Features > Property News & Insights > Market updates

Finder.com’s best and worst investment suburbs revealed

KEY POINTS

- Finder.com’s latest list of best suburbs for investors is heavily skewed towards established areas in the inner and middle-ring of our major cities

- The comparison website’s Property Investment Index uses a different methodology than many other price growth prediction models, awarding points for location, income levels, market demand and other metrics

Comparison website Finder.com has just unveiled its latest list of the best and worst suburbs to invest in across Australia, with the inner and middle ring suburbs of our major cities scoring particularly well.

Finder’s Property Investment Index is an unusual model for predicting potential property price growth, in that it doesn’t consider metrics like rental yields, relative affordability or give a lot of weight to past suburb performance.

Nevertheless, it’s another piece of investment advice worth considering.

So, let’s look at Finders' recommendations for Australia’s three largest property markets: Sydney, Melbourne, and Brisbane.

Methodology

Finder’s Property Investment index uses a weighted range of data inputs (see the chart above) to produce a score out of 100, with 100 indicating very high predicted price growth and 0 indicating very low or negative predicted growth.

An additional 15 points are also awarded to suburbs that have had at least one property sale over the past 12 months.

Finder.com’s Head of Consumer Research, Graham Cooke, says the index is “intended to be an indicator of relative price growth, rather than of property prices themselves.

“A high score does not necessarily mean that a suburb will have the highest house prices but that we can expect strong growth in that area.”

Sydney

Inner-city Zetland and Alexandria top the Finder’s list when it comes to potential house price growth in Sydney.

Both suburbs, within 5kms of the CBD, also have median house prices above the $2,000,000 mark.

If you are looking for affordability in a house investment (basically anything under $1,000,000), Finder says you’ll have to look much further, suggesting Berkeley Vale and Hamlyn Terrace on the Central Coast.

Carramar near Fairfield and Appin on the city’s southwestern outskirts are the two lowest-ranked suburbs for house investment prospects.

Unsurprisingly, there’s much more choice when it comes to affordability for good unit investments in Sydney.

Erskineville (median unit price $1,050,000), North Narrabeen ($1,700,000) and Cammeray ($1,376,000) top the index, but for those looking under the $1 million mark, Finder rates inner city Centennial Park ($900,000) and Monterey ($920,000) near Sydney Airport highly.

St. Marys and Holroyd in western Sydney are best avoided for unit investments.

Melbourne

Dwelling price growth has been subdued in Melbourne since the pandemic, but Finder.com believes some suburbs “still have more comparative investment potential than others”.

Topping its house investment category is Brunswick East, just 6 km and a short tram ride from the CBD with a score of 90.0/100.

The tiny suburb of Seaholme, sandwiched between Altona and Williamstown on Hobson’s Bay comes in second with inner city Coburg North third.

Garfield on Melbourne’s eastern fringe and Melton to Melbourne’s west don’t present great house investment potential, according to Finder.

When it comes to units, Finder thinks Hampton East, Albert Park, and Ripponlea—all in Melbourne’s inner southeast—present great potential, with inner-city Flemington (where the median unit price is $430,000) presenting good value for bargain hunters.

Melton South and Meadow Heights come last in Finder’s list of Melbourne unit investment hotspots.

Brisbane

Finder.com’s Head of Consumer Research, Graham Cooke, says data for Brisbane “shows investors are beginning to take on more of the market from owner-occupiers.”

“In January 2021, investor loans made up 24% of all home loans,” he says, “but that figure has now grown to 37%.”

So where should investors put their money in the Queensland capital?

According to Finder, Cannon Hill, with a score of 95.1 100, Dutton Park (92.6 100), and Camp Hill (92.1 100) are the top places for house investments in Brisbane.

All three suburbs lie on the south side of the Brisbane River and are within a 10-km radius of the CBD.

At the affordable end of the scale (less than $750,000), Finder suggests inner city Fortitude Valley (median house price $520,000) and Deebing Heights ($668,500) on the city’s southwestern fringe offer good investment potential.

Bannockburn in the outer southeast and Coominya near Wivenhoe Dam should be avoided, according to Finder.

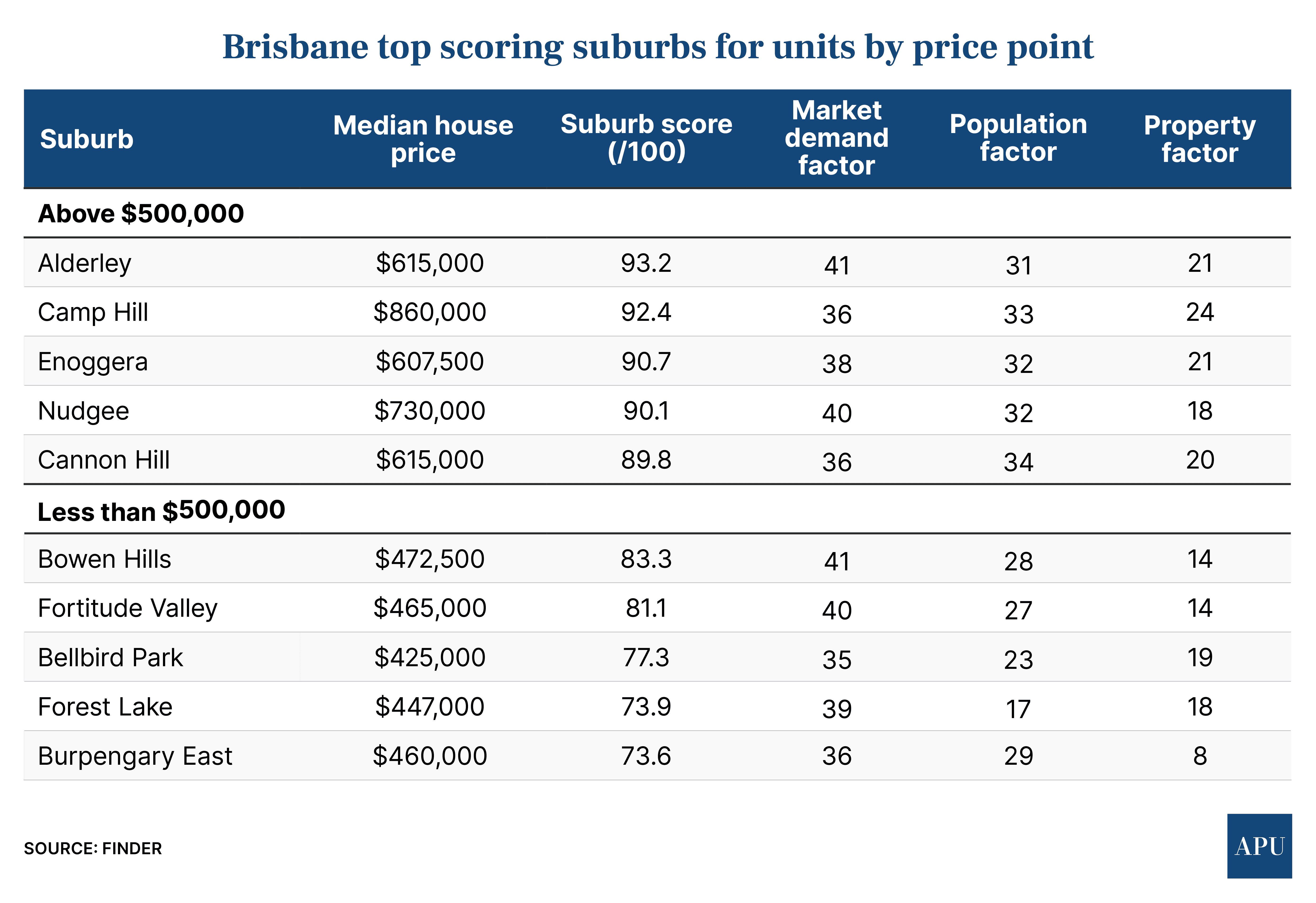

When it comes to units, Camp Hill (92.4/100) gets another honourable mention, coming in just behind Alderley (93.2/100) and Enoggera (90.7/100).

The latter two suburbs in Brisbane’s northwest are just over 10 km from the city and located near the giant Enoggera Army Base.

Kooralbyn near Beaudesert and Meadowbrook near Loganlea bring up the rear when it comes to the list of Finder’s Property Investment Index for units in the Brisbane area.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)