Features > Property News & Insights > Investment News

Waiting for a property bargain? Here are 5 reasons why you’re likely to be disappointed

KEY POINTS

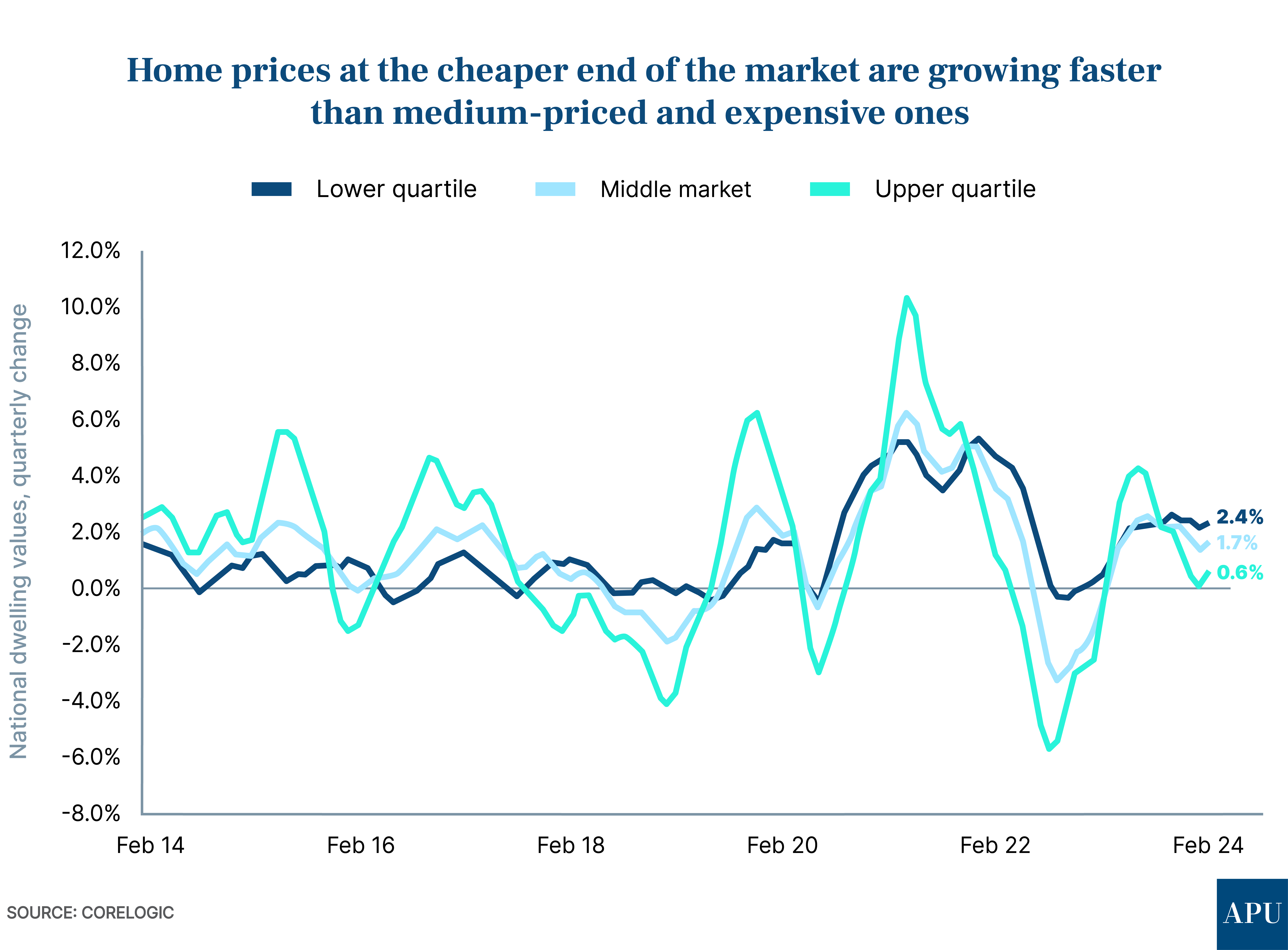

- CoreLogic data shows that cheaper properties in every Australian capital city are growing faster in value than more expensive homes

- Domain Group says so-called “distressed listings” are at two-year lows in most capitals, despite high interest rates

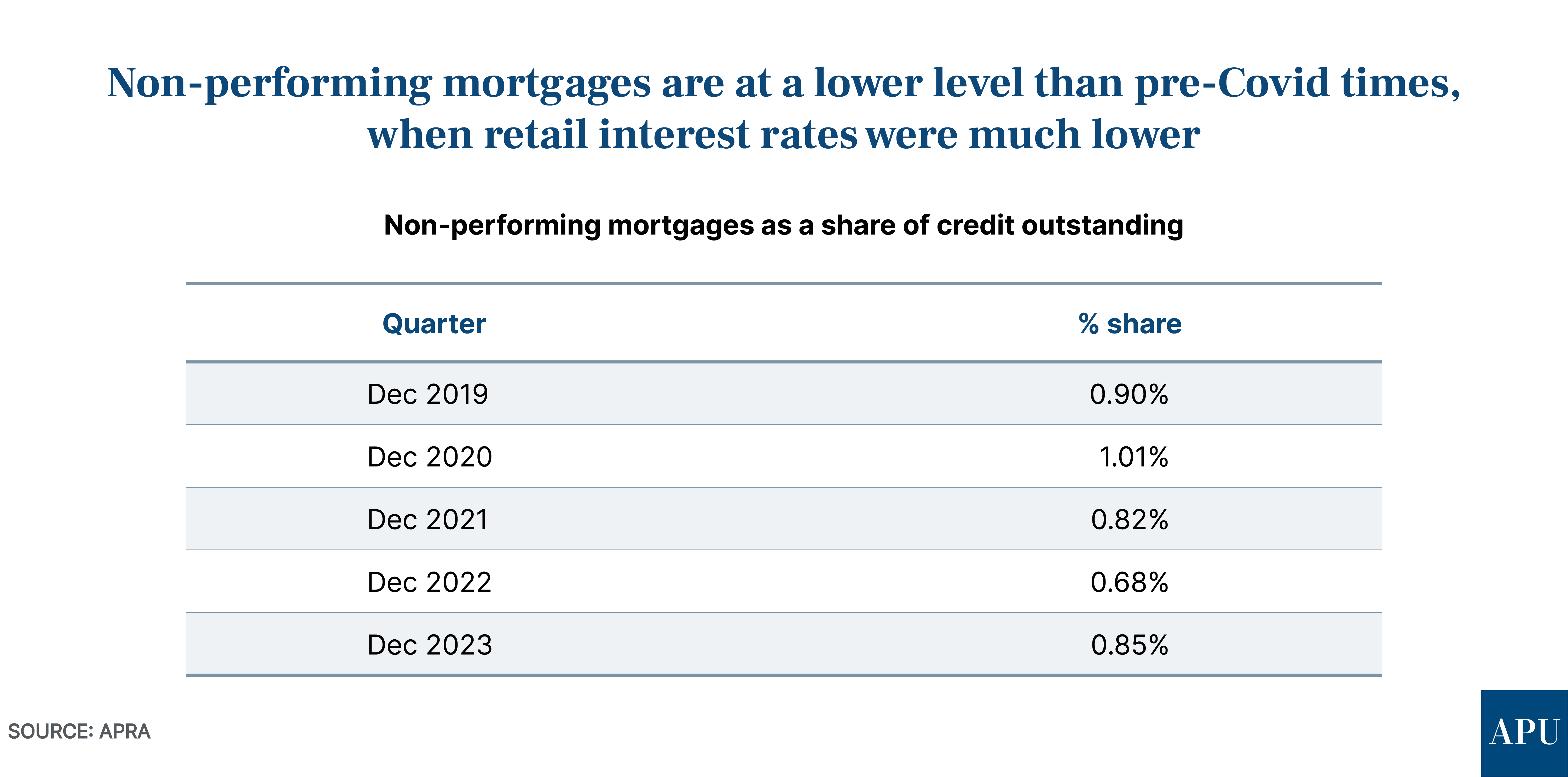

- APRA data shows non-performing loans are at historically low levels, meaning few people with mortgages face the prospect of having to sell as a distressed listing

- APRA data shows deposits in mortgage offset accounts are at record levels, as households do everything they can to ease the burden of high interest rates

- PEXA data shows 28.5% of properties purchased in Victoria, New South Wales, and Queensland last year were bought with cash

Many potential buyers find themselves ready to step onto the property ladder, but then they hesitate.

They start wondering if waiting for prices to fall might be a better strategy.

After all, in any normal market, a combination of high interest rates, a cost-of-living crisis, weak economic growth, rising unemployment, and low consumer confidence should mean lower home prices, right?

However, the Australian residential property market is behaving in an anything but “normal” way at the moment.

Several new pieces of data prove this and show that buyers who are waiting around for a “bargain” are likely to be severely disappointed.

The “bargain” end of the market is not such a bargain

First-home buyers and property investors usually target the bottom end of the market - the cheapest properties.

Real estate analysts call this the “lower quartile” - the bottom 25% of properties in terms of price distribution.

For first-home buyers, it’s a simple case of affordability.

It can be the same for property investors too, but many wealthy investors will also target cheaper properties because they often provide better rental yields than more expensive dwellings.

New data from CoreLogic shows that the lower quartile across every Australian capital city has recorded a stronger outcome for housing values relative to more expensive properties over the past three months.

In other words, prices at the bottom of the market are growing at a faster rate than at the top.

Perth has the largest gap in price growth between the lower and upper price quartiles with a 2.2% difference, followed by Adelaide (1.6%), and Brisbane (1.5%).

Sydney and Melbourne have a 0.7% difference, followed by Hobart and Darwin (0.6%), while the difference in Canberra is 0.4%.

“This trend is most evident in Sydney, Melbourne and, to a lesser extent Brisbane, where upper quartile values clearly led the 2023 upswing through the first half of the year,” says CoreLogic’s Research Director, Tim Lawless.

“The trend hasn’t been evident in Perth or Adelaide where lower quartile home values have consistently recorded a faster pace of capital gains through 2023 and the first two months of 2024,” he says.

Distressed listings

A very tangible sign that high interest rates are biting usually comes in the form of so-called “distressed listings”.

These are properties listed for urgent sale, often at a discount, typically due to the inability of the occupants to meet their mortgage repayments, and often in the face of a threat from the bank to repossess the home.

Distressed listings are highly sought after by investors, first home buyers, and renovators keen on “flipping” (a strategy where a property is bought at a bargain price, given an often superficial “makeover” and then sold for a profit).

However, new data from Domain Group shows distressed listings continued to decline in February across all markets.

That’s despite no less than 13 straight interest rate hikes by the Reserve Bank of Australia (RBA), which have taken the cash rate to its highest level in more than a decade.

According to Domain, distressed listings in Perth are at an all-time low, while they’ve “declined to a 26-month low in Darwin, an almost two-year low in Sydney, a 22-month low in Melbourne, a 21-month low in Brisbane, Canberra, and Hobart, and a 20-month low in Adelaide.”

Non-performing loans are very low

A good guide to how many distressed listings might be in the pipeline can be found by looking at the latest quarterly data from the banking watchdog APRA, the Australian Prudential Regulation Authority.

That shows that loans which are between 30-89 days in arrears and so-called “non-performing” loans (overdue by 90 days or more) are rising.

However, the numbers are still very low by historical standards, and lower than pre-COVID-19 levels, when retail mortgage rates were around 3.1%, less than half of the 6.8% they are hovering around today.

Offset record

One way that households with a variable mortgage are able to decrease the interest on their loan repayments is with an offset bank account.

Essentially any money deposited in that account 'offsets' the loan balance – reducing the amount of interest paid.

New data from APRA shows that the total amount of cash Australians have stashed in offset accounts hit a new record high of $265.45 billion in the December quarter of 2023.

That’s a 16% rise since May 2022 when the RBA started hiking the cash rate.

What that means is that many households with mortgages are not feeling the full “pain” of the RBA’s hikes.

As their retail mortgage rates have gone up, they’ve not only cut back on some of their spending.

They’ve also rearranged their finances to make sure every dollar they have is going towards offsetting their interest payments, precisely so they don’t fall into any kind of mortgage arrears, and then end up as a distressed listing.

Cash buyers

Data from property exchange service PEXA shows that more than one-quarter of all residential properties purchased in Victoria, New South Wales, and Queensland last year were bought entirely with cash.

Not only does that mean that 28.5% of buyers active in three largest states didn’t require finance to buy these properties, but it also means they are immune to interest rate hikes.

They are often also prepared to pay well above the market rate if they believe a property they like might be snapped up by someone else.

“Cash-buyers are changing the dynamics of the residential property market and exerting a greater influence on overall property demand,” says PEXA’s Chief Economist, Julie Toth.

“The relatively large size of this group helps to explain the property market’s resilience in 2023, despite rapid rises in interest rates.”

Separate figures show that while there was a 9.1% decrease in the total value of property (including residential and commercial property) transactions last year, compared to 2022, settlement volumes in the final quarter of 2023 steadily increased, “signalling a positive outlook ahead”, according to PEXA.

Buyers and sellers are increasingly active, and many are paying in cash - forcing up prices even more.

Australia is fast becoming a bargain-free property zone.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20(1).png)

.png)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)