Features > Property News & Insights > Financial Advice

Want to end the housing crisis? Getting rid of one tax could change everything

KEY POINTS

- New research has found that if New South Wales scrapped stamp duty, about 100,000 more people would move homes each year

- The same research estimates that 90,000 more people in Victoria would move homes annually

- The study’s author says scrapping stamp duty would enable many older Australians in large homes to “downsize” and allow more people to move to areas where they can find better jobs

- Some states and territories have shown that they’re willing to consider alternatives to flat stamp duty payments when people buy new homes

There’s no question Australia is in the grip of a housing crisis, fueled by rapid population growth, smaller household sizes, slow rates of construction of new dwellings, and a shameful track record by governments when it comes to providing adequate public and social housing for the most vulnerable members of the community.

The result is soaring property prices and rents, making home ownership seem more and more a distant dream for younger Australians.

So what can be done?

Most sensible observers seem to agree that the best solution to this crisis is to increase supply - to build more houses and apartments.

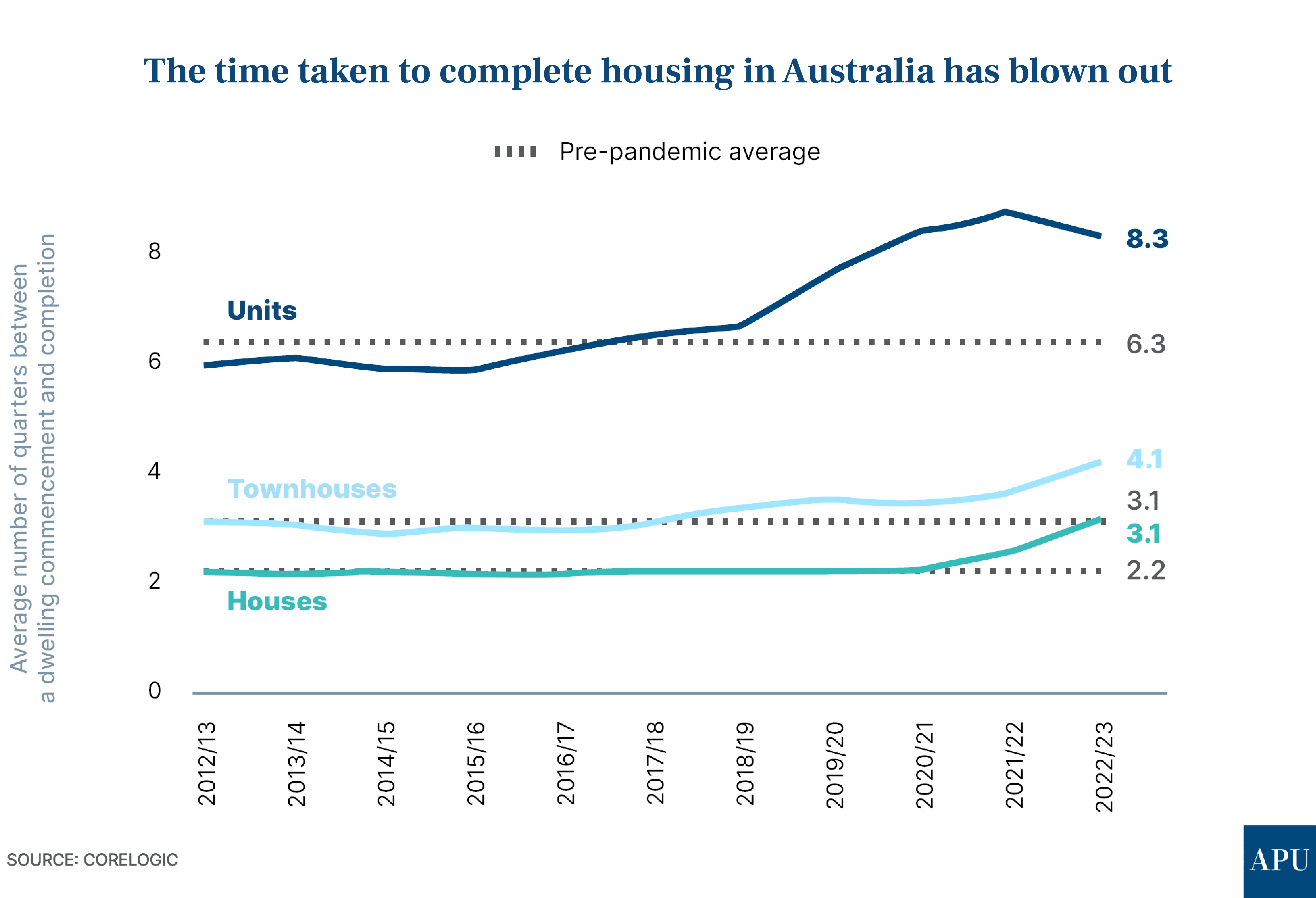

But that’s no quick fix, with recent figures published by CoreLogic showing the time taken to complete housing has blown out significantly over the past ten years.

That also ignores the fact that we probably already have enough housing in Australia to add to the market supply, alleviating a degree of strain from the current stock.

It’s just that a lot of that existing housing has been essentially “locked up” because of one particularly punitive tax - stamp duty.

How stamp duty is shaping our lives and holding back productivity and economic growth

New research by Macquarie University economist Nick Garvin and the e61 Institute found that if just one state of Australia, New South Wales, scrapped stamp duty on real estate transactions, about 100,000 more Australians would move homes each year.

With stamp duty in New South Wales currently averaging about 3.5% of the purchase price of a home, Mr Garvin and his team estimated there would be about 25% more purchases and moves by homeowners if the tax were scrapped completely.

So why is it good that people can move?

“The more that people are able to move, the more they will move to jobs to which they are better suited, boosting productivity,” Mr Garvin says.

“The more that people downsize when they want to, the more housing will be made available for others.”

This last point is particularly important.

The Australian Bureau of Statistics has estimated that 77% of Australian households had at least one bedroom spare in the 2019-20 financial year.

Other figures estimate that on any given night in Australia, there are 13 million spare bedrooms.

Many of these bedrooms are in homes owned by older, retired Australians, who live in ideal family-sized homes located in the inner and middle-ring suburbs of our capital cities, often close to schools and public transport.

Their children have long grown up and left home, and many would gladly downsize to a smaller dwelling, essentially “surrendering” their larger home to a younger family, or enabling several younger workers or students to create a well-located share-house.

However, many older Australians are discouraged from downsizing by the large transaction costs of moving, and the biggest by far of these is stamp duty.

The Queensland experiment

So, how did economist Nick Garvin and his team come up with these extraordinary numbers?

Quite simply, they looked at the case of Queensland.

In 2011, Queensland hiked stamp duty for most buyers.

For owner-occupiers, this worked out to be about a 1% hike, lifting the average rate to 2.27% of a home’s purchase price.

“What we found gives us the best estimate to date of what stamp duty does to home purchases,” Nick Garvin says.

A one percentage point increase in stamp duty caused the number of home purchases to decline by 7.2%, while the number of changes of address was similar.

“The effect appears to be indiscriminate,” he says.

“Purchases of houses fell about as much as purchases of apartments, and purchases in cities fell about as much as purchases in regions.”

“Moves between suburbs and moves interstate dropped by similar rates.”

The case against Stamp Duty

Nick Garvin points out that the most comprehensive critique of Australia’s tax system - the 2010 Tax Review headed by former Treasury Secretary Ken Henry - found stamp duty was inequitable.

“Ideally, there would be no role for any stamp duties, including conveyancing stamp duties, in a modern Australian tax system,” the Henry review declared.

“Recognising the revenue needs of the States, the removal of stamp duty should be achieved through a switch to more efficient taxes, such as those levied on broad consumption or land bases.”

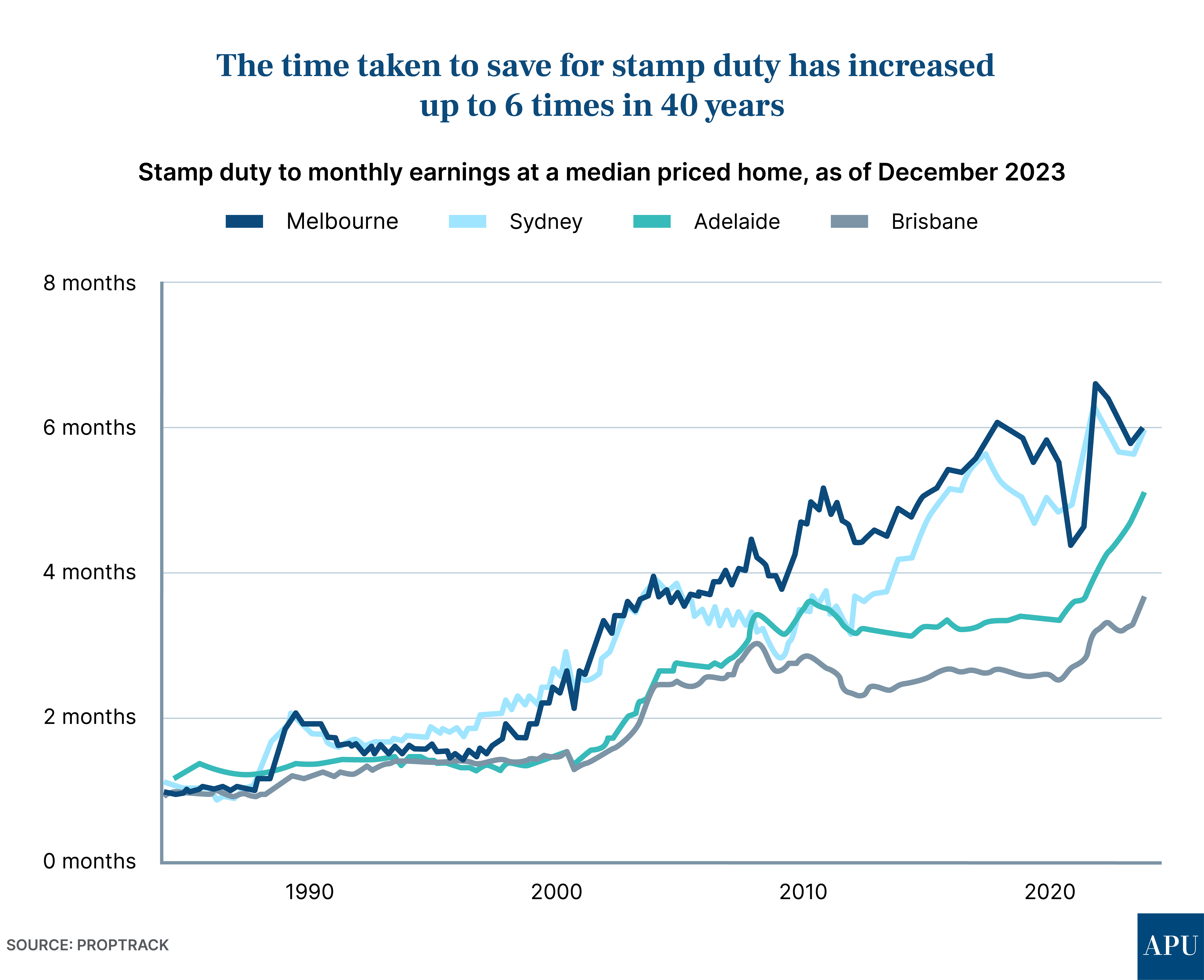

Since Ken Henry wrote that in 2010, stamp duty has ended up distorting the property market even more, with the amount of time people need to save for stamp duty on a property purchase doubling in many cities.

“It has happened because home prices have climbed faster than incomes and because stamp duty has brackets, meaning more buyers have been pushed into higher ones,” Nick Garvin says.

There’s no question that states offer some stamp duty exemptions, particularly for first-home buyers.

For example, in New South Wales, the state revenue office says “A full exemption from transfer duty will be available if you are buying a new or existing home valued up to $800,000, while homes valued over $800,000 and less than $1,000,000 may qualify for a concessional rate.”

But to put that into some perspective, the current median house price in Sydney is currently $1,395,804.

While no state would seriously consider scrapping the revenue cash cow that is stamp duty, they have shown they are open to alternatives, instead of demanding a big chunk of money upfront when someone buys a home.

Shortly before he lost the 2023 state election, former New South Wales Premier Dominic Perrotet introduced a scheme that offered home buyers a choice between stamp duty or a lower, annual property tax.

That was scrapped just months later by the incoming Minns government.

Victoria - which has the highest stamp duty in Australia - has also just introduced legislation to scrap stamp duty for commercial and industrial property from the 1st of July 2024, replacing it with an annual 1% fee on the property’s unimproved land value.

Replacing stamp duty on residential property will not be easy, but there are precedents to show that this regressive tax, which has helped create the housing crisis and which has a truly awful effect on our lives, can be replaced with something better.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

.png)

%20Scott%20Kuru%20DPU%20154.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20Cost%20of%20Living%20Crisis%20Has%20Reached%20a%20Breaking%20Point%20(Millions%20Will%20Be%20Homeless)%20Scott%20Kuru%20DPU%20154.jpg)

%20Scott%20Kuru%20DPU%20153.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Exposes%20Australia%E2%80%99s%20Oil%20Crisis%20Far%20Worse%20Than%20Expected%20($50%20Billion%20Lost)%20Scott%20Kuru%20DPU%20153.jpg)

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)