Features > Property News & Insights > Market updates

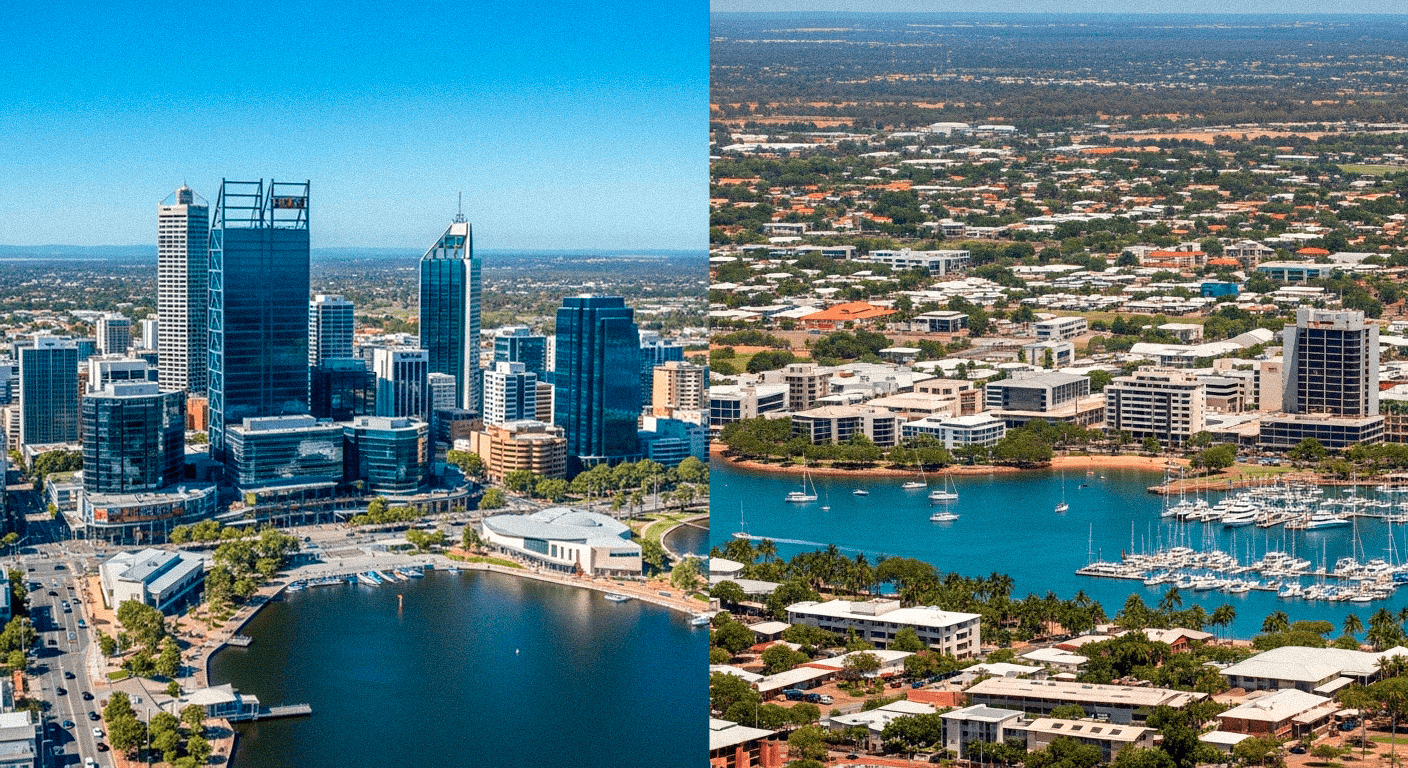

Solid price growth to be led by Perth and Darwin

KEY POINTS

- A leading property analyst projects Perth and Darwin to lead 2025-26 property growth with gains up to 11%, followed by Brisbane and Adelaide at up to 9%

- Cameron Kusher forecasts softer 2025-26 growth for Sydney (6–8%) and Melbourne (4–6%) amid high housing costs, excess listings, and local headwinds

- Overall, Mr Kusher expects national property values to rise up to 8%, driven by rate cuts, population growth, first-home buyer incentives, and tight housing supply, particularly in affordable and lifestyle-rich areas

One of Australia’s most respected property analysts has unveiled his price predictions for the next financial year, tipping solid growth across the nation.

Independent property economist Cameron Kusher expects Perth and Darwin to lead the charge with strong growth in the vicinity of 9% to 11%, with Brisbane and Adelaide also experiencing a significant 7% - 9% uplift.

Sydney and Melbourne are expected to see more modest growth, with predictions of 6%-8% and 4% to 6% respectively.

Mr Kusher says home values across the nation will mainly be driven higher by lower interest rates, population growth, significant stimulus programs from governments for first home-buyers and by competition among existing owner-occupiers looking to upgrade.

The details

Cameron Kusher is one of the best-known names in Australia when it comes to residential real estate.

Mr Kusher previously worked as the Head of Research at REA Group and also at Cotality (formerly CoreLogic).

He’s been an analyst at nationwide chain PRD Real Estate and worked as a property developer.

Cameron Kusher now runs his own independent property consultancy, publishing a regular newsletter called Oz Property Insights.

“Following a value change of +3.5% over the 24-25 FY, I expect that national dwelling values will rise between 6% and 8% in FY 25-26,” he says.

“This growth will be fuelled by lower interest rates, government support for first-home buyers, persistent strong population growth and insufficient new housing supply.”

Sydney

Despite having the most expensive housing in the country, Cameron Kusher says he expects that “demand will increase as interest rates fall.”

“I also expect some of the excess stock on the market for sale to be sold in the coming months.”

Given that, he believes home values will rise 6% to 8% this financial year in the Harbour City.

Melbourne

Cameron Kusher says Melbourne still has a lot of property for sale, and while he thinks that stock levels will ease, “higher taxes in the state and a weaker economy is likely to see a relative underperformance in terms of value increases.”

“Personally,” he says, “I think Melbourne is a good buy right now, but I am only anticipating value growth of 4% to 6% over the coming year.”

Nevertheless, Mr Kusher says the Victorian capital “could be the market to watch over the following year if value increases pan out as forecast.”

Brisbane

Cameron Kusher grew up and still lives in Brisbane, so he says he worries “about affordability and liveability of the region with infrastructure investment not keeping pace.”

“Brisbane is now an expensive market, but plenty of people are still coming across the border, and there is significant demand for construction workers and acute shortages of them.”

He says he expects values to rise 7% to 9% over the next 12 months.

Adelaide

Cameron Kusher says the supply of housing stock remains low in Adelaide, which “is still a relatively affordable market with a great lifestyle.”

He says lower interest rates this year should fuel more demand, and see values rise 7% to 9% over the year ahead.

Perth

Perth has been one of the standout markets for value growth over the past 3 years and Cameron Kusher doesn’t see much changing.

“A strong economy, strong population growth, great lifestyle, very little stock for sale and constrained new housing supply is likely to see strong growth in values over the coming year,” he says.

“The fact it is still relatively affordable and most homes are close to a beach is another tick for the market.”

He says he expects values to rise 9% to 11% this year.

Hobart

“There’s still a lot of stock on the market in Hobart, but relative to most other capital cities, it offers good value,” Mr Kusher says.

The challenge for the Tasmanian capital, he notes, is employment opportunities and the city’s ageing population.

He expects growth of 4% to 6% over 2025-26.

Darwin

Home prices in Darwin went backwards for many years after a mining boom which peaked in the mid-2010s.

However, the city has finally clawed back those lost gains and is at a new price peak.

“The region enjoys strong employment opportunities, strong rental demand from a transient population and very attractive rental returns plus affordable housing relative to other capital cities,” Cameron Kusher says.

He expects it to be one of the best-performing capital city markets, predicting a 9% to 11% uplift over the next 12 months.

Canberra

Cameron Kusher says Canberra still has quite a lot of established stock for sale and has been one of the best performers in terms of building new housing over recent years.

However, he points out that new housing stock coming on line has slowed substantially over the past year.

“I think Canberra could see stronger growth than most are expecting,” he says, “with values rising between 5% and 7% this year.”

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20Scott%20Kuru%20DPU%20148.jpg?width=1920&height=1080&name=Australia%20Is%20on%20the%20Brink%20of%20History%E2%80%99s%20Worst%20Mortgage%20Default%20Crisis%20(Housing%20Crash%20Inevitable)%20Scott%20Kuru%20DPU%20148.jpg)

%20Scott%20Kuru%20DPU%20147.jpg?width=1920&height=1080&name=RBA%20Warns%20Inflation%20Has%20Pushed%20Australia%20Into%20Household%20Recession%20(Millions%20Face%20Pay%20Cuts%20in%202026)%20Scott%20Kuru%20DPU%20147.jpg)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)