KEY POINTS

- Getting your investment location right is key - ignore media talk of cities and regions that are busting and booming - look at specific areas where demand will be high and supply short

- Pick the right property - ignore generalisations like “apartments are bad investments” and look at what types of property there is a shortage of and high demand for in your chosen area

- Mitigate the risks of property investment by not over-paying for alleged “potential” growth, learn to deal with FOMO, ensure a good rental return and look for a property with the maximum tax deductions like depreciation

I recently put up a video called “3 Secrets From Australia’s #1 Property Investor (Do Not Invest Until You Watch This) on my YouTube channel.

I got a lot of positive feedback about this video, with many people starting their property investment journey saying they found it really useful.

So, I thought I would summarise the video for easy reference.

No. 1: Getting your investment location right

When you invest in the share market, typically, you're not buying shares in one company.

Usually, you invest in a portfolio of companies, a fund, or an index that has exposure to several firms.

This diversifies your risk because, at any one point in time, some of those companies are going up, and some of those companies are going down in value.

It’s different with property.

You're picking one property, in one street, in one suburb, in one region or city.

You are not diversifying your risk, so it’s essential you get the location correct.

We often hear in the media about cities and regions that are booming, flattening or busting.

But that's what's happening across that city or region AS A WHOLE, not what’s necessarily what’s happening with a particular property, on a particular street, in a particular suburb within that city.

Let’s take the example of Sydney.

At various times between 2020 and2023, Sydney was booming.

At other times, prices were falling across the city.

But even when prices were falling across the city on average, there were suburbs that were actually booming.

So getting your location right is critical.

Then there’s growth.

I see way too many potential investors thinking, “Hey, what location is going to get me that 50, 100 grand growth in the next 3 to 6 months?”

They are not thinking about the long-term sustainability of getting their asset to double in value in the next decade or so, which is ultimately what you want to achieve.

Most gains in property are made over the longer term - holding the property for at least 10 years.

There are many entry costs to property, like stamp duty, and then there are exit costs, like real estate agent’s commission, so trying to make your profits in one to two years simply doesn't work.

That's why you've really seen the death of strategies like “buy, renovate, flip”.

That’s why fewer people are buying properties and trying to split a block or do a mini-development.

By the time they factor in all the entry costs, the interest costs, the cost of getting plans through the council and the costs of actually building - which will probably blow out - they realise it no longer makes financial sense.

That’s why I'm a huge fan of low-deposit leverage.

Leverage as much as you can, and buy and hold properties with the right cash flow and tax deductions.

Over time, you're going to make money.

Now, what suburb will you choose?

Ultimately, you want an area with high demand and very low supply.

You can get information about future supply from council websites, where you can see all the approvals, the zoning information, what's under construction, and what's being completed.

If you have the time and the know-how to go through all that information, you can then try and determine what’s going to be built in the next three, four, or five years.

The next thing to consider is demand.

How desirable is the location you are considering?

In my books, a location is desirable if it’s affordable, it has a feeling of community and safety, there are good amenities, and important things like health services, schools, and employment in the vicinity.

If you can get all those things right, then you're going to be in the right area - a long-term, sustainable growth location.

However, there are more than 15,000 suburbs in Australia.

Most would-be investors might only consider three or four locations.

You really want to be running the numbers on all 15,000 suburbs to make sure you are picking the right area.

No. 2: Picking the right property

So you have picked your location.

It’s an attractive area with a lot of demand, and a place where you have both home-buyers and renters looking for an ideal property.

Now, what type of property are you going to invest in?

A free-standing house, an apartment, a townhouse?

An existing home, one under construction or one off the plan?

All of those types of investment options work in the right location, particularly where there's a limit on the supply of a particular type of property.

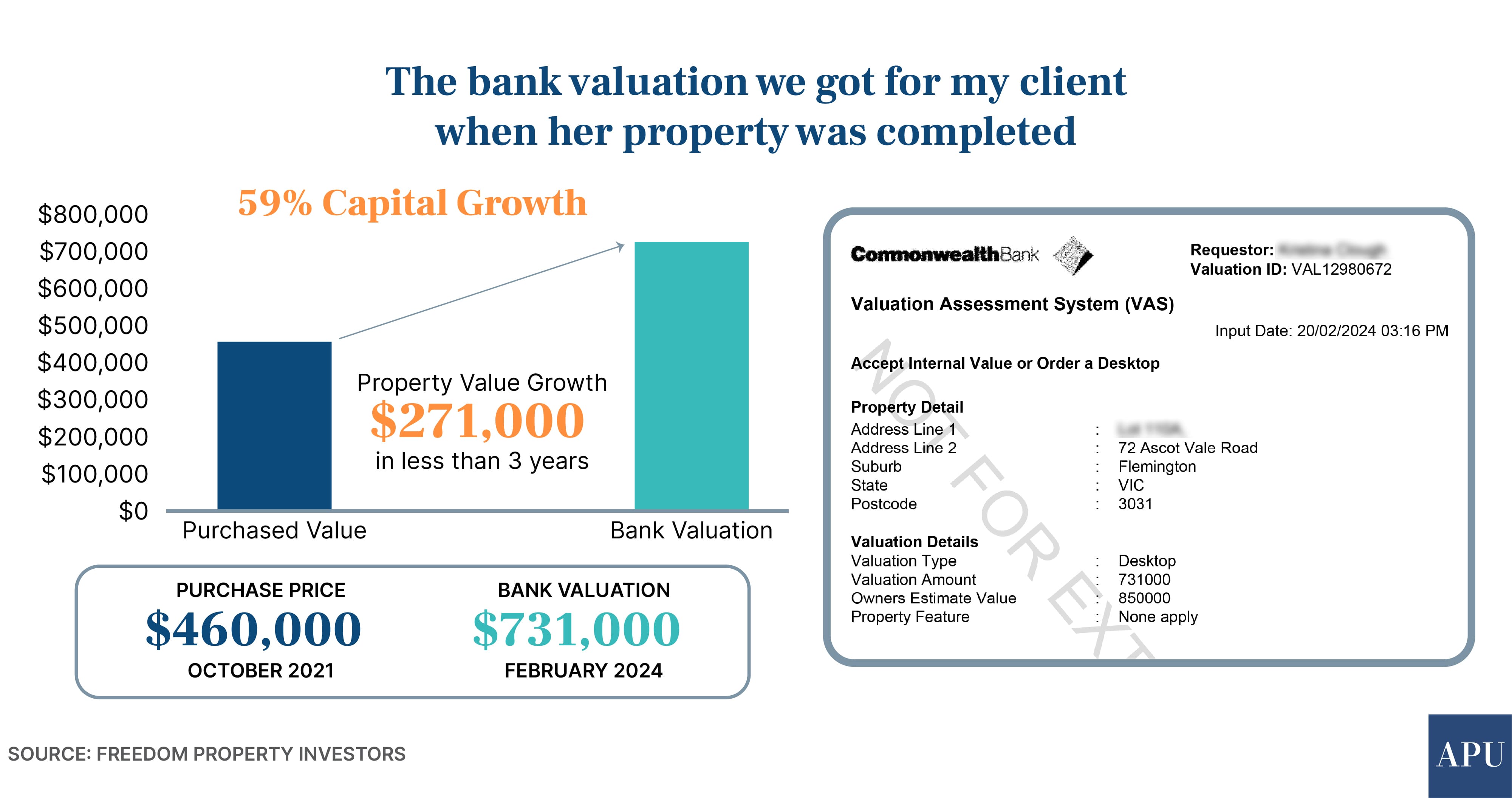

Here’s an example of a client I worked with.

She had a limited budget - about $450,000 to work with.

I suggested a one-bedroom apartment.

The client initially responded negatively.

She’d read an article, heard a podcast, and seen a TikTok video that said apartments were bad investments.

Anyway, I talked her around, and we got her into a one-bedroom apartment for $460,000.

It was brand new off the plan, it had a $15,000 rebate, and we were able to negotiate a good price because we were purchasing multiple properties in the building through our buying group.

Two years later, when the property was completed, we got a bank valuation that valued it at over $730,000.

Why did this work so well for her?

It turns out that in this particular location, there are a lot of young, single people who want access to amenities like cafés, restaurants, bars, public transport, and employment.

They want to rent something affordable, but they don’t really want to share a kitchen and bathroom with a whole herd of housemates.

They also want the option of being able to work from home in peace.

It turns out there was actually a lack of supply of one bedroom accommodation in this particular area.

Even in the new building she was buying into, very few of the apartments being built were one-bedroom.

So, the lesson here is not to generalise about a certain type of property.

The challenge is to identify the niche market in a particular suburb that is potentially being underserved in terms of location, housing type, parking, number of rooms or space, and to offer an attractive housing solution to a would-be tenant.

Once you do identify that gap in the market, you have to make sure that the property is well-built, it has the right appliances, it has the right layout, and it has the right features to attract the best possible tenant, at the best possible rent.

No. 3: Mitigate the risk

Firstly, you don't want to overpay for the property you have chosen.

The problem we're seeing now is because listings are so low on existing homes, what’s actually happening is that sellers aren’t prepared to negotiate, and getting value is tough.

If there is development potential on the property or growth potential in the area, vendors are now trying to price in that growth potential, even if the actual property you are buying is a total dump.

People say, “It’s ripe for development!”

But when you really run the numbers and go and talk to the council about what’s actually allowed, it can be a very different story.

People also get sucked in by FOMO - fear of missing out.

You go to an auction, or you've got a buyer's agent who's nagging you, “Hey, everyone's after it.”

You end up paying an extra $50,000 above what you’d planned, and then you've got your buyer's agent fee on top of that.

So it's really soaking up a lot of cash; cash that really should be going towards holding more property.

On the other hand, if you are buying property off the plan, you’ve got to be very careful that there are no hidden fees and charges, the materials being used are high quality, the builder is reliable, will finish the job, and won’t go bankrupt next week.

I've become an expert at putting groups together to go in and negotiate prices, specifically on brand-new homes.

That's where I concentrate because I understand the risks there, and I can mitigate them.

Cash flow is another thing.

What rent do you expect to get every single week?

How many weeks per year do you expect for the property to be vacant?

And what is the annual rate of rent increase?

If you invest in the right area, over two or three years, you could be looking at a 20-30% rent increase.

This substantially improves your cash flow, which means you can borrow more money to grow your property portfolio.

One way to do this is to talk to rental agents in the area where you’re thinking of buying.

They’ll tell you what's a good rental for an area, but they should also be able to tell you what features a renter is prepared to pay a premium for.

Perhaps people will pay more for a home with a study area or two living spaces.

Then there are vacancy rates.

I always get a real estate agent to guarantee my rent.

I’m able to do that for myself and my clients because I have the volume of the potential leases I can offer an agent.

The average investor won’t be able to do that.

So you’ll need to be realistic about how many weeks per year you expect your property to be vacant.

That’s got to be factored into your cash flow projections.

The last point about mitigating your risk is depreciation.

That will give you massive tax refunds, but remember, you only get the maximum depreciation on brand-new property.

That’s the reason I focus on brand-new homes.

So, there you have it.

These are the three key areas that you need to be thinking about, if you are going to be a successful property investor.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)