Features > Property News & Insights > Housing Trends

Did the NSW Budget just score a housing “own” goal?

KEY POINTS

- The NSW government has unveiled the state’s biggest single spend on social housing, earmarking $5.1 billion to build 8,400 new homes

- The State Budget also contains other housing initiatives designed to facilitate a total of 30,000 new homes over the next four years in a bid to ease the current housing crisis

- However, new taxes and charges on property owners have been sharply criticised by the property industry, warning they could scare away private investors - who provide the overwhelming bulk of rental properties in New South Wales

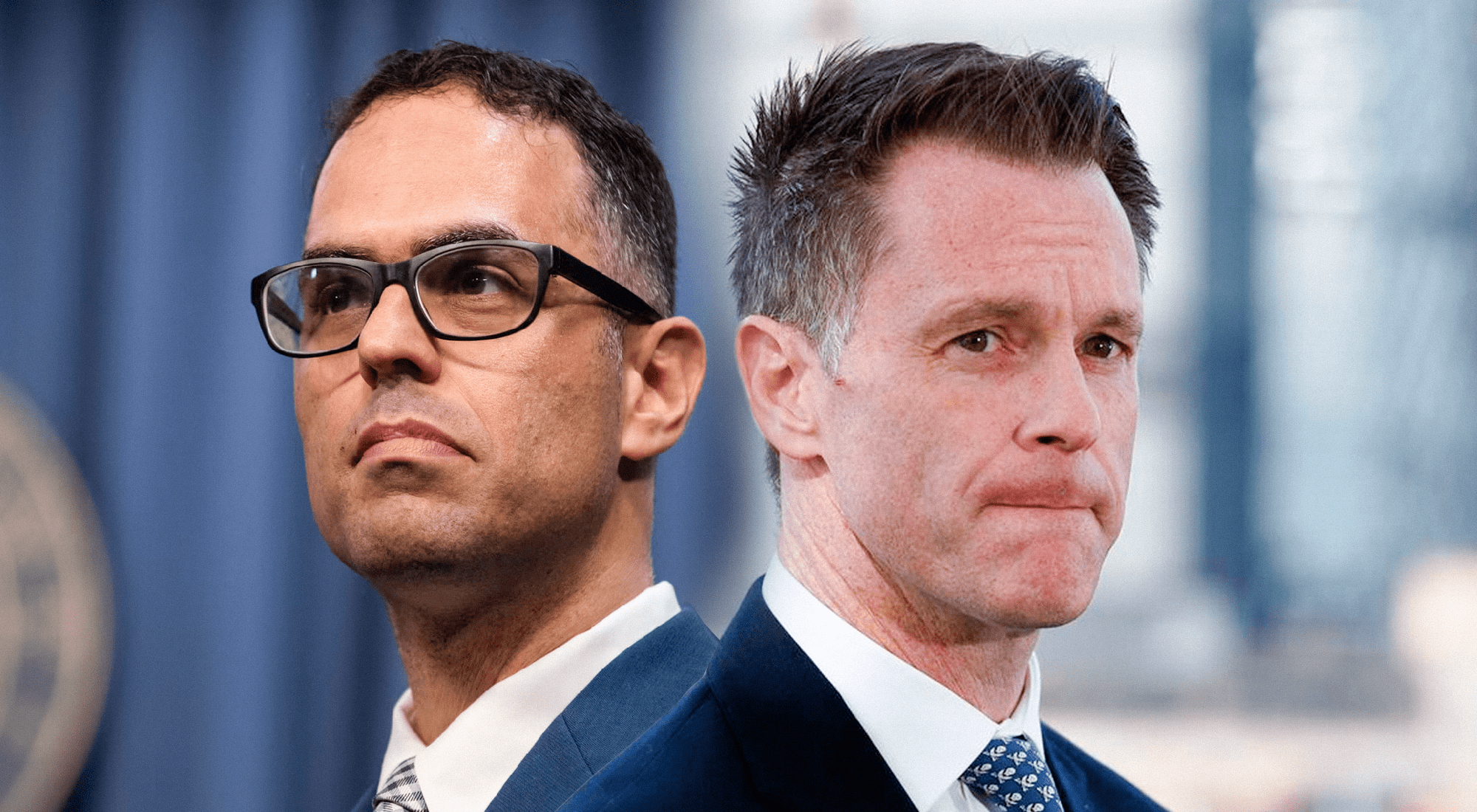

The New South Wales Labor government of Premier Chris Minns has put addressing the housing shortage in Australia’s most populous state squarely at the centre of its second budget, announcing a big social housing package and other spending plans which it says will deliver 30,000 new homes over the next four years.

However, planned tax changes—which will weigh heavily on property investors—actually have the potential to make the state’s housing crisis worse.

The details

The Minns government has declared that housing affordability and availability is the biggest single pressure facing the people of New South Wales, citing a recent study which found Sydney had the second least affordable housing in the world and that the state capital was at risk of becoming the “city with no young people.”

State Treasurer Daniel Mookhey says his second budget “supports 30,000 new homes directly.”

In the biggest single investment in the state’s history, the government will spend $5.1 billion to build 8,400 new social houses or apartments over the next 4 years.

More than half of these new dwellings will be prioritised for women and children fleeing family and domestic violence.

An additional $1.0 billion will be invested in 33,500 existing public homes for critical maintenance and to bring unlivable homes back online.

An audit has also identified 44 state-owned sites that are suitable for housing.

“In many cases, these sites have been left unused for years, despite being located close to transport and other essential infrastructure,” Premier Chris Minns says.

This land will be made available to state and private developers to deliver a mix of social and affordable housing.

$450 million has also been earmarked for a “Key Worker Build to Rent Program,” which will see over 400 rental homes constructed in metropolitan Sydney for essential workers like nurses, firefighters, and police, while 500 health workers will benefit from the program in regional areas.

Western Sydney University’s Professor Andy Marks says the big housing spend is a clear message from the state government that addressing the housing crisis is their “biggest ticket item.”

“This is about scale,” he told the ABC.

“Regardless of the detail, announcing a $5.1 billion package for social housing in the budget has the effect of motivating the market.”

The reaction from the property industry, however, is less enthusiastic.

“Measures that will increase taxes and costs and discourage investment will work against us and increase the challenge before us,” says Katie Stevenson, the Executive Director of the Property Council’s New South Wales branch.

The sting in the tail

Faced with a revenue shortfall that it claims is the result of an unfair GST carve-up, the state government is introducing a range of new taxes that will primarily hit property owners.

The Property Council says these tax and cost increases are anticipated to raise $6.38 billion for the state’s coffers over four years.

It says changes to the state’s Emergency Services Levy will see $4.7 billion in costs shifted from insurance premiums to property owners.

And in another blow to investors, the state Budget also includes the removal of indexation of the land tax threshold.

The Property Council describes this as a “stealth tax…subjecting more Mum and Dad investors to land tax”—because as property prices increase over time, more and more land “value” will fall into the revenue net.

It’s estimated this move will raise about $1.5 billion over four years.

“The formula of exploiting land tax thresholds was started by the state Labor government in Victoria, where wider plans are expected to bring in $4.7 billion,” says The Australian newspaper’s Wealth Editor, James Kirby.

Mr Kirby says this means “Sydney’s prime position as the nation’s hottest property investment market is now in jeopardy.”

The latest lending indicators show the percentage of loans going to investors in New South Wales is the highest in Australia at 40%, while Victoria has slumped to 30%.

The Property Owner Investment Association’s Nicola McDougall says the land tax changes will “drive rents higher, and it’s going to force investors away, just like it did in Melbourne.”

Increases in foreign investor surcharges have also been slammed by the Property Council.

“The changes mean NSW will have the highest level of foreign investor surcharges of any state in the country,” says Katie Stevenson.

“Industry is finding it hard enough to secure capital without increasing the cost of foreign investment.”

The take-out

There’s an old saying that there are only two certainties in life—death and taxes.

So, the idea that the New South Wales government would look at stinging an easy target like property investors should come as no surprise.

I’d urge people to look really closely at the fundamentals of any investments they have in New South Wales and do their sums carefully before pulling out.

As my business partner and the co-founder of Freedom Property Investors, Lianna Pan, says, “Things like taxes and changes in tax laws—they’re minor, they're not huge.

“If your property price is going to grow 10%-15%—it's got the potential because of the underlying severe shortage of housing—it's not going to be affected by a small percentage change in land tax.”

The problem for the New South Wales government is that a lot of property investors seem to regard tax changes as a personal affront, not a business challenge to be worked through.

And while a big new social housing spend is to be welcomed, the fact remains that more than nine out of every ten tenants in New South Wales—including many low-income people—rent in the private market.

If anything is done to upset “Mum and Dad investors,” it could have a much bigger impact on housing affordability and availability in New South Wales than the government envisaged, worsening the current crisis at a time of high population growth and low housing supply.

As the Property Council’s Katie Stevenson puts it, “It will not create the investment climate we need to deliver more homes than ever before.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)