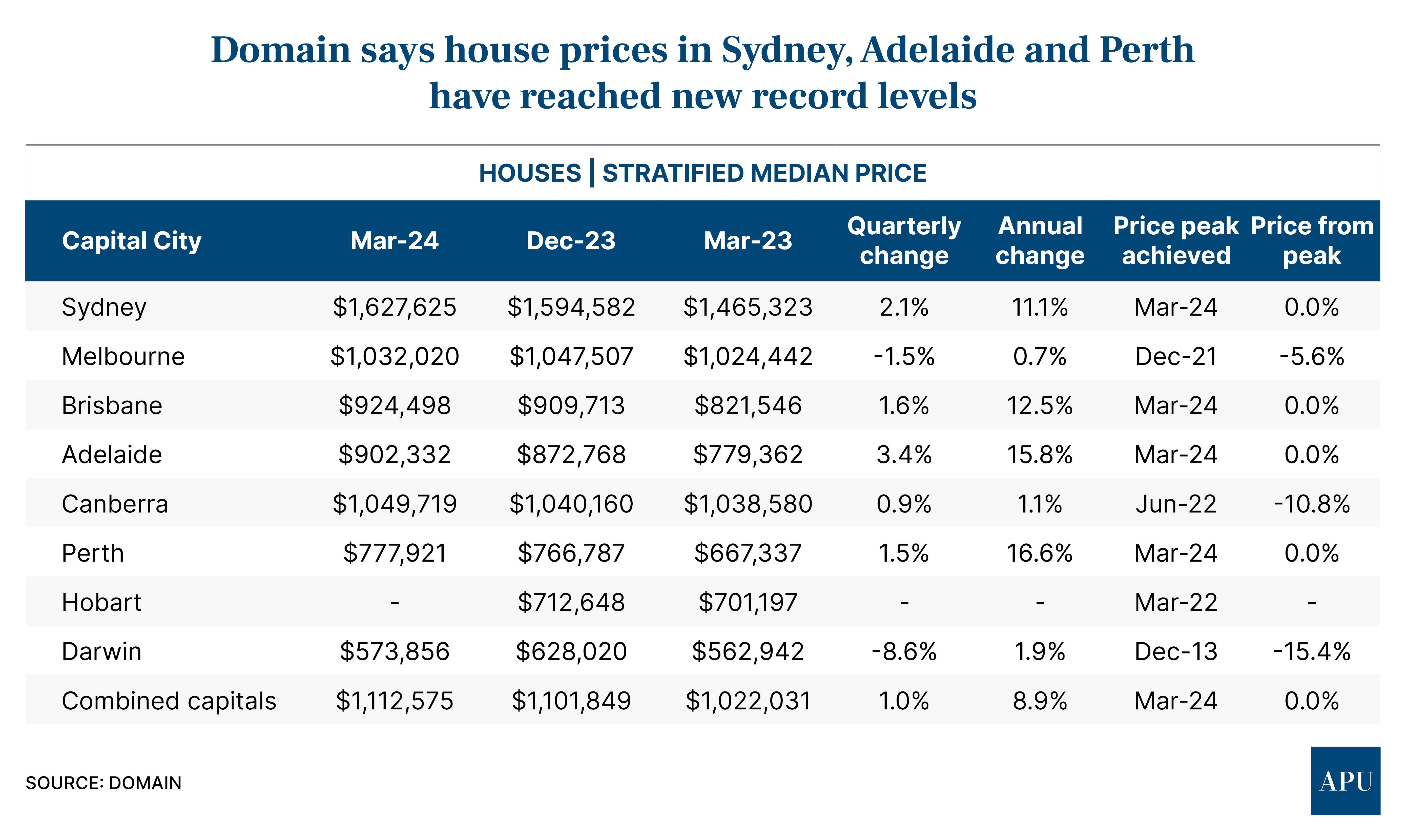

- Domain says house prices in Sydney, Adelaide and Perth have reached new record levels

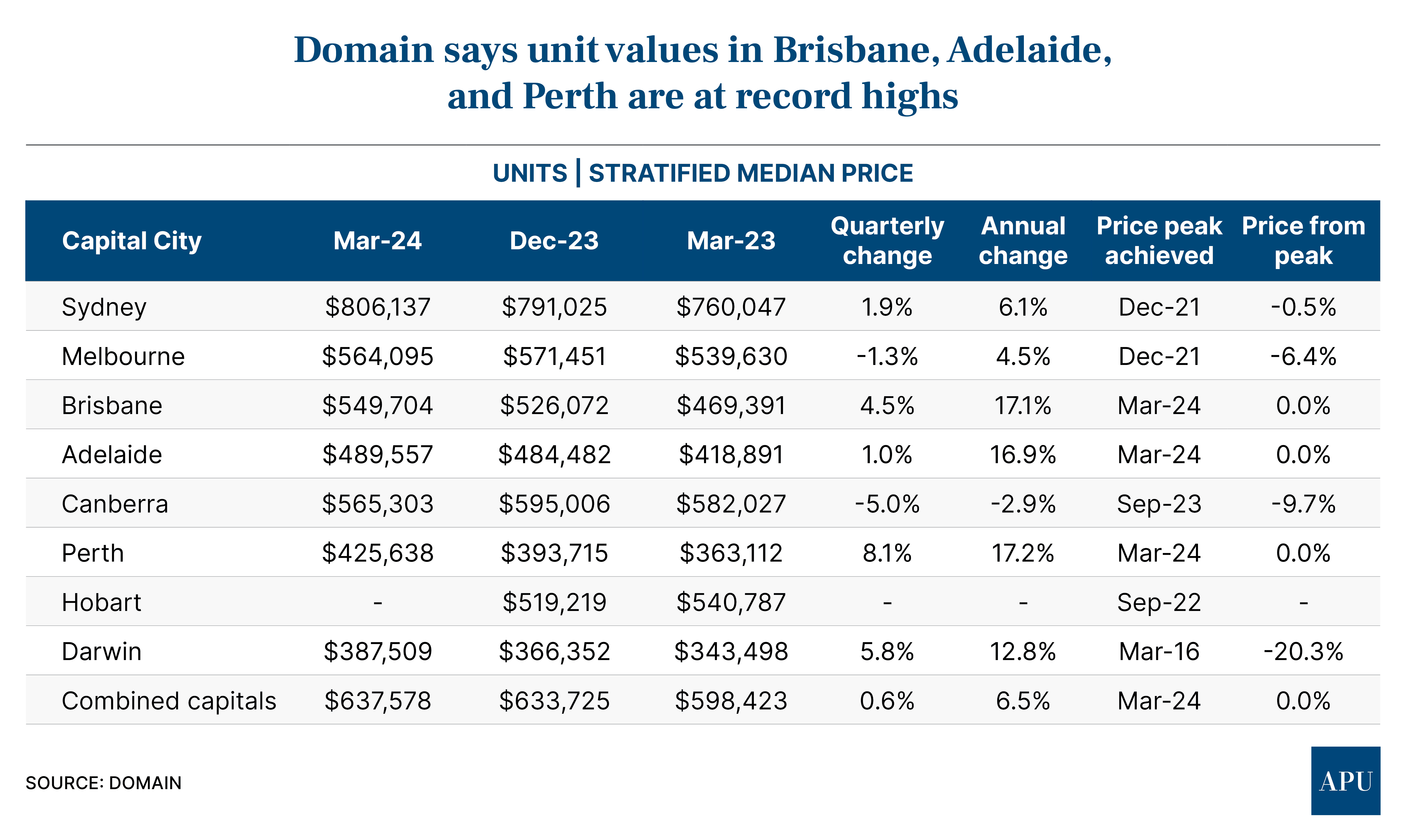

- Unit values in Brisbane, Adelaide and Perth are also at record highs

- The data analytics firm says growth is slowing, but it expects prices will continue to rise because of an undersupply of new homes, strong population growth, high construction costs and a tight rental market

New data from Domain Group shows Australian home prices have hit another record high in the March quarter of 2024.

Although price growth slowed compared to the previous quarter, Domain says it expects prices will continue to rise, driven by a chronic undersupply of new homes, strong population growth, high construction costs, and a tight rental market.

Domain’s latest figures come as rival data analytics firm CoreLogic has produced figures from a deep-dive into the link between population density and home price and rental growth in Australian cities.

House price growth

According to Domain, house prices in Sydney, Brisbane, Adelaide, and Perth reached another record high during the March quarter of 2024.

For the first time, the price of a median house in Sydney broke through the $1.6 million mark, jumping 2.1% since the start of the year to record annual growth of 11.1% since March 2023.

Adelaide houses cleared $900,000 for the first time, with a short supply of houses for sale in the City of Churches driving prices up 3.4% since the start of 2024 alone, to complete an eye-watering gain of 15.8% over the past year.

A median house in Brisbane will now set you back just under $925,000, after a solid gain of 1.6% over the quarter and a stellar 12.5% over the past year.

Domain says house price growth in Perth has been an extraordinary 16.6% since March 2023, but there are some signs that affordability constraints may be beginning to bite, with the city recording just 1.5% house price growth since the start of the year.

A median-priced house in the WA capital will now set you back $777,921.

Houses in Melbourne eased 1.5% over the quarter to a median price of $1,032,020, there was muted growth in Canberra of 0.9% (median price $1,049,719) and a huge quarterly drop in Darwin of 8.6%, seeing the median home price plummet from $628,020 to $573,856 in just three months.

Unit price growth

Domain says Brisbane, Adelaide, and Perth all recorded record-high median unit prices in the March quarter of 2024.

Perth's median unit price soared to a record high of $425,638, surpassing a previous peak set a

decade ago during the mining boom.

It was the city’s fastest quarterly gain for units in 3 and a half years (a jaw-dropping 8.1% in just three months), contributing to annual growth of 17.2%.

An undersupply of units in Brisbane saw similarly spectacular annual growth of 17.1%, reaching a new record median price of $549,704.

Adelaide units have also performed exceptionally over the past year, soaring 16.9% to reach a new median high of $489,557.

Unit prices in Melbourne (-1.3% to $564,095) and Canberra (-5.0% to $565,303) have eased since the start of the year, while units in Darwin jumped nearly 6% to $387,509.

However, this is still 20.3% down on the prices for units seen in the Top End capital at the height of the resources boom in March 2016.

The takeaway

Although the big increases in home values in some of these markets led to new price records, Domain points out that house price growth was slower during the March quarter of 2024 compared to the previous quarter in Sydney, Melbourne, Brisbane, Adelaide, Perth, and Darwin.

For units, Domain says Melbourne and Adelaide experienced slower quarterly growth.

“The slowdown in growth observed during the March quarter is due to an increased supply of homes for sale across the combined capitals, with more properties now available in Sydney, Melbourne, Hobart, and Canberra,” says Domain’s Chief of Research and Economics, Dr Nicola Powell.

However, Dr Powell says a reduction in the cash rate by the Reserve Bank of Australia could “flush out” more potential buyers in these cities, “potentially increasing housing turnover” and no doubt, more competition among buyers would mean more upward price pressure.

“Meanwhile, Perth and Brisbane have experienced a long-term decrease in the number of

properties for sale, which has contributed to significant price growth in these cities,” she says.

And while the rate of growth may have slowed, don’t expect prices to plummet.

“Despite the challenges of cost-of-living pressures and high interest rates, property prices are expected to continue rising,” Dr Powell says.

“This upward trend is driven by various factors, including a chronic shortage of new

homes, strong population growth, high building costs, and a tight rental market, all of which boost housing demand.”

She also believes the shortage of new housing is likely to continue, pointing to dwelling approvals figures dropping to a nearly 12-year low after trending downward over the past two years.

“This ongoing scarcity will maintain pressure on our housing supply,” she says.

Population density

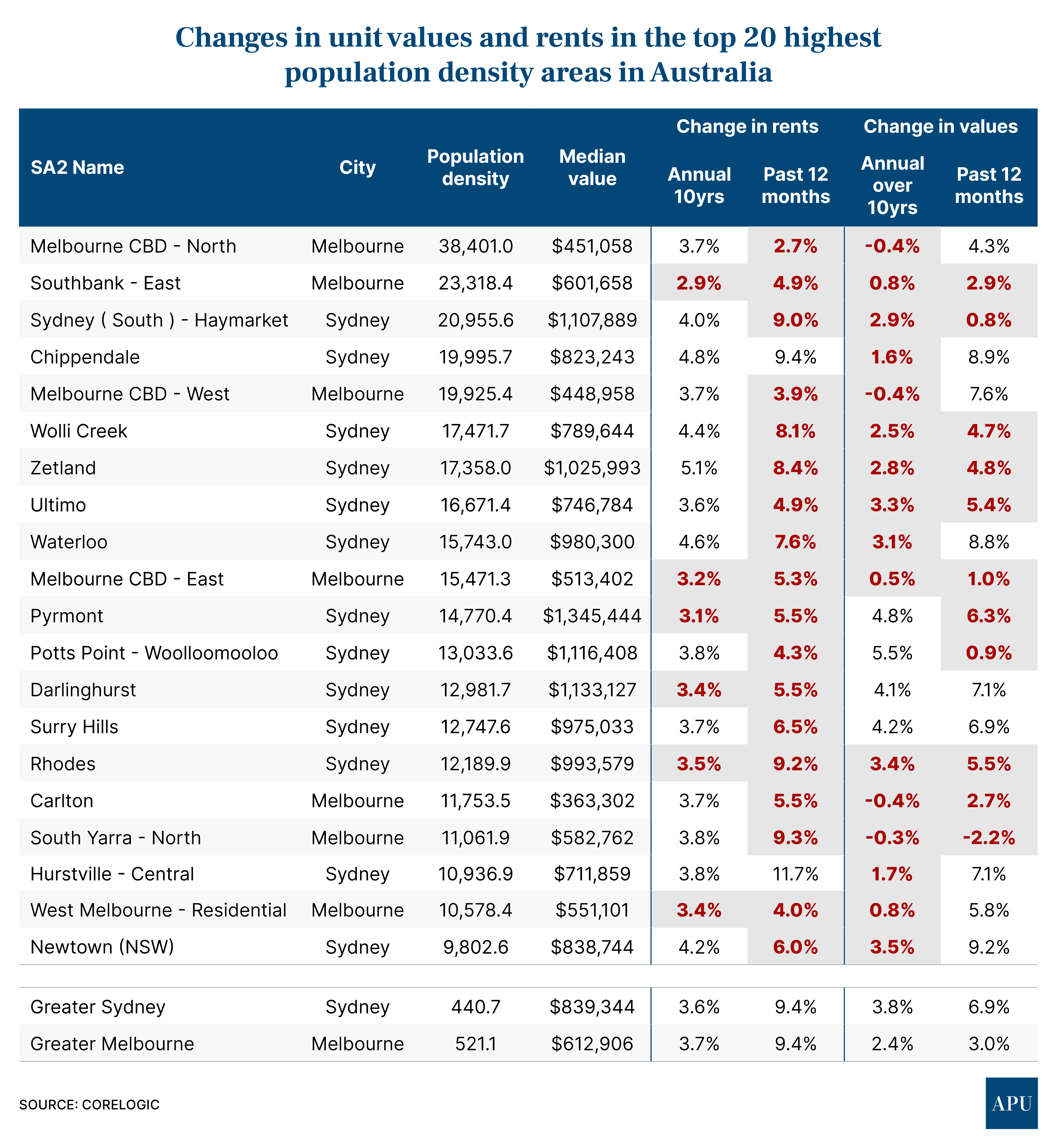

Domain’s latest home value figures come as rival number-cruncher CoreLogic has produced some fascinating data about the links between population density, home values and rental growth.

CoreLogic’s Research Director Tim Lawless points out that at a national level, Australia’s population density of 3.5 people per square kilometre is among the lowest in the world, highlighting our highly urbanised population.

“In fact, 75% of Australia’s population resides on just 2.6% of the land mass,” Mr. Lawless says.

His research finds Melbourne (521 people per sq. km) and Adelaide (444 people per sq. km) both have an overall population density that’s higher than Sydney’s (441 people per sq. km), largely because of the huge area that makes up the so-called “Greater Sydney” statistical area, including the Blue Mountains, Central Coast, Penrith, and Sutherland Shire.

Mr. Lawless says there’s no real correlation between house values and higher population density, but it’s a different story when it comes to units.

In findings that will be particularly interesting for property investors, he says that over the long term, “precincts with a high population density tend to show slightly stronger growth in unit

rents, but softer rates of capital appreciation.”

In other words, rental yields are likely to be slightly stronger in areas with high population growth, but price growth may be slower than the city-wide median unit measure.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)