KEY POINTS

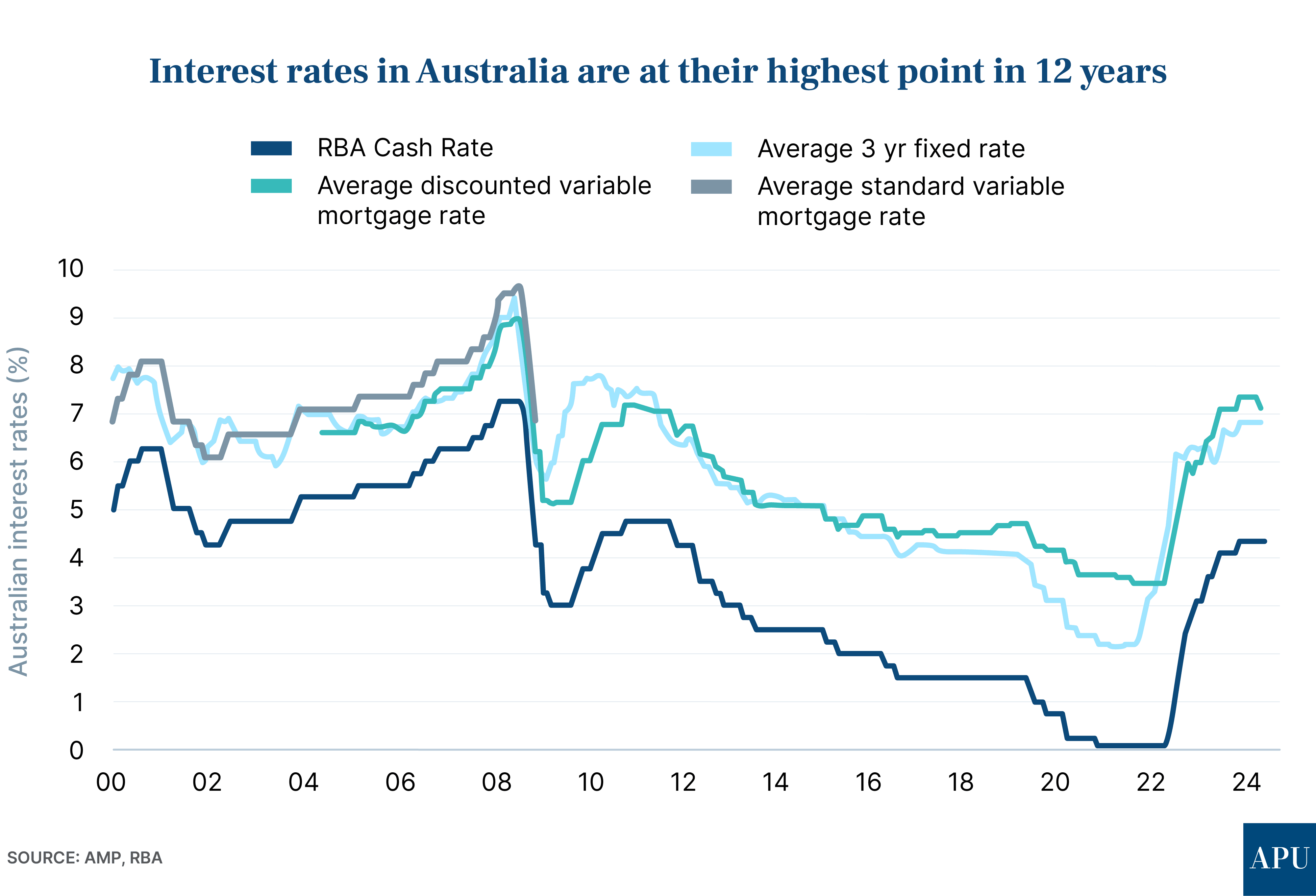

- Money markets are once again pricing in interest rate cuts in Australia after an inflation scare caused them to start betting that the RBA’s next move would be a rate hike

- Economists say weak Australian economic data still points to the central bank starting to cut interest rates later this year

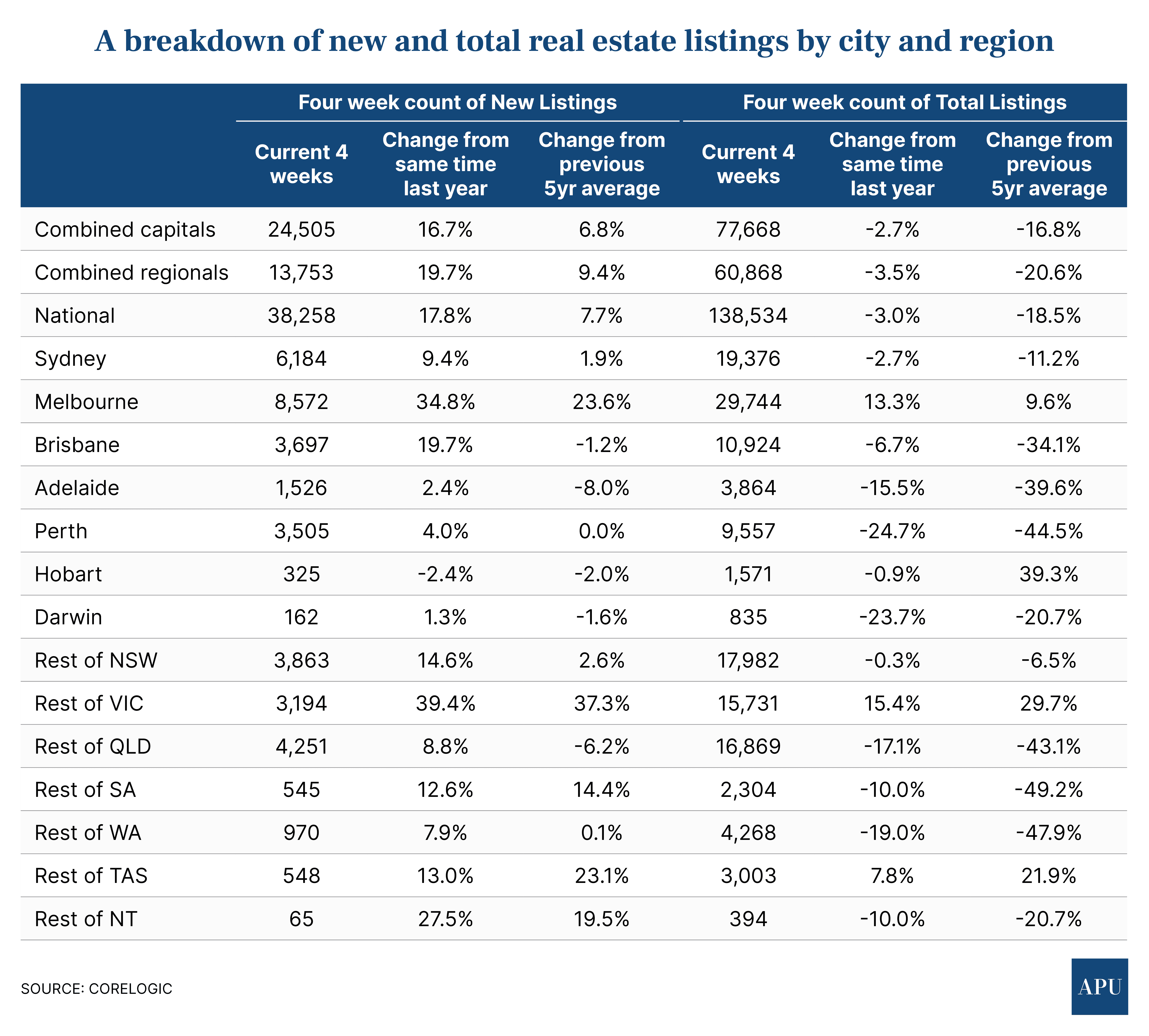

- There’s been an above-average number of new real estate listings coming onto the market over the last four weeks, according to CoreLogic

- However, the data analytics firm says that most regions are showing enough buyer demand to absorb the higher-than-average flow of new listings - indicating that vendor discounting is unlikely in most markets, keeping a floor under home prices

There’s renewed hope of interest rate cuts in Australia starting later this year, following several positive signals from the US Federal Reserve and the release of the minutes of the Reserve Bank of Australia’s (RBA) last monetary policy meeting.

It comes as vendor and buyer activity in the real estate market is defying continued high mortgage rates and the usual slowdown during the cooler months.

Although more properties are coming onto the market to be listed for sale, strong buyer demand in most markets points towards continued home price growth.

Interest rates

Fears of a renewed inflation breakout in Western economies, including in the US and Australia, appear to have subsided over the past two weeks.

After higher-than-expected March quarter inflation data in both countries, money markets pushed back their timetable for expected rate cuts in the United States and even began pricing in further interest rate hikes here in Australia.

But softer inflation data for April in the United States and signs of weak economic growth in Australia have seen a reassessment.

AMP’s Chief Economist Shane Oliver puts it this way:

“The last two weeks have seen money markets become dovish again with two cuts priced in by year-end for the US and one partly priced in for Australia.

“The renewed dovishness reflects better April inflation in the US, a less hawkish than feared Fed, a less hawkish than feared RBA, the Budget being seen as neutral, and softer data for local wages and jobs,” he says.

The minutes from the RBA’s May meeting—where the board decided to keep the cash rate on hold at the 12-year high of 4.35%—confirmed that a possible interest rate hike was discussed.

“Ultimately, the stronger case was to leave the cash rate on hold,” says Commonwealth Bank Senior Economist Belinda Allen.

“The Minutes highlight the Board is reluctant to ‘fine tune’ policy, so the hurdle to hike again seems high,” she says.

Ms Allen says the CBA’s “base case” is still that the RBA will begin cutting the cash rate in November 2024.

AMP’s Shane Oliver agrees.

“While the near-term risks for the RBA cash rate are probably on the upside, the most likely scenario is that the RBA holds rates ahead of rate cuts starting later this year.

“Australian economic growth is very weak, the labour market is cooling, and the effective rise in interest rates in Australia has been more than in comparable countries, resulting in far more pain for Australian households than their counterparts in other comparable countries,” he says.

That last bit is a sentiment many Australian mortgage holders would wholeheartedly agree with.

Muted winter slowdown

The cooler months of late Autumn and Winter traditionally see a marked slowdown in activity in the Australian real estate market, but that’s not the case this year.

According to CoreLogic, 38,258 newly advertised properties came onto the market around the country in the last four weeks, almost 18% more than at the same time last year and 7.7% above the previous five-year average.

Corelogic’s Head of Research, Tim Lawless, says the reasons for the higher-than-average number of new listings vary around the country.

“In strong markets like Perth, Adelaide and Brisbane, sellers may feel incentivised by market conditions that remain skewed towards vendors, while in softer markets, where overall stock levels are elevated, it is buyers who generally hold the upper hand,” he says.

Hobart is the only capital city where there are fewer new listings than a year ago.

CoreLogic says Melbourne (up 34.8% on a year ago) and Regional Victoria (up 39.4%) recorded the largest jump in vendor activity.

“The larger rise in new listings across Victoria could be related to a combination of factors including high property taxes, alongside a rising element of financial stress as high interest rates and cost of living pressures bite.”

The key here is that CoreLogic says that most regions are showing enough buyer demand to absorb the higher-than-average flow of new listings coming to market.

In other words, strong demand is set to support continued home price growth, as vendors are unlikely to discount when there are plenty of buyers.

As Tim Lawless points out, despite the higher-than-average trend in new listings nationally, the total number of homes advertised for sale is actually holding relatively flat.

The total number of homes for sale is actually 3.0% lower than a year ago and almost 19% below the previous five-year average.

“Advertised stock levels remain extremely low in some markets, especially across Western Australia, South Australia and Queensland, where total listings are more than 34% below the previous five-year average,” Mr Lawless says.

“Unsurprisingly, these regions are leading value gains nationally, as buyers compete for a small pool of available properties.”

However, total listings are higher than average in some markets.

The total number of advertised properties is sitting above the previous five-year average in Melbourne (9.6%), Hobart (39.3%), Regional Victoria (29.7%) and Regional Tasmania (21.9%).

“Given the higher stock levels and generally soft selling conditions, these regions have generally seen softer value growth,” Mr Lawless says.

CoreLogic’s latest Home Price Index showed national home values rose 0.6% in April (2.2% since the start of 2024), largely because of what the data analytics firm said was “low supply trumping high interest rates and inflation.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)