Features > Property News & Insights > Housing Trends

The Housing Crisis in Australia: Alan Kohler's Solution and its Challenges

Image from Papua New Guinea Investment Conference

Alan Kohler is one of Australia’s finest financial and business journalists.

In a long career, he’s been the editor of both The Age and The Australian Financial Review, founded the business publication “Eureka Report” and has written columns for The New Daily, The Australian and The Sydney Morning Herald.

You can see him most nights as the finance presenter on ABC TV News.

The great thing about Alan Kohler’s work is that he has an uncanny knack for making dry subjects like business and economics interesting and relatable.

For example, a recent clip from ABC of him explaining the disparity in wealth between Baby Boomers and younger people went viral on social media, because his tongue-in-cheek last line, “So…sorry about that, kids!” summed up how people of his generation (Boomers) may well have wrecked things for those who have come after them.

Australia’s housing mess….

Alan Kohler recently turned his attention to the housing crisis gripping the country, penning a lengthy piece for the high-brow “Quarterly Essay”, which has been released this week.

“The Great Divide” explains the history of housing in Australia and how what was once seen as a basic part of the Australian story - being able to afford your own home - is now a far-off goal for many.

“Generations of young Australians are being held back financially by the cost of shelter, especially if they live somewhere near a CBD and especially in Sydney or Melbourne”, he writes.

Alan Kohler says the way “wealth is generated” has also changed.

“Education and hard work are no longer the main determinants of how wealthy you are; now it comes down to where you live and what sort of house you inherit from your parents.”

Where it really went wrong

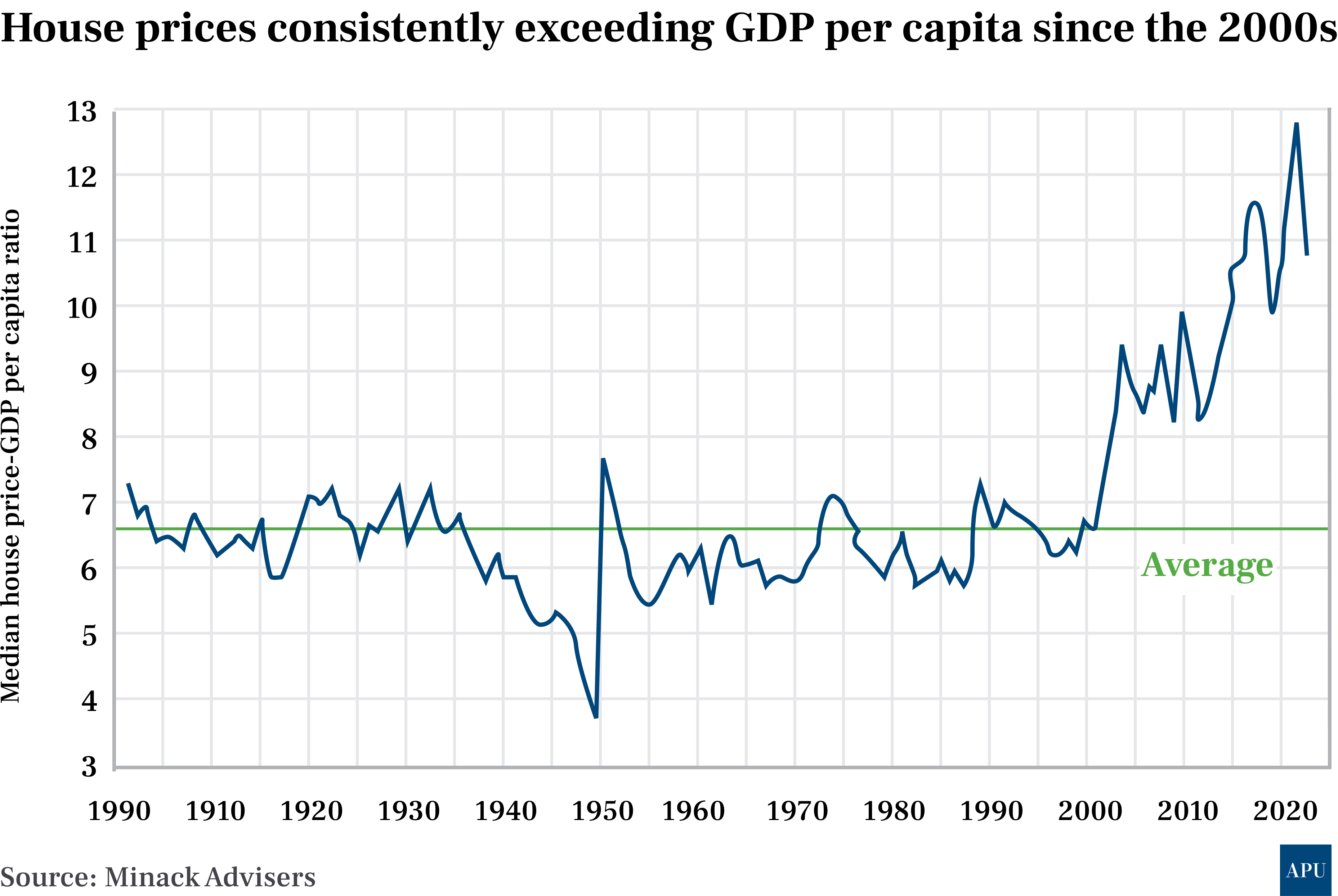

Alan Kohler’s thesis is that “the beginning of the end of affordable housing” in Australia happened around 2000.

“Before then, the median house price was 3.5 times average household income, and house prices had been increasing at roughly the same rate, on average, as both incomes and GDP or 3-4 per cent per annum.”

“In 2000, house prices went from increasing at roughly the same rate as both incomes and the economy, to double that rate, or an average of 6-7 per cent per annum, compound,” he writes in a summary of his Quarterly Essay piece in The New Daily.

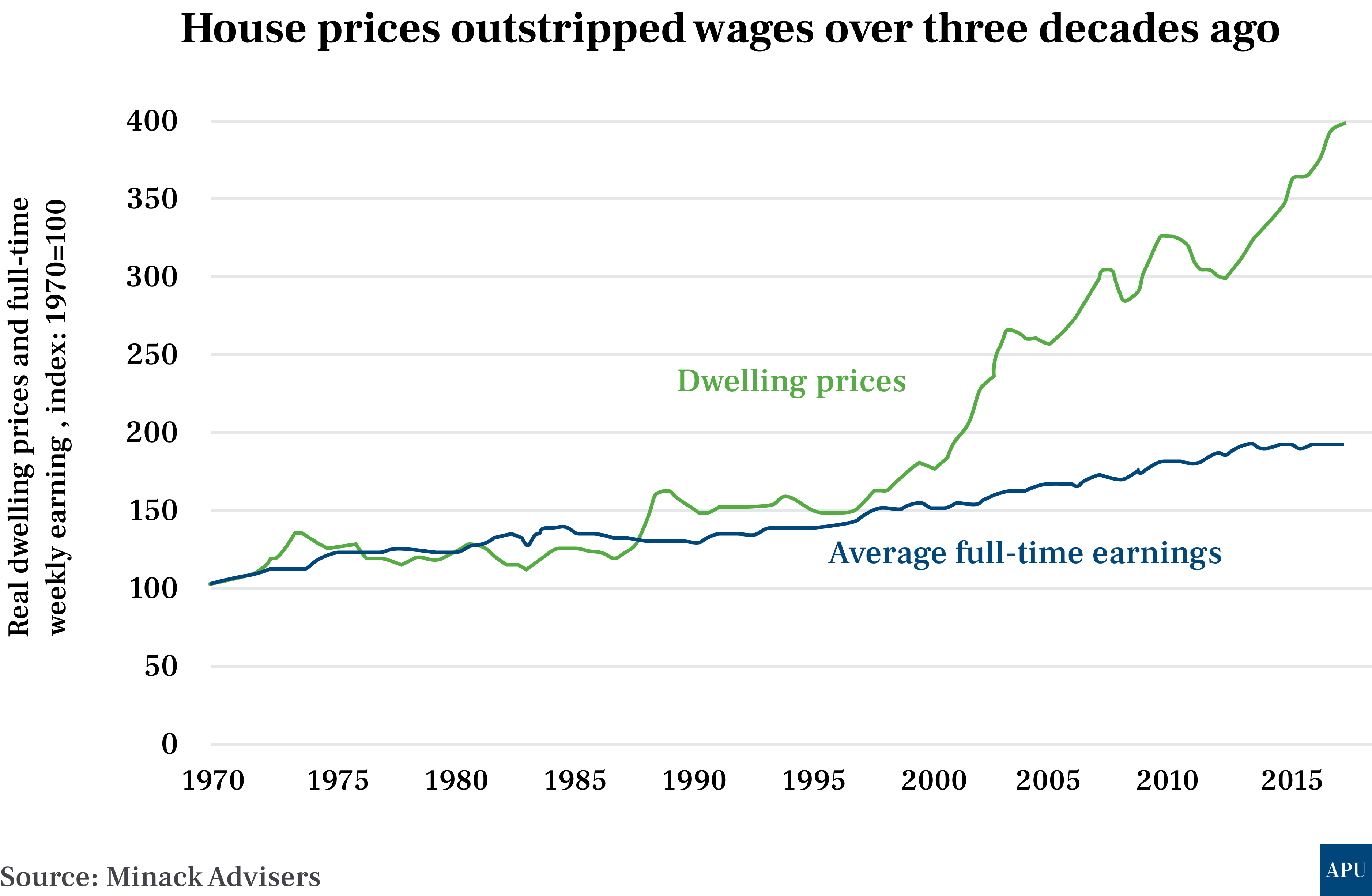

Alan Kohler says these two charts - one which tracks house prices and wages and one which tracks house prices and per capita GDP growth - clearly demonstrate when owning your own home started to become a distant dream for many Australians:

So what happened around the turn of the millennium?

Alan Kohler points to the decision in September 1999 by John Howard and Peter Costello to halve the rate of capital gains tax (CGT).

“The 50 per cent CGT discount supercharged the impact of negative gearing and led to investment property becoming everyone’s tax dodge,” he says.

Capital gains tax (CGT) is the tax paid on profits after disposing of investment assets, NOT your own home.

There are various qualifications around the length of time you hold an asset and whether you are an Australian resident for tax purposes, but basically, the 50% CGT discount scheme works like this:

“Justin, an Australian resident, buys a block of land. He owns it for 18 months and sells it, making a profit of $10,000. He has no capital losses.

Justin is entitled to the 50% CGT discount for the land. He will declare a capital gain of $5,000 in his tax return.”

That’s an example straight from the Australian Tax Office, by the way.

Basically, Justin doesn’t pay any tax on half of the profit he made from the block of land.

…And how to fix it

Alan Kohler argues that for housing to become affordable again in Australia, we have to get the lines on his two graphs back to the point where they roughly track each other again, not diverge more and more.

In other words, median house prices need to fall back to being in the 3 to 4 times average annual household income range.

To make a start on this, Alan Kohler says Anthony Albanese’s Labor government must go to the next election with a platform to halve the 50% CGT discount and limit negative gearing (where your rental return is less than your interest repayments and other expenses) to new homes only.

Basically, this would be a rerun of the housing policies that Bill Shorten took to the 2016 and 2019 elections.

Mr Shorten lost both elections.

But that doesn’t deter Alan Kohler.

“No government has more political capital than in its first term. It is one of Australia’s most important national assets and must be spent wisely for the good of all.”

“John Howard spent his on the GST, by going into his first election as PM in 1998 with that as his policy. He won, just, but the tax base was broadened,” he writes.

Good luck with that…

I agree with a lot of Alan Kohler’s analysis of the housing crisis and that it’s not good for our society, but that’s where we part company.

Ironically, the CGT discount introduced by Howard and Costello in 1999 was not aimed at making life easier for property investors.

It was originally a proposal put forward to the government by a group of leading business figures, designed to get more people to invest in the share market.

Australians, however, are sensible.

They know what a casino the stock market can be.

People who had money to invest looked around and saw the overwhelming way their family and friends had made any wealth through residential property, and so they set about emulating that.

The year 2000 was also when former New South Wales Premier Bob Carr famously declared that “Sydney was full”.

The comment signalled the start of a period of turbo-charged NIMBYism by state and local governments around Australia.

Former Reserve Bank Economist Tony Richards, in an article by the Australian Financial Review, has calculated that 1.3 million more homes could have been built between 2001 and 2021, had it not been for costly zoning, planning and building red tape imposed by local councils.

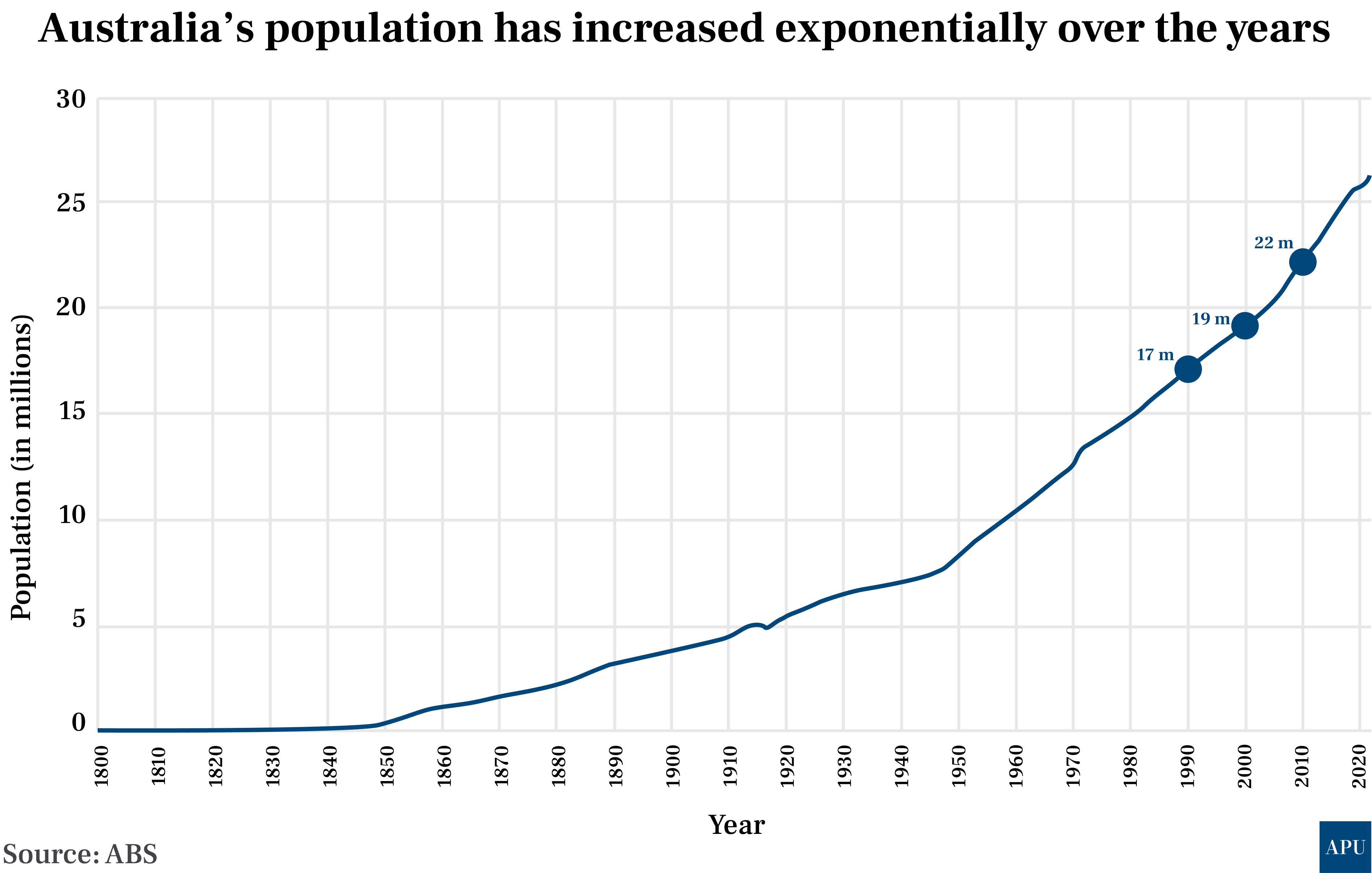

That’s an extraordinary missing number of homes, at a time when the population started growing faster.

Between 1990 and 2000, 2.03 million people were added to the population.

But over the next decade, the population grew by 3.16 million.

So more people, less homes being built.

That equals higher prices for available homes.

This also coincides with state governments waving the white flag on what’s meant to be one of their main roles - providing adequate public housing for the less well-off in society.

According to leading economist Saul Eslake, an average of 12,379 new public housing dwellings were completed yearly from the mid-1970s to the early 1990s, but this dropped to less than 6,000 annually until the late 90s, when it further plummeted to 4000 a year.

Political capital

Finally, what about Alan Kohler’s argument that first-term governments must spend their “political capital” on big reform - no matter the cost?

He ignores the fact that the Albanese government has, in fact, already spent its first-term political capital.

It was spent on trying to get an indigenous Voice to Parliament enshrined in the constitution.

That failed.

His call for the Federal government to be bold and champion causes that have already proved to be unpopular twice at the ballot box came on the same day that Newspoll showed the Coalition had finally worn down Labor’s lead in the polls - with both sides of politics tied at 50/50 on the two-party preferred vote.

Realpolitik suggests touching negative gearing or the CGT tax discount is now well and truly off the political agenda.

So…sorry about that, Alan Kohler!

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20154.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20Cost%20of%20Living%20Crisis%20Has%20Reached%20a%20Breaking%20Point%20(Millions%20Will%20Be%20Homeless)%20Scott%20Kuru%20DPU%20154.jpg)

%20Scott%20Kuru%20DPU%20153.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Exposes%20Australia%E2%80%99s%20Oil%20Crisis%20Far%20Worse%20Than%20Expected%20($50%20Billion%20Lost)%20Scott%20Kuru%20DPU%20153.jpg)

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)