Features > Property News & Insights > Investment News

Housing shortage to continue driving prices in 2025

KEY POINTS

- REA Group’s PropTrack says national dwelling prices will rise between 1% and 4% in 2025, down from 5.5% in 2024

- The slower growth is driven by high interest rates, an increase in properties being listed for sale, and the anticipation of rate cuts in mid-2025

- The supply of new properties is expected to remain limited in 2025 due to cost pressures, helping to maintain a “floor” under prices amid high population growth

The company behind Australia’s top real estate search website - realestate.com.au - and the PropTrack data analytics business says it expects residential property prices to continue to increase in 2025, although it predicts growth will be slower than in 2024.

The forecasts are contained in PropTrack’s latest Property Market Outlook publication.

A key theme of the Market Outlook report is that low housing construction rates, in the face of strong population growth and smaller households, will continue.

This is a scenario which should keep supporting property price growth.

The details

PropTrack says the current rate of home price growth is slowing.

When combined with the fact that interest rates are expected to remain higher for longer, along with more properties coming to market for sale, PropTrack’s Director of Economic Research, Cameron Kusher, says, “It appears 2025 is set for weaker price growth than over recent years.

“With interest rate relief for households now anticipated closer to mid-2025, combined with fewer expected rate cuts overall, we anticipate price growth will slow further in 2025.”

Since the Property Market Outlook was published, markets have priced in an 80% chance of a rate cut in February 2025.

Mr Kusher points to the upcoming federal election, which must be held before the end of May 2025.

“Housing activity typically slows in the lead-up (to elections)," he says, “so, this could contribute to a slower than normal housing market early in 2025.”

Across 2025, PropTrack is forecasting national home prices to grow between 1 and 4%, down from 5.5% in 2024.

Once again Perth, Adelaide and Brisbane are predicted to be the strongest markets.

Perth, which recorded extraordinary price growth of 18.7% in 2024, will see growth moderate to between 3 and 6%.

PropTrack is forecasting the same magnitude of growth for Adelaide which saw prices rise by a stellar 14.6% in 2024.

Brisbane’s price growth is predicted to moderate to between 2 and 5%, after a very strong 12.6% last year.

Sydney - which surprised many pundits in 2024 by continuing to grow at a steady 4.6% - is tipped to see slower growth of between 1 and 4%.

Melbourne, which recorded a price slide of 1.6% in 2024, is predicted to be largely in a holding pattern in 2025, with PropTrack forecasting the Victorian capital will see -1 to +2% growth.

PropTrack also forecasts Canberra, Hobart and Darwin will tread water in 2025, forecasting growth of 0 to 3% in all three cities.

Slow pace of new housing delivery

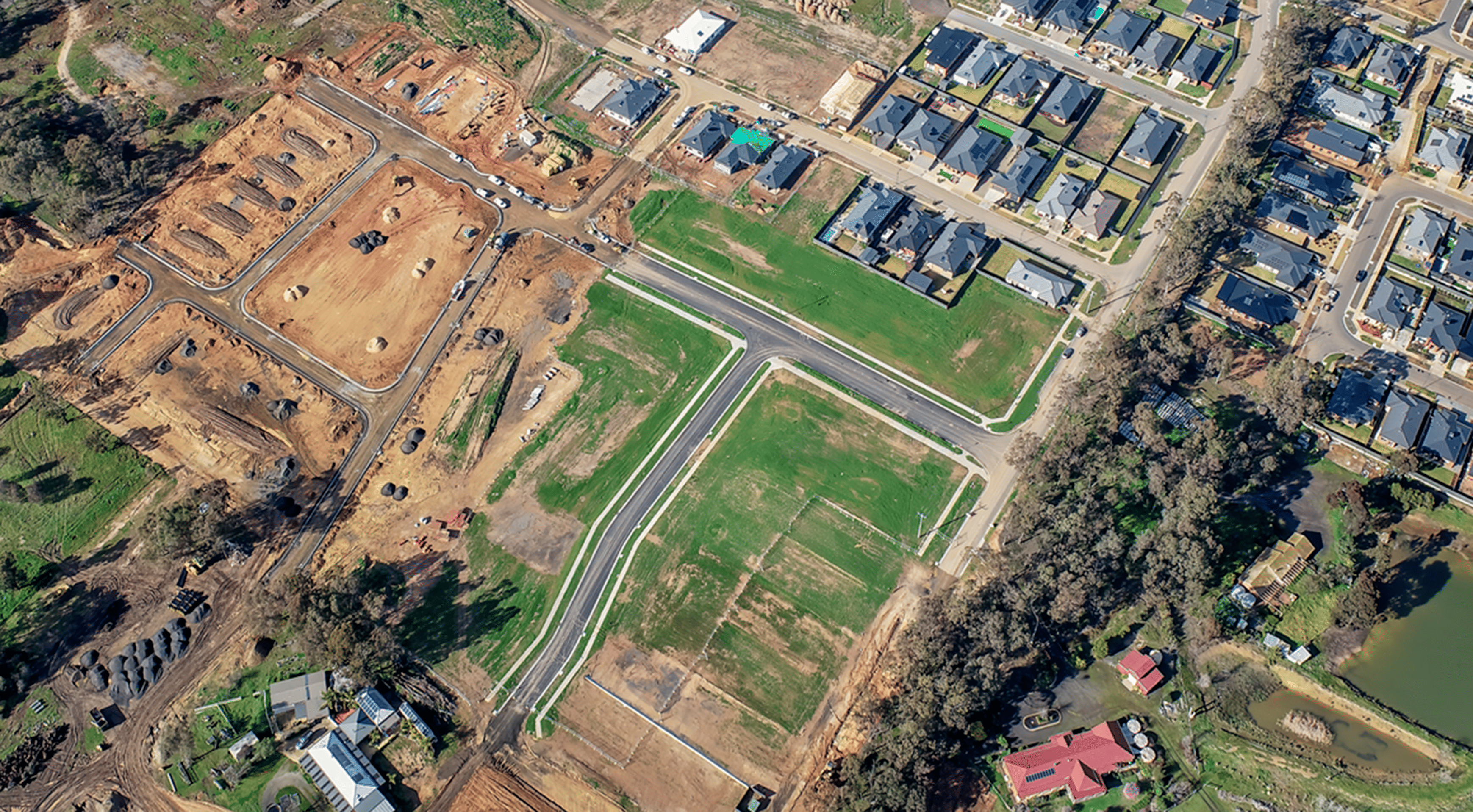

A key aspect of the PropTrack report is the emphasis on the slow pace of new housing to meet a growing population.

“The significant cost of constructing new properties means there is a price premium for new properties compared to existing,” PropTrack’s Cameron Kusher says.

“In turn, buyers are preferencing existing properties which is resulting in less new housing being built and the overall shortage of housing stock being exacerbated.

“What is being built is smaller, such as new houses on smaller lot sizes on the outskirts of our cities, or larger and more expensive units targeting higher wealth owner occupiers and/or downsizers.

“The surge in construction costs is expected to keep new construction activity constrained in 2025,” he says.

“Persistent shortages of labour and higher interest rates are likely to make reaching presale targets more difficult and finance for new construction more expensive to obtain.”

Mr Kusher says these supply difficulties are being magnified by the fact that the population continues to expand rapidly, largely due to the rapid rate of net overseas migration.

“Over the 12 months to March 2024, Australia’s population increased by 2.3% (or 615,254 persons) with 82.9% (or 509,754 persons) of the total increase coming from net overseas migration.

“We expect elevated levels of migration to continue.”

This is despite pledges by the Federal government to slow immigration to help ease the housing crisis.

Indeed, the latest mid-year budget update, released by Treasurer Jim Chalmers in the lead-up to Christmas, shows the Albanese government now expects net overseas migration of 340,000 in the 2024-25 year, a whopping 31% increase on the 260,000 forecast in May.

This slow pace of new housing delivery in the face of stronger-than-expected migration is set to help keep a floor under home prices for the foreseeable future, despite more new stock coming onto the market.

Forecasts are just best guesses

PropTrack’s Property Market Outlook makes an interesting read, but, at the end of the day, REA Group’s forecasts are just best guesses, made with the information available at the time of going to print.

Director of Research, Cameron Kusher, is frank about the accuracy of previous PropTrack forecasts.

“At the end of 2023, we forecast prices would rise between 1% and 4% for the 2024 calendar year – a more significant slowing than what has occurred.

“While our forecasts for Sydney, Hobart, Darwin and Canberra were accurate, Melbourne price growth has been weaker than forecast and price growth in Brisbane, Adelaide and Perth, which was already strong, has remained much stronger than forecast.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20(1).png)

.png)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)