Features > Property News & Insights > Market updates

Rates on hold at 4.35%, but home price growth is unstoppable

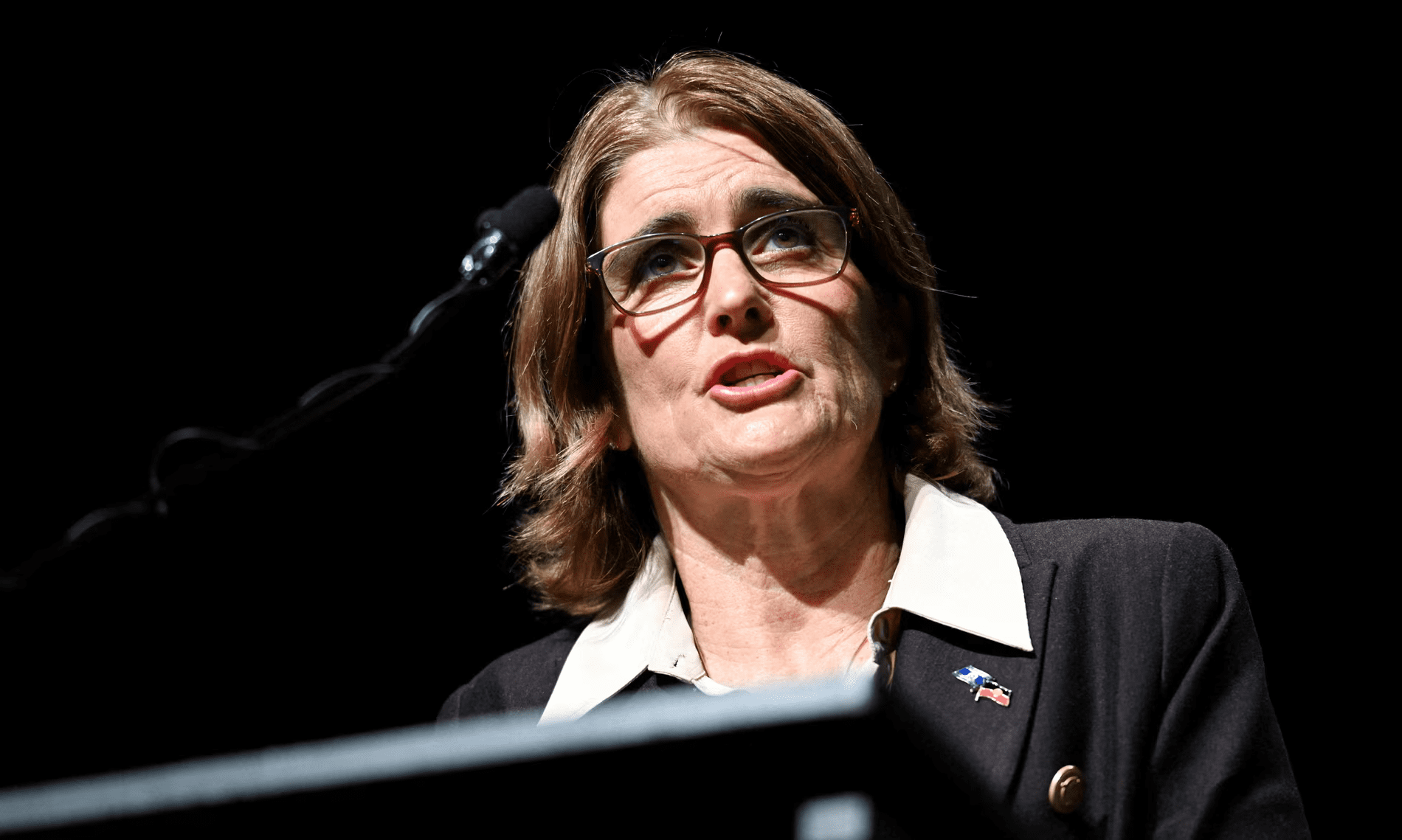

Image from ANU/TRACEY NEARMY/Reuters

KEY POINTS

- The Reserve Bank of Australia has kept the cash rate on hold at 4.35% at its May monetary policy board meeting, as widely expected

- However, the RBA Governor Michele Bullock says the board did consider raising interest rates for a 14th time

- The RBA has also wound back its own forecasts for the rate at which inflation will come back to the central bank’s target range of 2-3%

- Even though there is unlikely to be any early relief for mortgage holders, property analysts believe home prices will continue to grow.

The Board of the Reserve Bank of Australia (RBA) has decided to keep the cash rate on hold at 4.35% at its May meeting.

In a statement accompanying the decision, the board says inflation is slowing “but is declining more slowly than expected”.

The decision was widely expected, although a small number of economists and market traders had flagged an outside chance that the RBA may raise rates again in May, after recent higher than expected inflation figures.

However, the Reserve Bank Governor Michele Bullock says the RBA board did actively consider raising interest rates again to bring inflation down faster but decided against it.

The details

The RBA has raised rates no less than 13 times since May 2022 as it seeks to get Australia’s runaway inflation rate back down into its 2-3% target band by its self-declared timetable of the end of next year.

Annualised inflation peaked in December 2022 at 7.8%, and while it was down to 3.6% at the end of March 2024, that was still higher than the RBA had forecast.

In the statement accompanying the latest rates decision, the board indicated it is still worried about the pace of so-called “services inflation” - the cost of things like visits to the dentist, the hairdresser and dining out.

“It (services inflation) is expected to ease more slowly than previously forecast, reflecting stronger labour market conditions including a more gradual increase in the unemployment rate and the broader underutilisation rate,” the board says.

AMP Chief Economist Shane Oliver says the statement indicates the RBA believes the “jobs market is still too tight and inflation is moderating more slowly than expected.”

He says the RBA “reiterated it’s ‘not ruling anything in or out’, but the language is more hawkish”, indicating the RBA has “little tolerance for another upside inflation surprise.”

With that “little tolerance” line, Shane Oliver is indicating that the RBA seems more prepared than it was at its last meeting to raise interest rates again if it has to.

When economists like Dr Oliver looked through the minutes of the RBA’s last meeting in March, they were surprised to find that the board had not actively considered a rate rise.

However, this time there’s no doubt a rate rise was a live option.

“The board did discuss the option of raising interest rates,” RBA Governor Michele Bullock told journalists.

“There was a discussion about it, but the board decided on balance to stay where it was.”

“On balance, the board felt that at the moment, staying where they are was appropriate.”

“We think that policy is currently restrictive,” Ms. Bullock said.

“That doesn't rule out that we might have to raise rates, but it doesn't mean we will have to raise rates.”

Warren Hogan, the Chief Economic Advisor to Judo Bank, has predicted the RBA will need to raise rates at least three more times this year to get inflation back to target in time.

“They're saying inflation is going to be very slow to get down, their patience has been tested, and there are upside risks to inflation,” he says.

“There's a bit of language there that suggests that they're moving towards a rate hike, but I wouldn't expect to see it until maybe August if, indeed, the economy proves to be resilient enough and inflation sticky enough to justify.”

However, Australia’s largest bank, the Commonwealth, says it sees no immediate case for a rate rise.

“Our base case sees the RBA on hold until the November Board meeting when we expect the RBA to commence an easing cycle,” says the CBA’s Head of Australian Economics, Gareth Aird.

What the decision mean for housing

The RBA governor acknowledged that keeping interest rates high was causing pain for Australians with a mortgage—but not all.

“In fact, some of those with mortgages are still making extra payments into offset and redraw accounts on top of their required payments,” she said.

Meanwhile, home prices have continued to climb since early last year, despite higher and higher interest rates.

PropTrack Senior Economist Eleanor Creagh expects that will continue.

“Property prices are expected to lift further this year, with housing demand buoyed by population growth, tight rental markets, resilient labour market conditions and home equity gains supporting upgrade activity,” she says.

“Further, falling inflation and tax cuts (from July 1st) will support real incomes and household spending over the second half of this year.”

However, she says it’s possible that the pace of home price growth will slow.

“It is reasonable to expect a slowing from here as we move into a seasonally quieter (winter) period for property markets,” she says, “especially with interest rate cut expectations pushed back.”

CoreLogic’s Research Director, Tim Lawless, doesn’t seem so sure that home price growth will slow down.

“The upward pressure on housing prices may seem surprising at face value, given the high cost of debt, stretched affordability and low sentiment,” he says, “but housing remains in short supply while demonstrated demand is continuing to track higher than a year ago and above the decade average for this time of the year.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)