KEY POINTS

- Property analytics firm Domain claims its latest quarterly rental report contains positive news for tenants, with “several market indicators shifting in their favour”

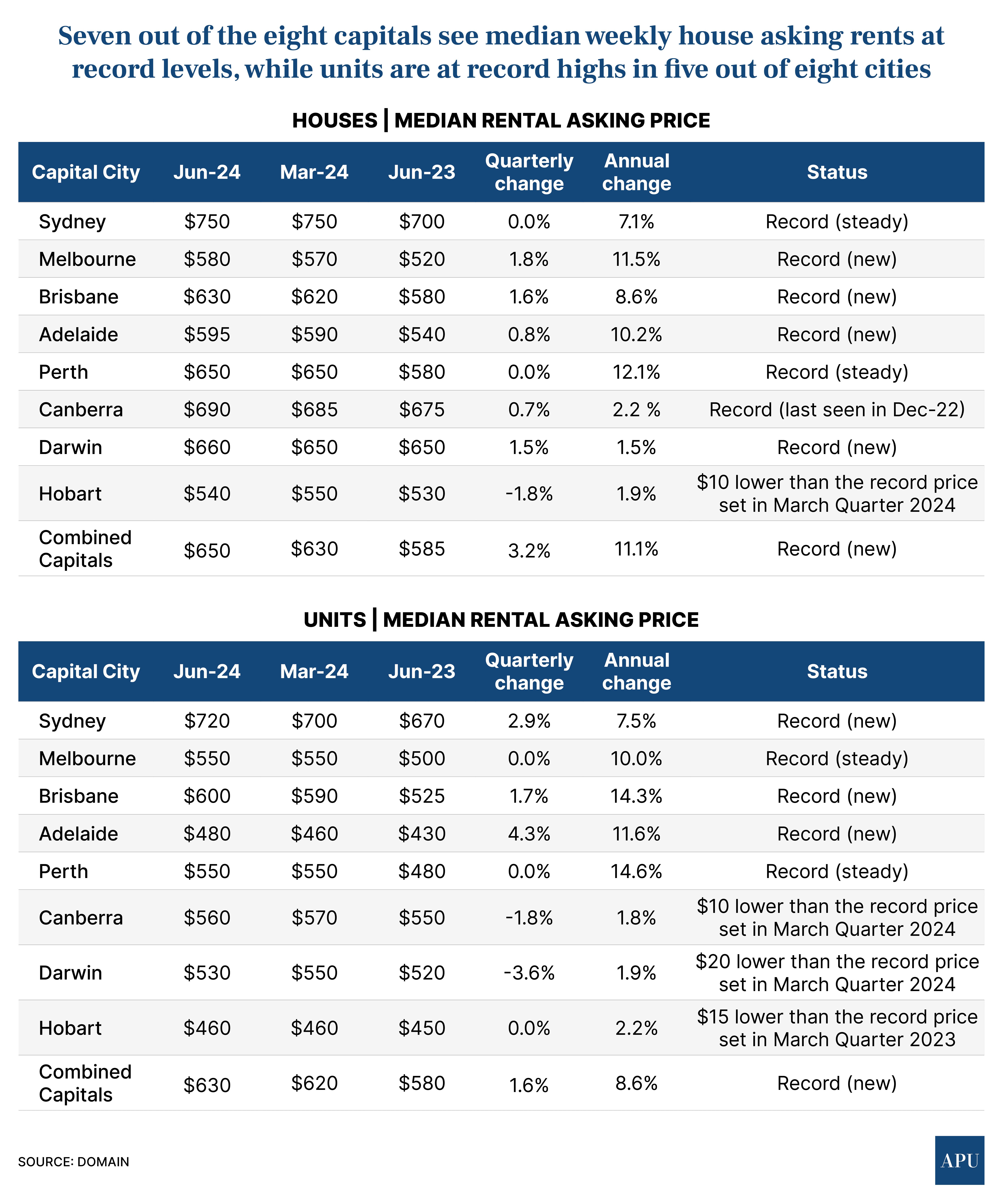

- However, Domain’s June Quarter Rent Report shows that 10 of the 16 capital city house and unit markets surveyed are at record highs for median weekly asking rents

- Domain’s figures also show rental vacancy rates in all capital cities except Canberra remain below 1.25%, where 3% is considered a “balanced” market

Domain Group has released its latest quarterly rent report, claiming that “renters are finally seeing some relief, with most major cities experiencing rent prices either declining, increasing at a slower pace, or stopping rising altogether.”

However, a close look at Domain’s figures shows most Australian tenants are unlikely to be popping champagne corks and celebrating much cheaper weekly rental prices, while most landlords are unlikely to notice much change, if any, to their existing rental income.

The details

Domain says its latest Rent Report for the June Quarter of 2024 “reveals positive news for tenants, with several market indicators shifting in their favour.”

“For houses, the pace of quarterly rental growth was 1.5 times slower than the previous quarter across the combined capitals, halved in Melbourne and Brisbane and (was) seven times slower in Adelaide, while growth stalled in Sydney and Perth, and declined in Hobart,” the company’s latest report states.

“For unit rents, the pace of quarterly growth was halved across the combined capitals, three times slower in Brisbane, stalled in Melbourne, Perth and Hobart, and down in Canberra and Darwin.

“We recognise the challenges renters have been facing,” Domain’s Chief of Research and Economics, Dr Nicola Powell, says, “so it's encouraging to observe our latest data showing easing rental conditions.”

Some perspective

While it’s true that the pace of rental growth for houses has slowed from the previous quarter, it’s worth putting the numbers in some perspective.

Seven out of the eight capital cities see median weekly house asking rents at record levels, with Melbourne, Brisbane, Adelaide, and Darwin all setting new highs in the June quarter, while Sydney and Perth were unchanged, and Canberra bounced back to a previous high.

Only Hobart saw the median weekly asking rent for a house decline by $10 from the record set in Domain’s previous report for the March quarter of 2024.

As for unit rents, five out of the eight capital cities see median weekly unit asking rents at record levels, with Sydney, Brisbane, and Adelaide all at new highs with Sydney (2.9%) and Adelaide (4.3%) seeing extremely strong quarterly price growth.

Median weekly unit rents in Canberra were $10 (or -1.8%) cheaper than the record set in the last (March) quarter, while Darwin asking prices were $20 (or -3.6%) lower than the March quarter.

This is particularly unsurprising in these two cities.

As places with a lot of government employment and a strong transitory workforce, demand for rentals is usually strongest in these cities at the start of the year, when many new workers arrive to begin year-long assignments or postings.

Rental markets tend to be much quieter in the Autumn and Winter months.

It’s also worth noting that 10 of the 16 capital city house and unit markets surveyed by Domain see annual rent growth well above the current annual inflation rate of 4%, ranging from 7.1% for Sydney houses to an astonishing 14.6% for units in Perth.

Only investors with property in Canberra, Hobart and Darwin would have experienced rental growth (for both houses and units) lower than the current rate of inflation.

The outlook

“Looking ahead, Australia's rental market will continue to be more balanced, driven by several factors,” says Domain’s Dr Nicola Powell.

“Firstly, rental growth is slowing in line with a gradual increase in rental availability, which will lead to a rebalancing of supply and demand pressures.”

This might be true, but if it is, it is happening quite slowly as there remains a chronic shortage of rental housing in Australia.

In its latest monthly Home Value Index report, rival data house Core Logic noted that “nationally, the decade average rate of annual rental growth prior to the pandemic was just 2.0%.”

While rent growth may be slowing or even declining in some parts of Australia, it’s going to take many years to revert to that previous national decade average.

Domain’s Nicola Powell also believes that “rental demand is easing, as the number of prospective tenants per rental listing has consistently fallen throughout 2024.”

“This aligns with overseas migration passing a peak, and it’s expected to decline further in the year ahead.”

She also points to the “slow comeback” of investors to the property market and a number of new first-home buyer schemes and stamp-duty tax breaks coming into effect which “aim to facilitate home ownership transitions and improve affordability, further alleviating rental conditions in Australia.”

However, Domain’s own figures show rental vacancy rates around the country remained incredibly low during the June 2024 quarter.

Most analysts regard a 3% vacancy rate as a “balanced market”, where tenants have a decent choice of rental properties to choose from, while landlords can still command a fair rental return.

In perhaps the most telling sentence of the June Quarter 2024 Rental report, Domain admits, “the misalignment between supply and demand is still on full display across Australia’s rental market, with each capital city operating with a sub-2% vacancy rate, so tenants remain in a landlords’ market.”

I’d suggest that’s unlikely to change much in the foreseeable future, meaning Domain has tried to put a silver lining on what’s still an extremely black cloud for renters.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)