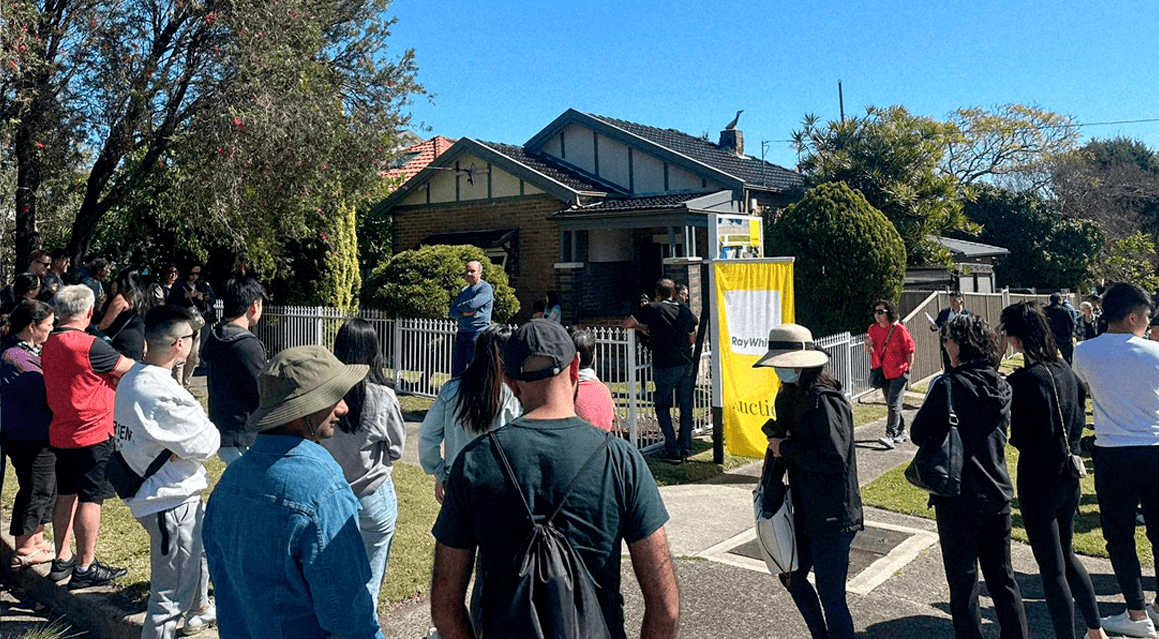

Image from Ray White

KEY POINTS

- Australia’s housing market is shifting structurally due to undersupply, demographic changes, and evolving living preferences—not just traditional price cycles

- This “super-cycle” will persist as supply lags demand, sustaining ongoing price growth and putting a floor under housing prices

- Growing demand for smaller dwellings and higher-density living presents opportunities for new housing types and improved construction processes

One of Australia’s leading housing economists argues Australia’s housing market is now in what she calls a “super-cycle”, driven by a persistent imbalance between supply and demand.

Nerida Conisbee, the Chief Economist at real estate chain Ray White, argues this “super cycle” is creating significant challenges - but also opportunities - for the future of housing in Australia.

Ms Conisbee says investment success in this environment requires understanding and adapting to these structural changes in the housing market, rather than simply waiting for the next price cycle.

The details

Ray White’s Nerida Conisbee says media headlines and even everyday conversations around property tend to focus on interest rates, house prices and market cycles.

She argues this misses the “bigger picture”.

“For decades, our housing market has been driven by much deeper forces: a persistent undersupply of homes, major demographic shifts, and fundamental changes in how and where Australians want to live,” she says.

“This isn't just another housing cycle - it's a super cycle that has been building for years, and it's now accelerating.”

The Ray White Chief Economist says that unlike regular housing cycles driven by interest rates or market sentiment, a “super cycle” is indicative of deep structural changes in the property market that create lasting imbalances between supply and demand.

In Australia, she says, this transformation is being driven by demographics, changing living preferences, and ongoing supply constraints.

To demonstrate these accelerating super cycle conditions, Ms Conisbee has used data provided by Neoval - Ray White’s in-house data provider - to look at the way dwelling price growth, particularly for houses, has risen sharply since 2019.

“Supply can't keep up with these changing needs,” Nerida Conisbee says.

“Last year, Australia completed 209,000 homes against a requirement for 220,000.

“A further problem is that the number of houses required every year is compounding as we continue to under-deliver.”

At the same time, Ms Conisbee points out that the building industry is struggling, with business failures, declining productivity, and escalating construction costs that are ballooning faster than home price growth.

“The industry as it stands can’t deliver the number of homes required consistently,” she says.

As well as tackling labour shortages, she says the industry needs to embrace new construction techniques to make it more efficient.

“This can include the use of modular construction, less customisation of homes, and alternative building materials,” she says.

However, Ms Conisbee says a key problem for the building industry is the fact that foreign investment in residential housing has hit a decade-low.

“This matters significantly,” Ms Conisbee says, “because the last time Australia came close to delivering 1.2 million homes over five years (the current government target) was during a period of record foreign investment.

“The fundamental question remains: where will the money come from to fund such ambitious housing delivery targets?”

Dwelling sizes

There’s also the question of appropriate housing for Australia’s population.

“Not only do we need more homes for more people, we are also spreading out more, and most of our homes have been built for big families, containing three or more bedrooms,” Nerida Conisbee says.

This comes at a time when the household type set to see the strongest growth is ‘single person’.

On average, Australian households are getting smaller.

However, Ms Consibee says the house type with the strongest growth currently has four bedrooms.

“This is leading to a lot of spare capacity in homes.

“Remarkably, 75.4% of couples without children live in homes with two or more spare bedrooms,” she says.

“This disconnect between household size and housing stock points to a deeper structural issue in the market.”

This preference for building larger dwellings at a time of shrinking household sizes means Australian cities face unique challenges.

“Compared to international cities like London and Singapore, where over 90% of dwellings are units, Australian cities remain predominantly low-density,” the Ray White Chief Economist says.

Nerida Conisbee points out that Melbourne and Sydney have just 34.6% and 46.2% units, respectively.

As demand grows for smaller properties, this will make it harder for these cities to meet changing housing needs efficiently.

Opportunities

While this housing “super-cycle” presents significant challenges, Ms Conisbee says there are also significant opportunities.

These include new housing types, improved construction processes and a trend toward less centralised population growth, “such as what we are seeing in northern New South Wales and south east Queensland.”

Although the move is slow, Nerida Conisbee says consumer preferences are gradually shifting from low to high-density living.

“Demographics are driving opportunities in single-person dwellings and multi-generational housing.”

The “super-cycle” is here to stay

The Ray White Chief economist says while there continues to be a big focus on monthly and yearly trends in house prices, “looking beyond traditional cycles is now more important.”

“While we'll continue to see market fluctuations, the underlying trends point to a persistent imbalance that will shape the market for years to come.”

This is underlined by the fact that the largest price drop in the last 20 years has been just 5% - demonstrating the residential property market's structural resilience.

“This isn't just another property boom - it's a fundamental reshaping of Australia's housing landscape,” Nerida Conisbee says.

“Success in this environment requires understanding and adapting to these deeper structural changes, rather than simply waiting for the next market cycle.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20157.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Has%20Noticed%20Yet)%20Scott%20Kuru%20DPU%20157.jpg)

%20Scott%20Kuru%20DPU%20156.jpg?width=1920&height=1080&name=BREAKING%20Do%20China%20and%20Japan%20Now%20Own%20Most%20of%20Australia%E2%80%99s%20Property%20Market%20(New%20Data%20Out)%20Scott%20Kuru%20DPU%20156.jpg)

%20Scott%20Kuru%20DPU%20154.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20Cost%20of%20Living%20Crisis%20Has%20Reached%20a%20Breaking%20Point%20(Millions%20Will%20Be%20Homeless)%20Scott%20Kuru%20DPU%20154.jpg)

%20Scott%20Kuru%20DPU%20153.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Exposes%20Australia%E2%80%99s%20Oil%20Crisis%20Far%20Worse%20Than%20Expected%20($50%20Billion%20Lost)%20Scott%20Kuru%20DPU%20153.jpg)

%20Scott%20Kuru%20DPU%20150.jpg?width=1920&height=1080&name=BREAKING%20Senate%20Hearing%20Proves%20They%20Deliberately%20Inflated%20House%20Prices%20(This%20Wasnt%20an%20Accident)%20Scott%20Kuru%20DPU%20150.jpg)

.jpg?width=1920&height=1080&name=WARNING%20Australia%E2%80%99s%20High%20Debt%20Levels%20Could%20Collapse%20the%20Economy%20-%20Are%20We%20Headed%20for%20Bankruptcy%20Scott%20Kuru%20DPU%20149%20(1).jpg)

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)