Features > Property News & Insights > Investment Strategies

Seven things we can learn about property investment from Taylor Swift

Image from Getty Images

KEY POINTS

- Taylor Swift is not only a global pop megastar, she is also an extremely successful business leader

- Swift's secret to success as a business strategist boils down to seven key things, from a strong work ethic to constantly reinventing herself

- These strategies are applicable to property investment, and implementing them will guarantee success

It’s now official.

Taylor Swift is a billionaire.

The singer/songwriter recently made it onto Forbes magazine’s annual “World’s Billionaires List” for the first time, with an estimated US $1.1 billion (AUD $1.7 billion) fortune.

As Forbes' Monica Mercuri commented, it’s a rare feat, as “Swift is the first musician to reach the milestone solely from songwriting and performing.”

“Her fortune doesn’t largely derive from profitable side hustles (think: beauty brands, fashion lines, alcohol investments, etc.), which have been typical avenues for entertainers to become billionaires in recent years.”

And there’s no doubting the economic clout of “Miss Americana”.

Recent figures from the Australian Bureau of Statistics (ABS) clearly demonstrate the impact the world’s biggest pop star had during the recent Australian leg of her “Eras” Tour.

Retail turnover rose 0.3 per cent (seasonally adjusted) in February 2024, according to ABS figures.

According to Ben Dorber, the ABS Head of Retail Statistics, growth would have only been a measly 0.1% if it hadn’t been for Taylor Swift’s seven sold-out concerts in Sydney and Melbourne.

With over 600,000 Swifties flocking to these events, Mr Dorber says “This led to increased spending on clothing, merchandise, accessories and dining out.”

An enviable marketing and publicity machine backs Taylor Swift, but there’s no getting away from the fact that she is an extraordinary business figure in her own right.

People often look to billionaire business figures like Warren Buffett, Jeff Bezos, Elon Musk, Bill Gates and Steve Jobs for inspiration.

So, what can we learn from Taylor Swift?

And more specifically, what can Taylor Swift teach us about property investment?

Quite a bit, as it turns out:

- Work ethic

Taylor Swift has an extraordinary work ethic.

From an early age, she decided she wanted to pursue a career as a singer and songwriter and single mindedly pursued that goal, supposedly even persuading her parents to relocate from Pennsylvania to America’s music capital, Nashville.

Swift signed an artist development deal when she was only 13 and has worked incessantly to transform herself from a teenage country star into a global icon.

She’s recorded (or re-recorded) 15 albums, starred in 6 films and undertaken six world tours.

And Taylor Swift is still only 34.

You work hard for your money, so like Taylor Swift, you should have your money working incessantly for you, even while you sleep.

For the overwhelming majority of Australians, the best and easiest way to achieve this is through investment in residential property.

It allows you to free up “lazy equity” in your home or your self-managed superannuation fund and use the power of leverage—the leverage that’s really only possible with property—to build wealth.

- Have the best team around you

Taylor Swift didn’t get to where she is today by settling for second best.

She has constantly sought out and surrounded herself with the most talented people in the entertainment industry.

When she wanted to move on from the country rock sound of her first two albums, she brought in two of the biggest proven contemporary hit-makers - Swedish producer/songwriters Max Martin and Shellback - to help complete her transition to Pop Princess.

As she has shifted her sound, she’s turned to notables like One Republic’s Ryan Tedder, Bleachers frontman Jack Antonoff, and The National’s Aaron Dessner for production and songwriting assistance. She has also dueted with Ed Sheeran, Kendrick Lamar, John Mayer, and Zayn.

The videos for Swift’s singles—many of which are virtual mini-films—have been directed by industry legends such as Joseph Kahn, Anthony Mandler, Drew Kirsch and more recently, Taylor Swift herself.

If you are starting an investment property journey, it makes sense to have the best advice to choose the best property for your individual circumstances in a growth location.

As you develop your portfolio, you’d be well-advised to surround yourself with strategists, brokers, and taxation specialists who constantly review your assets' performance to ensure you meet your investment goals.

- Keep it simple

Despite changing her sound and image, Taylor Swift has stuck with a fairly simple formula throughout her long career.

She appears to have realised early on she has an uncanny knack for creating melodic hooks that are easy to remember and sing along to.

When it comes to lyrics, she usually looks no further than her own life and experiences.

Her personal relationships and experiences have produced material for hits such as “I Knew You Were Trouble” (Harry Styles), “Bad Blood” (a falling out with one-time friend Katy Perry), “Forever and Always” (Joe Jonas), “Dear John” (John Mayer) and “We Are Never Getting Back Together” (Jake Gyllenhaal), just to name a few.

More recently, “Midnights” became an entire concept album, simply based on the thoughts that went through her head in the middle of the night when she couldn’t sleep.

The key here is to stick with what you know and understand.

The overwhelming majority of Australians understand the power and the wealth that can be generated through owning property.

Real estate is called exactly that because it’s “real”—it’s a tangible asset that you can see and touch, unlike shares, which are simply a piece of paper stating that you own a portion of a certain entity.

Stocks, crypto, commercial property and other investments can also be extremely volatile, but residential property has a long and solid track record of steady growth.

- Be prepared to reinvent yourself

While we’ve talked about how Taylor Swift keeps it simple, that doesn’t mean she hasn’t been prepared to re-invent herself.

In the 18 years since her first record was released, she’s morphed from a naive teenage country singer into a worldly pop megastar with a biting wit and sharp business acumen. She’s also become a poster girl for feminism and artists’ rights.

Times and tastes change, so like Taylor Swift, it’s worth keeping abreast of trends and styles when it comes to real estate.

For example, following the COVID-19 experience, any new investment property purchase—no matter how small—should take into account the need to have a space where the occupant can work comfortably from home if necessary.

A “zoom room” is now a must-have.

Likewise, it’s always worth considering new locations and different dwelling types for your property portfolio that may have more potential for growth than styles or areas you have traditionally considered, even if these are interstate.

This is where a good strategist comes into their own.

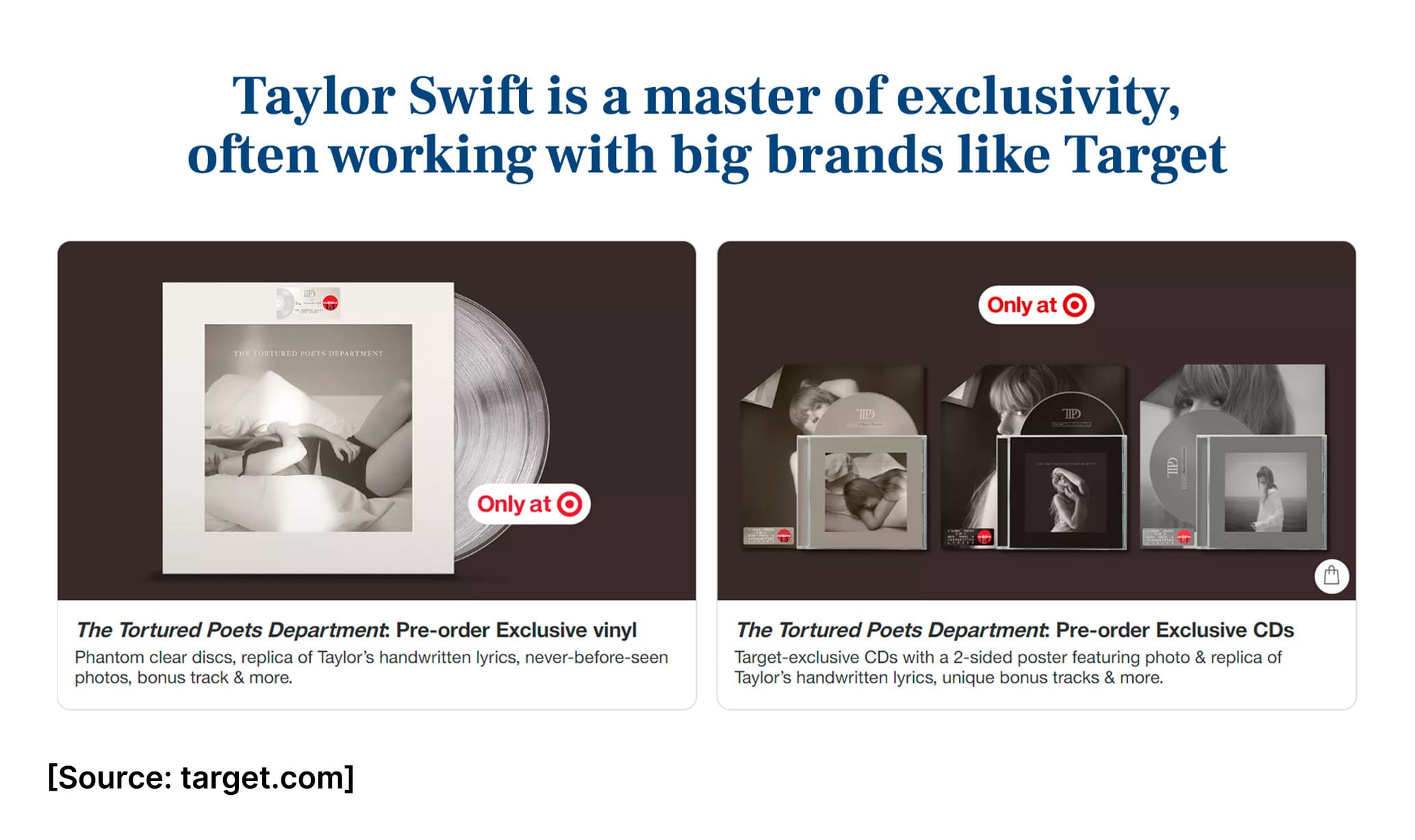

- Exclusivity

Taylor Swift has been an absolute master when it comes to exclusivity.

She constantly deals with retailers—particularly in the US—to give them access to special editions of her albums, which may feature extra songs, come in different formats—like vinyl or CDs—or have different covers or artwork.

This ensures that her legion of die-hard fans will probably end up owning several physical versions of her music and constantly streaming it on services like Spotify and Apple Music.

When she could not secure a good deal on royalties from her back catalogue, Swift simply took the extraordinary step of re-recording several of her most popular albums again to make sure she got a much better cut of proceeds.

The key here is that Taylor Swift constantly takes steps to protect her assets and make them as appealing as possible to her audience.

Similarly, when it comes to property investing, the key is to make your investment stand out from the crowd for potential tenants and to have an aura of exclusivity about it.

That’s why it pays to buy an investment property in an area with a high proportion of homeowners who are invested in the area.

Not only will you be able to attract a higher rent, but having neighbours that own properties in a street, an estate, a complex or a building will almost always guarantee better outcomes for general maintenance, the property’s appearance and attractiveness.

- Use government incentives

Taylor Swift may be a successful business figure and may come from a land known for its brand of rugged individualism and cut-throat capitalism, but she’s not at all shy about using government incentives to further her aims.

The most striking example of this was her recent decision to make Singapore the only stop in Southeast Asia on her global Eras Tour, despite having a massive fan base in Thailand, Indonesia, the Philippines, Vietnam and Malaysia.

Swift reportedly received an incentive of between US $2-3 million from the Singapore government to only play in the island nation.

Singapore’s Prime Minister Lee Hsien Loong was forced to defend the deal after it was described as an “unfriendly” and “unneighbourly” act by other Southeast Asian lawmakers.

When it comes to real estate, Swift has used California’s “Mills Act” - an incentive scheme designed to preserve historic buildings - so she pays substantially less state land tax on her own Beverly Hills mansion.

In Australia, the public sector has consistently demonstrated that it is largely unwilling to spend the huge sums of money that would be needed to provide adequate housing for all who need it.

Instead, governments have left it to the private market to provide the overwhelming bulk of rental properties.

And guess what?

The strategy has largely worked.

As Ray White's Chief economist, Nerida Conisbee, recently wrote, “incentives available to property investors in Australia have been successful in providing a steady stream of rental properties and keeping the proportion of households under rental stress at globally low levels.”

“Between 1996 and 2021, there were an additional 1.1 million rental properties provided by investors.”

“Compare this to an increase of 41,000 homes provided by community groups and a loss of 53,000 rental properties provided by the government.”

There’s a reason governments provide incentives like negative gearing and capital gains tax discounts on investment properties—the wise investor should use them.

- Shake it off

Let’s turn to what’s arguably Taylor Swift’s most famous song for some final inspiration.

'Cause the players gonna play, play, play, play, play

And the haters gonna hate, hate, hate, hate, hate

Baby, I'm just gonna shake, shake, shake, shake, shake

I shake it off, I shake it off.

“Shake it off” is probably the best summary of Taylor Swift’s philosophy.

She’s not worried about what critics or detractors may say or think; she’s just going to do her own thing, stick to what she’s good at and believe in herself.

It’s exactly the same if you are a property investor.

You have to block out a lot of the media noise and view your investments in a dispassionate way.

In the last 18 months, we’ve seen many investors decide to pull out of property, particularly in Queensland and Victoria.

While it’s clear that some (particularly those who bought when interest rates were at historic lows) could simply no longer afford to hold their investments because of much higher interest rate repayments, others took moves by state governments to introduce land tax changes and strengthen tenants rights as a personal affront.

They essentially sold up their holdings in a fit of pique.

Many would be kicking themselves now, with rents for units in Melbourne going up 14.6% and 18% in Brisbane over the year to March, according to figures from Domain.

As my business partner Lianna Pan says, “If your property price is going to grow 10%-15%—it's got the potential because of the underlying severe shortage of housing—it's not going to be affected by a small percentage change in land tax.

“You have got to focus on the bigger picture, which is, 'Is this an investment property market with the fundamentals to go up or not - is it going to perform or not?' and if the answer is 'Yes', these are small things that are not going to cause a major change to your overall outcome.”

In other words, Lianna’s advice is to stick to what you know works.

And anything else?

“Shake it off”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)