Features > Property News & Insights > Investment Strategies

Why Property Outperforms Stocks: A Comprehensive Analysis

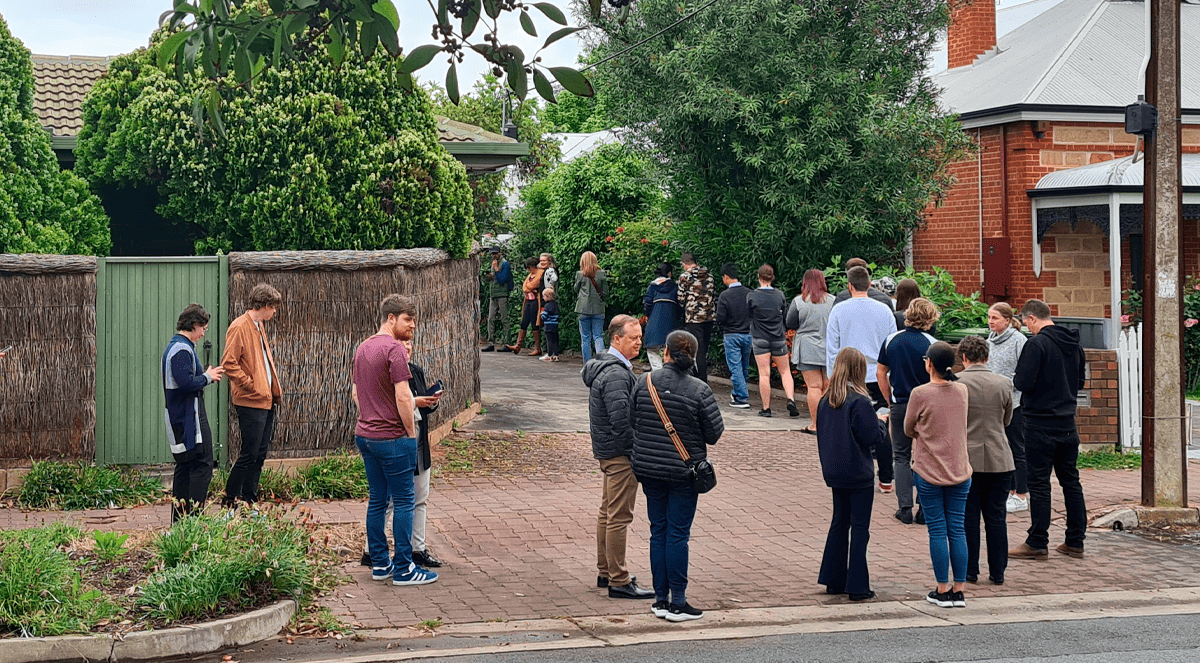

Image from Glen McCurtayne/Sydney Morning Herald

KEY POINTS

One of the most important investment decisions most people make is where to allocate the bulk of their resources. Some investors weigh heavily on stocks. Some investors weigh heavily on property. Some like a very even distribution across both asset classes.

This article will show you exactly how the vast majority of high net worth individuals have been able to build their wealth through property. We'll discuss the pros and cons of each asset class and help you draw the same conclusion as us — that property is absolutely the best way to go.

However, it doesn't win in every category, as you will soon see, and that could be significant depending on your own personal circumstances.

Your financial position and attitude towards risk may dictate that one asset class is better than the other, and the only way to truly know will be to assess each asset class across the eight criteria that we are analysing today.

Capital growth potential

Capital growth potential refers to how much an asset can be expected to grow in value. For an extended historical period, Australian real estate has consistently demonstrated robust capital growth year on year with very few slumps, particularly when juxtaposed against the volatility inherent in stocks on the ASX or broader global markets.

The Federal Reserve of San Francisco published a research paper in 2015, titled "The Rate of Return on Everything," which analysed nearly a century and a half of data to reveal long-term returns across various asset classes and locations.

The study found that Australian real estate yielded a 6.37% per annum return in real terms across the entire dataset, while stocks yielded 7.81% per annum. Examining the data from 1950 onwards, real estate outperformed stocks, delivering 8.29% per annum compared to 7.57% per annum for stocks. However, focusing on the more recent data from 1980 onwards, stocks outperformed real estate, returning 8.78% per annum compared to 7.16% per annum for real estate.

While the overall capital growth may look like more with shares, the security around property and the ability to leverage property purchases and to do so with banks and with a lot of confidence that your investment is not going to fail allows you to multiply those returns by three, four or five times. When this ability to leverage is factored in, property comfortably outperforms stocks.

Of course, comparisons come with their own set of challenges. Returns can fluctuate based on the selected time period, and real estate can be segmented into different regions, just as stocks can be divided into various sectors. It is crucial to remember that both asset classes have experienced periods of rapid growth and significant decline. Additionally, the returns can be affected when factors like leverage and expenses are taken into account. Nevertheless, it is important to note that past performance does not guarantee future results.

However you choose to analyse the data, it is evident that both stocks and real estate have yielded appealing returns over the long term.

And while it is possible to leverage against stocks, this would essentially be akin to investing in a hedge fund and, owing to the inherent volatility of this asset class (a point discussed next in this article), it can put your entire portfolio at significant risk. At the very least, much riskier than property.

An alternative way to look at it, is that real estate is for a long-term investment where you can comfortably leverage and gain exceptional capital growth. Whereas stocks are more suited to short to medium-term investments where timing the market is where the real gains are made, and leverage comes with significant risks.

Winner: Real Estate

Market volatility

The volatility refers to the fluctuation in prices over short time periods. Therefore, the heightened volatility of an asset directly amplifies the associated risk, particularly when circumstances necessitate its liquidation (such as personal needs, health related issues that are expensive, loss of income, these kinds of things).

With real estate, we're talking about a market with much less volatility compared to stocks. And the underlying reason for having such stable and predictable increases in property values stems from the rigorous regulatory framework governing the Australian property market, buttressed by an abundance of safeguards to prevent any regressive market trends.

In contrast, stocks lack such protective measures, where various financial institutions are constantly trying to outperform each other in a market that is far less regulated, resulting in semi-regular financial crises.

For example, during the GFC, the ASX dropped by 54% from a high in November 2007, to a low in March 2009.

In the June and September quarters of 2008 the median house price in Australia fell by 3.5%, but had recovered the loss by March 2009. This is a clear demonstration that property is not as sensitive to market fluctuations.

Unlike real estate, stock valuations can oscillate numerous times within a single trading day, exhibiting significant price shifts. These price movements are highly susceptible to a plethora of market influences, ranging from fundamental economic indicators to global events. In some instances, stocks can even experience abrupt and drastic shifts due to misinformation or false news, only to rebound once the truth emerges. This heightened volatility inherently introduces a greater degree of risk to stock investments, making them a more unpredictable asset class.

Winner: Real Estate

Income Generation

Real estate yields grow predictably year on year through incremental rent rises, which are part and parcel of most tenancy agreements. Given the long-term nature of leases, it is relatively easy to secure a reliable stream of income. With stocks, remuneration comes in the form of dividends, and this can fluctuate wildly depending on the performance of the company. The company's financial performance is influenced by a confluence of factors, both direct and indirect, that affect the company's ability to produce profit.

Some key factors affecting a company's ability to generate profit include:

- Economic Conditions

- Industry Trends

- Competitive Landscape

- Operational Efficiency

- Management Decisions

- External Events

- Regulatory Environment

The inherent volatility of the stock market positions real estate as the preferred avenue for sustained annual income growth.

Winner: Real Estate

Liquidity

Liquidity refers to the ease and speed with which a particular investment can be converted into cash. Stocks are traded daily. In fact, a buy or sell order can happen in a matter of minutes (depending on the size of the trade). In contrast, property transactions typically necessitate extended durations, spanning several weeks at a minimum, occasionally months, and in exceptional instances, years—often indicative of a seller’s valuation misalignment with the market.

Real estate cannot be bought or sold off immediately because of the extended negotiation phases and requisite procedures, encompassing structural assessments and the enlistment of conveyancing professionals before final settlement. Even after a contract has been signed, numerous factors can obstruct the settlement process. Essentially what this means is that stocks are much more liquid, conferring them a clear advantage in this area.

Winner: Stocks

Maintenance/Transaction costs

With real estate, owners recurrently encounter annual expenses tied to the maintenance of the property. This includes costs related to repairs, general upkeep, and any upgrades aimed at enhancing the property's value. If an investor opts to hire a property manager to oversee tenant interactions and property care, this introduces an added layer of expense. Beyond these, property investments typically come with a range of transaction fees. These can encompass charges for pest and building reports, legal and conveyancing fees, and in many regions, the notable cost of stamp duty.

On the other hand, investing in stocks presents its own set of costs. When buying or selling, investors usually encounter brokerage fees, the specifics of which can differ based on the chosen platform or broker. Furthermore, should an investor decide to enlist the expertise of a financial adviser or broker, they should be prepared for the fees attached to their advice or portfolio management services.

While property investments can entail a diverse array of ongoing and upfront costs, from maintenance to legal fees, the costs tied to stock investments, such as brokerage and advisory fees, are typically more straightforward and can be lower in comparison.

Winner: Stocks

Barriers to Entry

“Barriers to entry” refers to how quickly or easily one can start purchasing a particular asset class. In the case of real estate, one significant impediment is the requisite of substantial capital to enter the market. We do not have particularly sophisticated or plentiful property funds in Australia in which one can buy shares. Consequently, most real estate investors are eyeing up and investing in individual properties, usually for themselves, rather than buying in collectives that might include friends or family members. This means that the capital required can often be in excess of $75,000.

However, real estate does offer an advantage in terms of financial leverage, with investors only requiring 20% of the loan’s value. It’s a simple and regulated process that gives investors the opportunity to amplify their purchasing power by using the bank's money, allowing them to accumulate compound gains on borrowed funds.

In contrast, stocks present a lower barrier to entry from a capital perspective. Individuals can commence their stock investment journey with sums as modest as $100, reaping returns almost immediately. Yet, it's essential to note that while real estate investors can easily leverage their investments, attempting to invest in stocks using borrowed money, a practice known as margin trading, is fraught with risks and is typically reserved for seasoned traders.

Winner: Stocks

Management, maintenance and control

Real estate does not require the same level of constant monitoring and research as stocks do. With property, once you've acquired the right asset in the right location, and have a high level of confidence that it is going to appreciate, then the managerial focus shifts to little more than ensuring you have a good property manager and accountant in place. All in all, a small proportion of your rental yield can be invested in experts to take away the headaches from real estate investment, and your investment can be very easily managed without compromising your overall growth trajectory. This will allow you to focus on other aspects of your financial portfolio.

With stocks In order to achieve returns comparable to what the real estate market can produce, you need to be outperforming the market average, which requires constant monitoring and research and, crucially, timing the market. Even full-time expert traders can have difficulty outperforming the market, despite the fact that they can dedicate eight hours a day looking at graphs, isolating patterns, and then making calculated investment decisions.

Winner: Real estate

Tax benefit

Real estate investment is heavily incentivised in Australia from a tax perspective. Owing to mechanisms such as depreciation and negative gearing, investors can claim losses despite the fact that their asset is growing in equity astronomically. It is a quirk (and some might say a bug) of the Australian taxation system that a property may appreciate by $100,000 or $200,000 in a year and yet the owner can claim significant losses that they can offset against their tax. In short, this effectively means that the tax man is subsidising property investment.

With stocks, when you sell your stock holdings at an appreciated price, there is an immediate imposition of capital gains tax. Engaging in frequent stock transactions not only instigates recurrent tax implications but also potentially changes one's designation with the ATO from a "share investor" to a "share trader." Put simply, the more you trade, the more intricate your tax administration becomes.

Winner: Real Estate

Australian property investing prevails

Both real estate and stocks have their unique rhythms and steps. As we've dissected throughout this article, real estate consistently emerges as the preferred asset class for building long-term wealth, especially in the Australian context. From capital growth potential to tax benefits, the scales often tip in favour of property. While stocks do have their merits, particularly in terms of liquidity and lower barriers to entry, the risks and volatility associated with them can't be ignored.

However, it's essential to remember that every individual's financial situation, goals, and risk tolerance are unique. While this article presents a compelling case for real estate, it's crucial for potential investors to conduct their own research, consult with financial advisors, and deeply introspect about their investment priorities. But if history and the current landscape are any indicators, real estate in Australia has proven time and again to be robust and rewarding.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)