Features > Property News & Insights > Housing Trends

Cost blow-outs behind weak building approvals and “zombie” projects

KEY POINTS

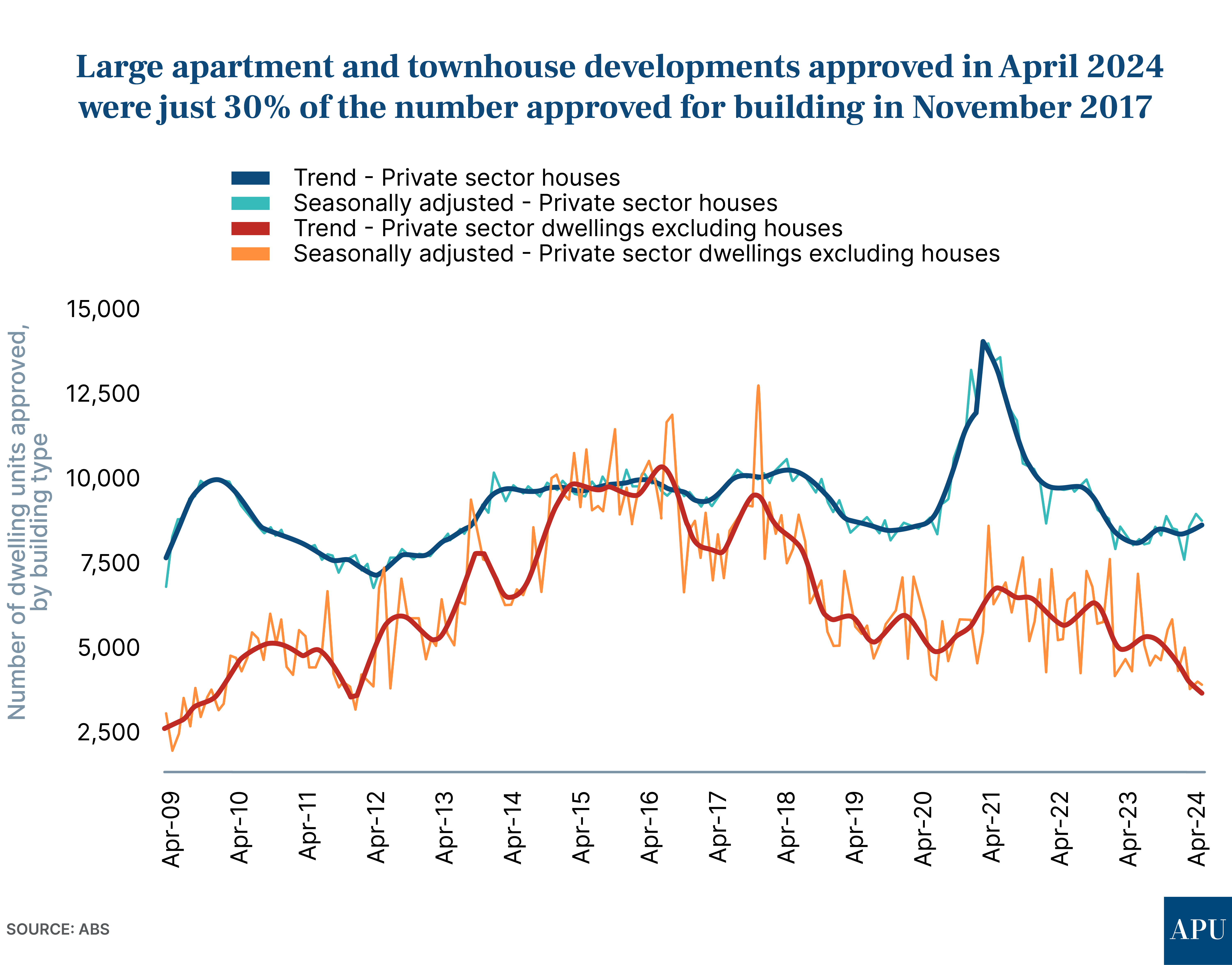

- The latest ABS Building Approval figures show fewer homes were given the go-ahead in April 2024

- Analysts are particularly concerned at another fall in approvals for higher-density homes like apartments and townhouses

- Soaring construction and labour costs are deterring builders from seeking approval for new projects or proceeding to the construction phase of many large developments that are already approved

- Economists say the failure to proceed with many of these inner-city “zombie” projects is a major factor that’s pushing up rents

The latest official building approvals data has underlined the challenges in addressing Australia’s current housing crisis, particularly when it comes to the construction of higher-density dwellings, like apartments and townhouses.

The construction industry says high costs are making large inner-city housing projects - many of which are already approved by local councils and regulators - uneconomic to build.

Economists say that’s helping to fuel the housing crisis and leading to increased rents for the smaller number of homes available to tenants.

The details

Seasonally adjusted figures from the Bureau of Statistics show that total dwellings approved in April 2024 fell 0.3% to 13,078.

It’s a long way from the recent peak of 23,126 dwellings, given the green light in March 2021.

The number of houses approved in April 2024 fell 1.6% to 8,822.

Just 275 homes were approved for development across Australia in the public, social or community housing sectors.

Private Sector Dwellings Excluding Houses (the ABS category, which includes apartment and townhouse developments) fell another 1.1% to 3,981.

Apartment and townhouse construction approvals have not been this low since July 2012.

What’s more, in April 2024, approvals of this type of housing - exactly the sort of high-density in-fill developments political leaders and experts say we need more of in our cities to ease the housing squeeze - were less than a third of the number approved for building in the most recent peak month of November 2017.

Why aren’t we building enough homes - particularly apartments?

The National Australia Bank (NAB) has just released the latest edition of its quarterly Property Survey.

The NAB says the “Q1 survey showed once again that the majority of property professionals characterised rental markets in their local areas as undersupplied.”

So, given the chronic undersupply of homes and rental properties, why aren’t developers seeking approvals to build more apartment developments?

The NAB survey makes it very clear why.

“The majority of survey participants (76%) still saw construction costs as a barrier to starting new residential projects in Q1 – particularly in VIC (88%) and NSW (79%),” the NAB says.

“Delays in obtaining planning permits were another notable barrier to starting new projects, with around half of survey respondents identifying this as a concern.”

With official interest rates at their highest point in 12 years, you might think that might be a big factor deterring builders, but the latest NAB survey found that “with policy rates not rising again since November (last year), fewer property professionals saw rising interest rates as a barrier (39% down from 55%).”

Approvals versus actual building

Building approvals are only part of the story, though…

A recent report by KPMG’s urban economist Terry Rawnsley found that as of the end of last year, over 37,000 homes that had received approval had not yet commenced construction.

While there are often delays between when a home or a project is approved and when building actually starts, Mr Rawnsley points out that figure is a 9% increase on the five-year average.

He calculates that at the end of last year, there were enough homes approved but not built to house everyone in a large regional city like Toowoomba or Ballarat - a situation you certainly don’t want to see at the time of a national housing crisis.

So why are so many approved projects - particularly large apartment developments - being left on the drawing board?

The simple reason is cost.

The bottom line

Maxwell Shifman is the CEO of Intrapac Property, which specialises in apartment and townhouse developments.

He’s also a former President of the Urban Development Institute of Australia.

“Perhaps obvious” he says, “but creating larger buildings is more complicated, time-consuming and expensive than domestic 'sticks and bricks' (housing construction).”

He points out that multi-level apartment buildings are heavier, use more concrete, need more significant foundations and also require more approvals and certification than a regular house.

“Meanwhile, public infrastructure investment has grown rapidly in the last 5 years - projects competing for the same materials and workers,” he says.

“This has crowded out the private sector, which is more price sensitive, and elevated the price of materials and labour.”

While cost growth has slowed, he says, a ballpark comparison of building costs would be something like this:

- Domestic single-storey house - $1,400-$1,600 per m2

- Double storey townhouse - $2,200-$2,400 per m2

- Multi-storey apartments - $5,500-$6,600 per m2

Mr Shifman says building in regional areas or anywhere in the state of New South Wales means you usually have to add 20% or more to this cost base.

He also points out that these costs exclude:

- land

- design and engineering work

- marketing and sales

- compulsory insurances

- planning fees, taxes and charges

- developer contributions

- funding costs (financing the project)

- GST

This perhaps explains the seemingly bizarre phenomenon of why many developers, who may have fought lengthy battles with councils and with state planning bodies and tribunals to get projects approved, are now reluctant to proceed to the actual building stage.

That’s why many of our cities (particularly Sydney and Melbourne) are full of so-called “zombie developments” - large plots of well-located land with approved plans for multi-storey buildings that are just sitting vacant, until a developer believes their cost-base is viable.

The take-out

It’s the failure to proceed with a lot of these big apartment projects that are helping to drive rents up, particularly in the capital cities.

According to Commonwealth Bank economist Harry Ottley, “What really drives rents and the rental market is those multi-unit dwellings.”

“It’s the big developers really that need to build these big apartments, and they need certainty over a period of years to ensure that their project is feasible,” he told the Sydney Morning Herald.

Master Builders Australia’s Chief Economist Shane Garrett agrees.

“High rental inflation is a direct result of years of underbuilding on the higher density side of the market, caused by a drastic lengthening in the build times for new homes, labour and material shortages, as well as excessive homebuyer taxation,” he says.

The latest Building Approvals data and the cost challenges faced by developers don’t bode well for the national target of building 1.2 million well-located homes over the next five years.

The current housing shortage is likely to continue indefinitely, and upward rental pressure is unlikely to ease anytime soon.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)