Features > Property News & Insights > Market updates

RBA leaves rates on hold, softens language on more rate hikes

KEY POINTS

- As widely expected, the RBA has left the cash rate on hold at 4.35%

- Governor Michele Bullock says conditions have not yet been met for the central bank to consider a rate cut

- The RBA has modified its language around future monetary policy, in a move analysts see as moving from a “hawkish” to a more “dovish” or neutral stance

The Reserve Bank of Australia (RBA) has decided to leave the cash rate on hold at 4.35%.

In a widely expected move, the board of the central bank is leaving rates where they’ve been since November last year - the highest level in more than 12 years - as it attempts to bring down inflation to its target range of 2-3% by the end of next year at the latest.

The good news is that the RBA acknowledges that its campaign of 13 interest rate hikes since May 2022, which has caused severe pain to Australians with a mortgage, is working.

In the statement accompanying the decision, the RBA board says “Higher interest rates are working to establish a more sustainable balance between aggregate demand and supply in the economy.”

And in an apparent change of tone, the central bank has moderated its language around the possibility of further rate hikes.

For the overwhelming majority of economists and analysts, it’s yet more proof that interest rates have reached a peak in this cycle - and the next move will be down - but not necessarily anytime soon.

Change in mood?

After its decision in February to keep rates on hold, the RBA Board hawkishly declared that "a further increase in interest rates cannot be ruled out".

That’s now been changed to a more dovish "the Board is not ruling anything in or out."

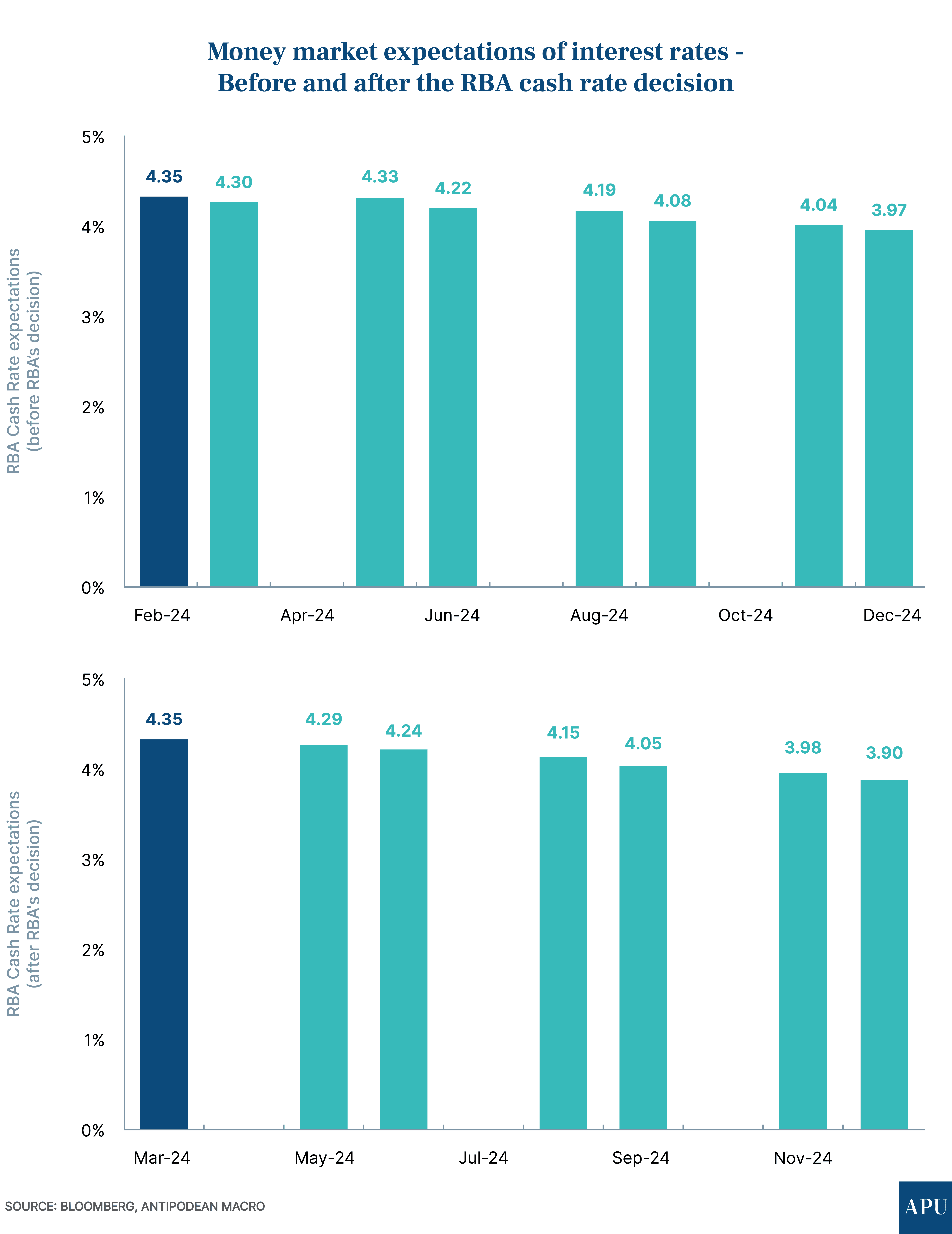

Not a great change, but enough to make the money markets notice.

As if to underline that subtle change, RBA Governor Michele Bullock seemed to be going to great lengths not to use the words “rate rise”, at her press conference after the cash rate decision was handed down.

“We're neither ruling it in or out,” she said, “we have changed the language - that's true, but that was in response to some data which has demonstrated to us that we are still broadly on the path we thought we were on.”

“So we're not confident enough to say we can rule out further interest rate changes, but we do think that we are on the path to get ourselves back to inflation in target within our forecast period.”

The analysis

“Clearly the Reserve Bank is fairly happy with the fact that the economy is slowing down,” says EY Oceania Chief Economist Cherelle Murphy.

“So we're still seeing some of the impact of last year's rate hikes flowing through the economy - that hasn't finished yet…inflation is kind of starting to come down, but the unemployment rate remains fairly stable and fairly low….so it all adds up to a Reserve Bank that's going to be happy sitting pat for the moment,” Ms Murphy told ABC News.

While Cherelle Murphy thinks the cash rate has peaked, she thinks it will be some time before the Reserve Bank even starts thinking about cutting the cash rate.

RBA Governor Michele Bullock underlined that at her press conference.

“What we need to consider a rate cut is really to be much more confident that inflation is coming back into the (target) band in the future.

“And as you know, the forecast, the central forecasts, have it not coming back into the band until 2025.

“So if we were to see some acceleration and get some more confidence that we are overachieving there, then it’s possible rate cuts might be something on the agenda - but at the moment we're not seeing that.”

Implications for homeowners

The message that the RBA is not currently even considering rate cuts will come as a blow to homeowners with a mortgage.

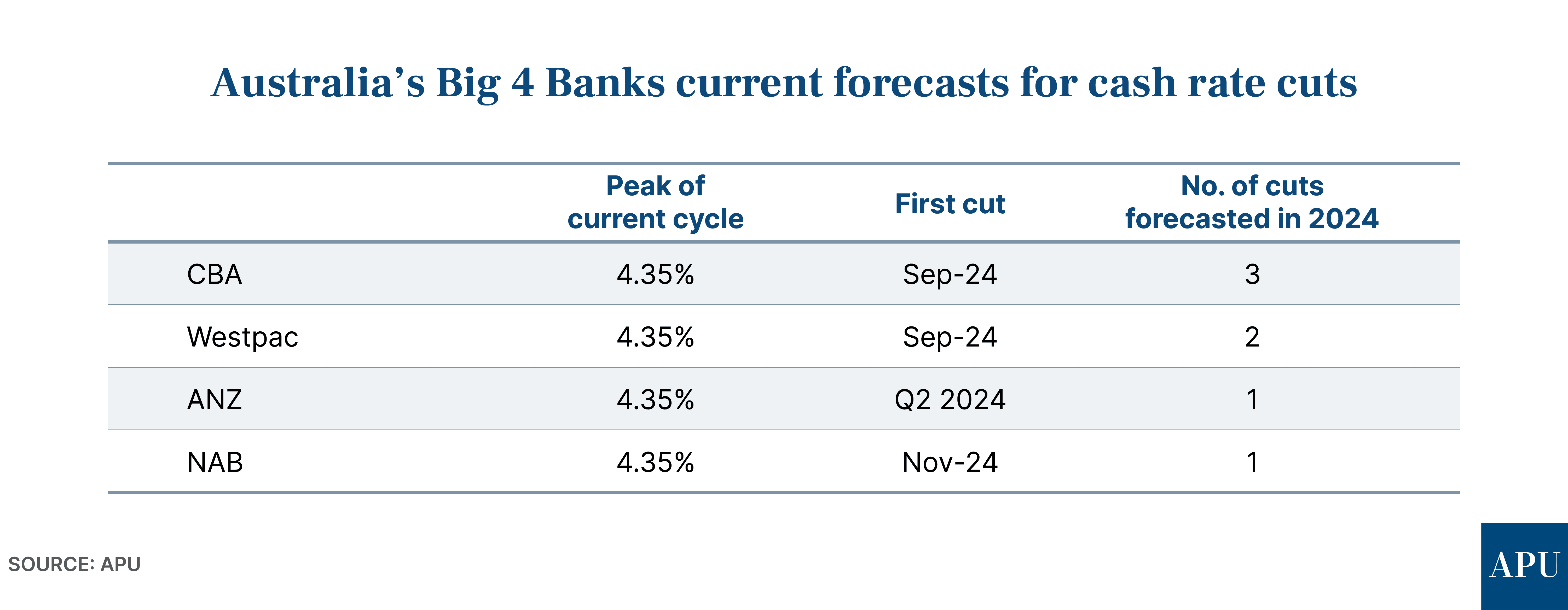

“The big bank economic teams believe the first cash rate cut will land in the second half of this year, but if you’ve got a mortgage, do not go betting your budget on it,” says Sally Tindall, RateCity.com.au’s Research Director

“The last thing the RBA wants is to cut the cash rate, only to watch inflation get away from it again and be forced to reverse the decision.”

Sally Tindall says homeowners struggling with high mortgage rates should put in place a six-point plan to survive continuing high interest rates.

She suggests:

- Refinancing your mortgage, potentially knocking hundreds of dollars off your monthly repayments

- Renegotiating energy, internet, and mobile phone plans

- Plan out a budget

- Get a second job

- Give up a vice

- Hit pause on gym memberships and roll out the yoga mat at home instead

The good news

The good news for struggling homeowners exercising on yoga mats instead of at the gym is that you may be paying a high variable interest rate on your mortgage, but the value of your home is still going up.

Despite plenty of evidence the Australian economy is slowing, amidst higher interest rates and a cost of living crisis, that slowdown doesn’t seem to be manifesting itself in the residential property market.

Virtually no homeowner in Australia will find themselves in negative equity - where the value of their mortgage is greater than the value of their home.

“The decision by the Reserve Bank to hold the cash rate steady in March will maintain both buyer and seller confidence,” says Eleanor Creagh, the Senior Economist at REA Group’s PropTrack.

“Looking ahead, the next move for interest rates is likely to be down.”

Ms Creagh says PropTrack’s Home Price Index showed national home prices hit a new record high in February, lifting 0.45%, the largest monthly rise since October 2023.

“Prices are expected to lift further in the months ahead, particularly while the expectation remains that interest rates will move lower in late 2024,” she says.

Rival number-crunchers CoreLogic agree with that assessment.

“Nationally, we have seen a reacceleration in the pace of value growth through the first two months of the year, which could reflect renewed optimism amid a peak in the rate hiking cycle and progress towards the inflation target,” says CoreLogic’s Research Director, Tim Lawless.

He says CoreLogic’s Home Value Index points towards further growth in housing values, with each of the five largest capital cities recording a rise in dwelling values through March.

Both research houses believe any cut in interest rates this year will see even more confidence return to the property market.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)