Features > Property News & Insights > Market updates

Why Hogan will not be a hero with his prediction

KEY POINTS

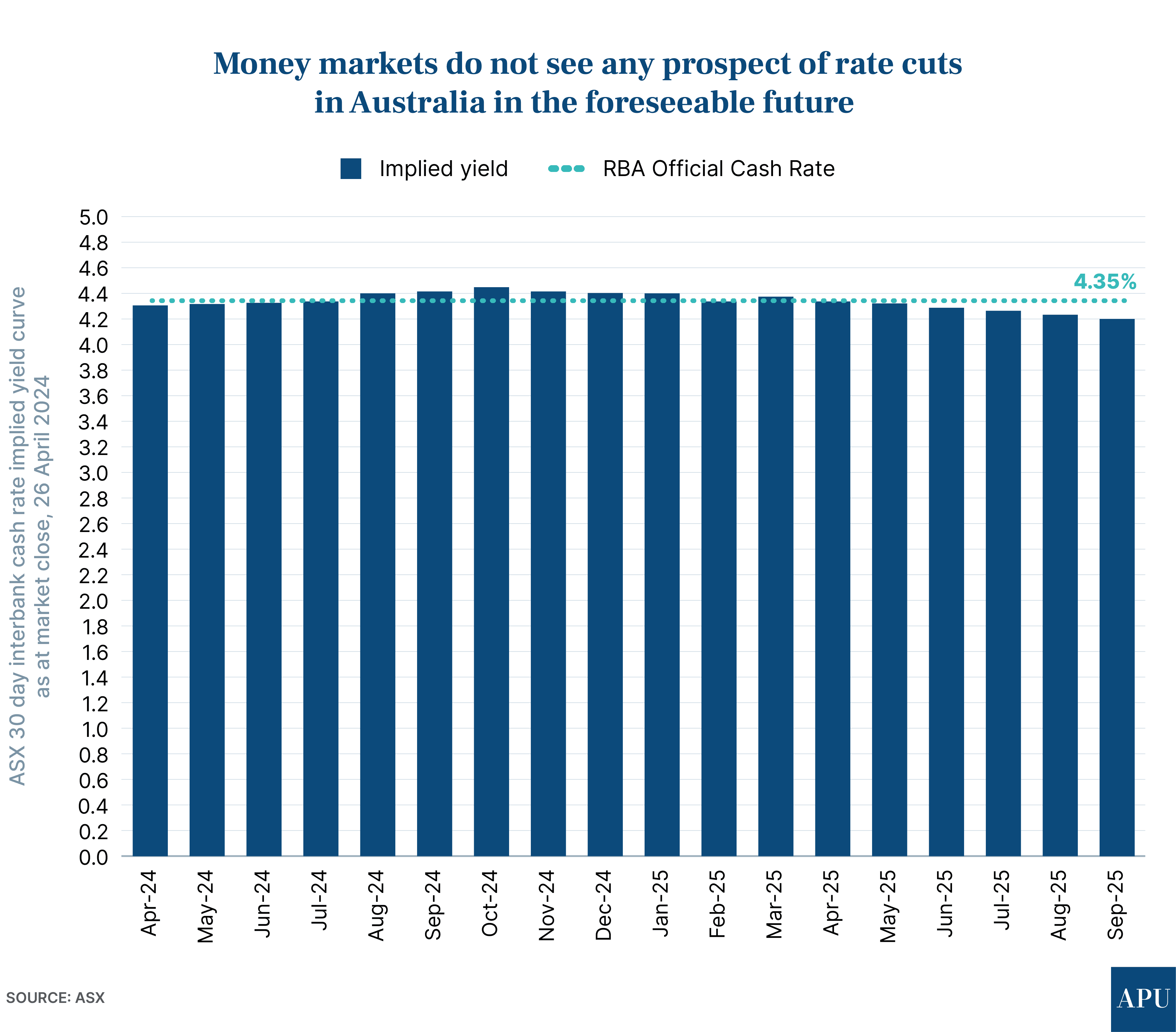

- Leading economist Warren Hogan believes the RBA will raise interest rates three more times before it is satisfied that inflation in Australia is under control

- Money markets do not believe interest rates in Australia will be cut any time soon and are pricing in the possibility that the next move in rates may be up

- Property market experts say the traditional link between home values and the RBA cash rate and the relationship between interest rates and buyers' borrowing capacity has been broken, so it’s unlikely home values will fall

Last week’s quarterly inflation figures were grim reading for Australians with a variable rate mortgage.

The fact that inflation came in above market expectations at an annualised 3.6% has dashed hopes of an early rate cut by the Reserve Bank of Australia (RBA).

Westpac Bank immediately pushed back its expectation of a rate cut in September to November, while ANZ said it would be reviewing its forecasts.

It’s even led some economists and a majority of financial market traders to predict the next move by the central bank will be up - not down - with one leading forecaster predicting no less than three more rate rises before the RBA finally has enough confidence to believe it has won the battle against inflation.

The RBA is mandated to return inflation in Australia to 2-3% - a target it says it will achieve by the end of 2025.

Warren Hogan says the central bank will raise rates at its August, September, and November monetary policy meetings this year by 25 basis points or 0.25% each time.

Three more increases of 0.25% would take the official cash rate (already at its highest level in 12 years) to 5.1%.

According to RateCity, that would mean an increase in repayments by $226 a month on a $500,000 mortgage, $317 for a $700,000 loan and $452 a month on a million-dollar debt.

Who is Warren Hogan, and why does what he says matter?

-09takAjzf-transformed.png?width=1240&height=826&name=image_(3)-09takAjzf-transformed.png)

Warren Hogan is currently the Chief Economic Advisor at Judo Bank, one of Australia’s fastest-growing tier 2 banks.

He’s also an economic and strategic advisor at financial institution Earnr and principal at his own firm, EQ Economics.

Before that, he spent twenty years in banking and financial markets, including stints as Chief Economist at ANZ Bank and Credit Suisse, Australia.

He’s worked for the Federal Treasury and the New South Wales government and was an Industry Professor at the University of Technology Sydney (UTS) Business School.

However, perhaps more appropriate, in this case, is his uncanny ability to predict moves by the RBA.

Last year, he picked all five of the RBA’s rate increases, helping him to win the Australian Financial Review's Top Cash Rate Forecaster and Top Economic Forecaster for 2023 award.

“I think the cash rate needs to get to five (percent),” he says.

“We're in a new, more inflationary world than we've seen for 30 years.”

“Unfortunately, a 4.35% cash rate probably isn't high enough to address that inflation, and most importantly, to get rid of it,” he says.

Referring to the “narrow path”—the idea that by being judicious with interest rate rises, the central bank can slow the economy and rid Australia of high inflation without crashing the economy and sending unemployment soaring—Warren Hogan says he thinks the concept is “still a viable one”.

“But,” he adds, “it does require the RBA to probably ‘tap’ on the brakes a couple more times.”

The only brake the central bank really has at its disposal is the ability to raise the cash rate.

Warren Hogan admits his grim prediction “will just really push some people to the edge.”

Warren Hogan is not alone

While the view that interest rates need to go up again to tame inflation in Australia is still a minority view among economists, Warren Hogan is by no means alone.

Abhijit Surya of Capital Economics believes the central bank will put rates up as early as its next policy meeting on the 7th of May.

Leading broker Alan Hemmings agrees.

While the CEO of Home Loan Experts says that headline inflation is coming down, “if you look at underlying inflation, there is a marked difference.”

“[Inflation] for goods is definitely down, but for services, which includes items like rent, it’s still sitting above 4 per cent,” Mr Hemmings told broker’s newsletter The Advisor.

He believes there could be up to two more rate rises over the next eight months.

“The (Stage 3) tax cuts in July will also put pressure on inflation,” he says, “as everyone will have more money to spend.”

Warren Hogan agrees.

“It's the last thing that the economy needs as we're trying to slow spending,” he says.

The markets

After the release of the above-expectation CPI figures last week, markets pushed out any chance of a rate cut by the RBA until well after May next year.

Around midday on Friday, the Australian Financial Review reported markets were factoring in “a 52% chance that Australia’s cash rate would climb from 4.35% to 4.6% by August.”

That seemed to ease back somewhat by the close of trade that afternoon.

Nevertheless, the bottom line is that the markets—who are betting millions of dollars on the RBA’s next move—do not believe rates in Australia are going down any time soon and are not ruling out the possibility that the central bank’s next move may be a rate hike.

What does this mean for the property market?

In a nutshell - not much.

With official interest rates at their highest level in 12 years and home values continuing to rise, it’s now clear the long-standing relationship between property prices and the RBA cash rate has broken down.

So, too has the long-standing relationship between borrowing capacity and interest rates.

“It almost defies logic,” Domain’s chief of research and economics, Dr Nicola Powell, recently told the Sydney Morning Herald, “if you’ve got slashed borrowing capacity and also the higher cost of debt in the face of high cost of living as well.”

“We’ve seen strong, strong rates of population growth run headfirst into an undersupply of housing and an extremely tight rental market.”

Jarden’s chief economist, Carlos Cacho, has another explanation.

“The average household is no longer able to afford the average home,” he says,” so what you’ve seen is home buyers are skewing much higher income and much higher wealth.”

“A lot of that would be intergenerational wealth transfer.”

Recent data from property settlement exchange platform PEXA also showed that nearly 30% of properties purchased in Victoria, New South Wales, and Queensland last year were bought outright with cash.

In other words, the so-called “Bank of Mum and Dad”, cashed-up buyers, high population growth and a chronic undersupply of homes appear set to continue to support higher property prices, no matter whether the RBA moves the cash rate up or down.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)