Features > Property News & Insights > Housing Trends

Big banks say strong housing demand to keep driving price growth

Image from Dominic Lorrimer/Sydney Morning Herald

KEY POINTS

- Two of Australia’s “Big 4” banks have released bullish new housing price forecasts

- NAB expects capital city home prices to end the year 6.7% higher, with ANZ predicting prices will grow by 7.3% in 2024

- Both banks say price growth will vary across the country, with Perth, Adelaide and Brisbane powering ahead

- NAB and ANZ point to supply constraints in a time of high housing demand as having more impact on the market than high interest rates

Two of Australia’s big four banks have released new housing forecasts, which show the resilience of the residential property market, despite the continuing low-growth, high interest rate environment.

Both the ANZ and the National Australia Bank say they continue to expect property prices to keep rising, as very strong demand for housing continues to outpace the supply of homes.

National Australia Bank:

Each quarter, the National Australia Bank’s economic forecasting team produces an Australian Residential Property Survey.

In its latest report, the bank says it has revised up its expectations for property prices this year and now expects capital city dwelling prices to end the year 6.7% higher.

“We still expect price growth to slow somewhat in 2025 to around 4%,” the bank’s report says, but notes that “we continue to see very strong demand for housing continuing to outpace new supply, with completions likely to continue trending lower in the near term as the pipeline of new construction is worked through.”

NAB also says it expects property market performance will vary across the country, with Perth, Brisbane and Adelaide continuing to grow more strongly than Sydney and Melbourne.

Property prices in Perth are set to end this year an astonishing 23.1% higher (up from 15.8% last year), according to NAB, with Adelaide soaring by 16.8% (up from 8.9% last year).

Brisbane prices will moderate slightly, but still experience very strong growth.

NAB is predicting 12.7% dwelling price growth this year after 13.5% in 2023.

Sydney prices will lift 5% this year (down from last year’s 11%), while Melbourne is expected to ease 0.7% this year, following last year’s 3.9% growth.

However, NAB predicts Melbourne dwelling prices will start growing again next year, predicting that the Victorian capital and Sydney will both put on 3.7% next year, slightly below the national average of 4.1% over 2025.

As for the rental market, NAB says it “will also continue to be pressured by the demand/supply imbalance with vacancy rates still low – and therefore rents growth, while having slowed slightly, will remain strong in the near term.”

It says the majority of the 300 property professionals that responded to its latest survey still believe that “rental markets in their local areas are undersupplied.”

“Consequently, average survey forecasts for rent growth for the next 1-2 years remain solid at 3.5% and 3.8%, respectively.”

“Rents in the next 12 months are forecast to grow in all states, with growth accelerating in VIC, SA, and the ACT, but slowing elsewhere,” according to the report.

ANZ Bank:

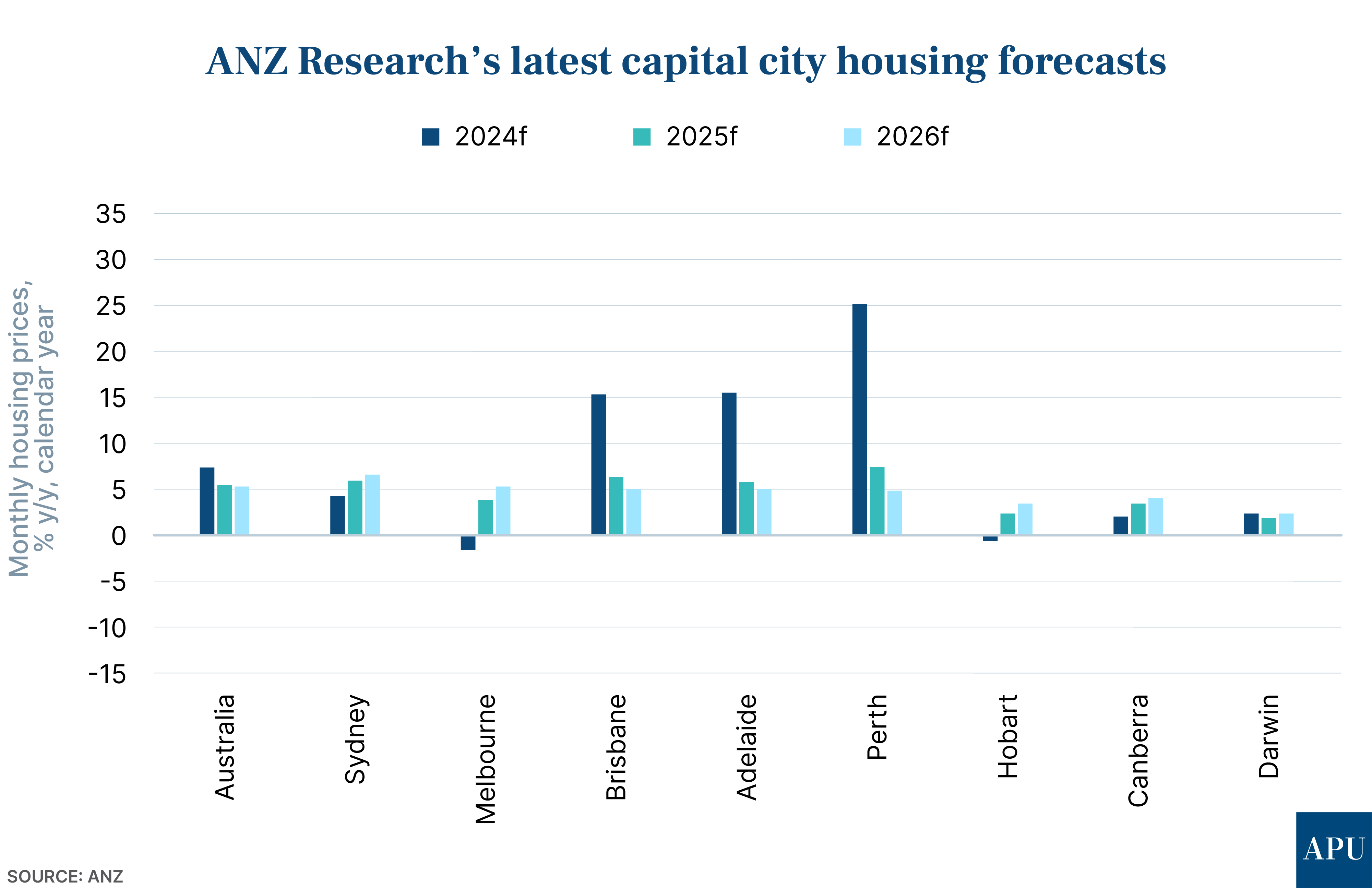

ANZ's latest Housing Prices and Private Sector Forecast research paper shows the bank is expecting stronger price growth across the capital cities this year than NAB, predicting housing prices to rise 7.3% in 2024.

Like NAB, bank economists Madeline Dunk and Adam Boyton point out that “the state-by-state picture is quite varied”, where “price outcomes will continue to be largely driven by the gap between supply and demand.”

The clearest example of this is Perth, “where demand continues to outstrip supply” with ANZ predicting housing prices will finish 2024 a whopping 25.1% higher.

ANZ also predicts Brisbane and Adelaide - which have already seen strong price growth of around 9% so far this year, will both finish 2024 up “about 15%.”

In contrast, Dunk and Boyton say momentum in Melbourne “looks soft” and they expect prices to end the year 1.7% down.

However, ANZ believes the Victorian capital will bounce back next year with annual dwelling price growth of just under 4%, before accelerating to 5.4% in 2026.

While housing price growth in Sydney this year will be a relatively modest 4.2% (moderating after last year’s 11.5%), ANZ predicts a quickening in 2025 to 6% and then 6.6% in 2026.

Interest rate outlook

Interestingly, both banks play down the role of the current high interest rate environment in driving home prices in their latest publications.

With the cash rate stable at a 12-year high of 4.35% since last November, their analysis puts much more weight on the imbalance between supply and demand and continuing constraints on new housing as the primary reasons for continuing price growth.

NAB is also predicting the interest rate environment will stay stable for some time to come.

“On rates, we see the RBA (Reserve Bank of Australia) on hold until May 2025, before cutting by around 100 bps (1%) over the subsequent year,” the NAB says.

Like NAB, the ANZ predicts that the next move in interest rates will be down, with cuts to start in February of next year and rates dropping to a level of around 3.60% by the end of 2025.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)