Features > Property News & Insights > Investment News

Are Perth’s property fortunes totally reliant on the price of iron ore?

KEY POINTS

- Historically, the fortunes of Perth’s property market have been linked to mining

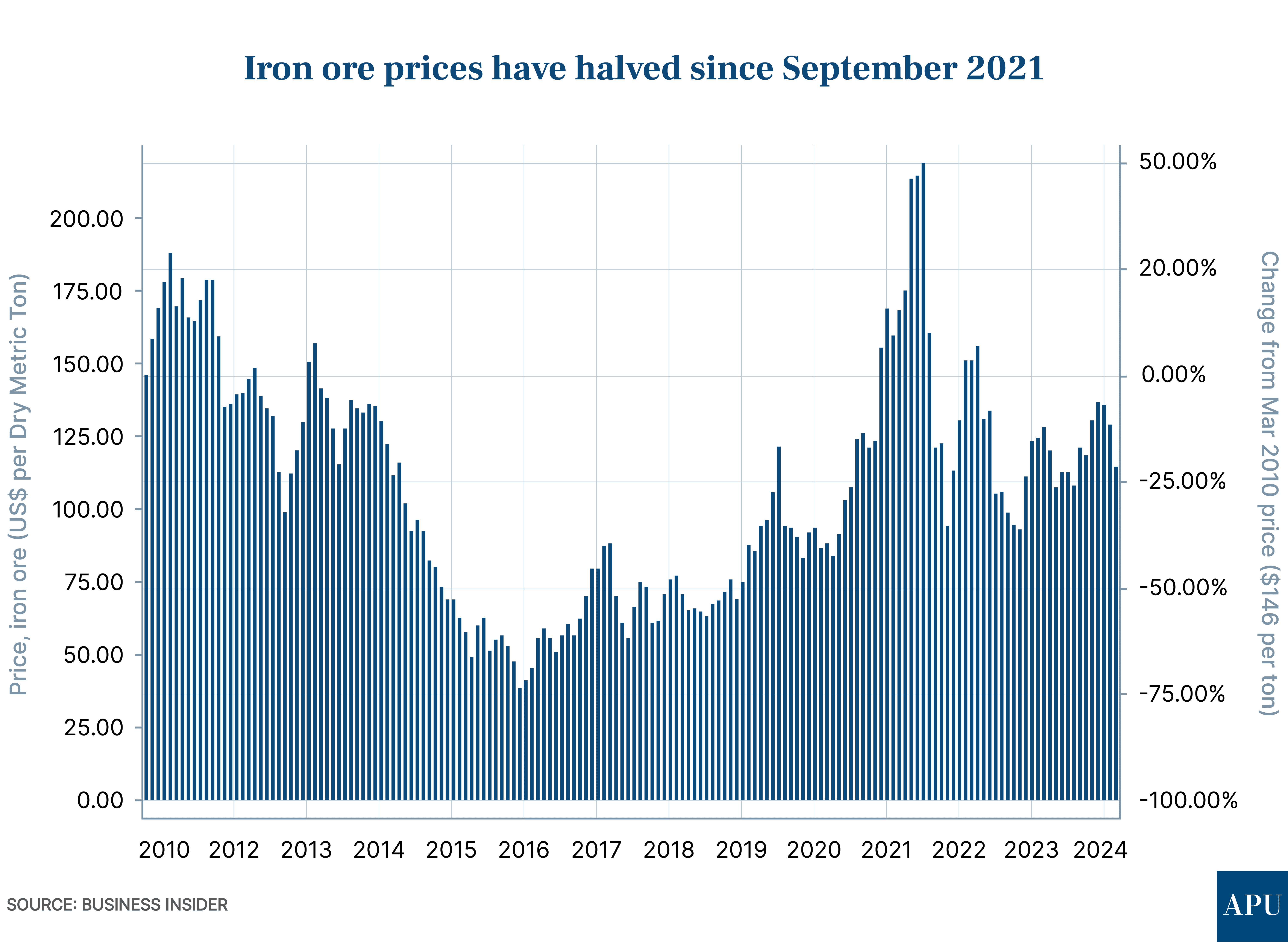

- Iron ore prices have halved since a peak of $US218 a tonne in September 2021

- However, Perth property values have actually accelerated since the iron ore downturn began

- Strong population growth is helping to drive the WA economy

- Prices in the WA capital have grown by more than 5% in just the last three months

There’s no doubt that Perth has been one of the stand-out performers when it comes to growth in property values over the last few years.

CoreLogic data shows home values in the Western Australian capital have soared by 52.9% since the onset of COVID-19 in March 2020.

Compare that to Sydney on 24.8% and Melbourne, which has only managed 11% growth in 4 years.

Although the gains in Brisbane (53.5%) and Adelaide (55.3%) have been slightly larger, Perth is now growing at a faster rate, with home values increasing by 18.3% in the past 12 months, partly driven by a chronic housing shortage in the WA capital.

An affordable entry point compared to the east coast capitals, strong price growth, low vacancy rates, and strong rental yields have also made the city a magnet for interstate investors.

But will it last?

Is Perth just a “boom and bust” mining town?

Recently, realestate.com.au questioned whether Perth’s property boom would continue, in the face of falling iron ore prices.

Iron ore is Australia's largest and most valuable export commodity, with most mines concentrated in WA’s Pilbara region.

In the 2021-22 financial year, it’s estimated miners made $133 billion in export earnings from iron ore.

Western Australia’s “heavy reliance on resources - particularly iron ore - has raised concerns over whether many are jumping on the property wave without considering the lessons of the last mining downturn, which saw home prices trade sideways for most of the last decade,” wrote property writer Kirsten Craze.

She quoted Perth real estate agent Ben Keevers.

“We've had a huge amount of growth in such a short period, and history shows us that it can also come off fairly quickly,” the Ray White North Beach agent said.

The price of iron ore has fallen nearly 20% so far this year in the face of easing demand from Chinese steel mills.

Expected weaker demand from China has also affected the medium-term outlook for iron ore, with some forecasters predicting it will be trading as low as $US85 a tonne by the end of next year.

That’s obviously a long way from the high of $US218 a tonne the commodity was trading at in September 2021.

However, it’s worth noting that since those record iron ore prices two and a half years ago, property price growth in Perth has actually accelerated - as the price of iron ore has halved.

So is it different this time?

While the outlook for growth in iron ore prices may be muted, there’s plenty of evidence to suggest that we’re unlikely to see a repeat of the scenario where Perth home values go backwards, as they did after the last mining boom.

According to REA Group’s PropTrack, Perth’s median dwelling price was $520,000 in mid-2014, but slipped down to $460,000 by the end of 2019.

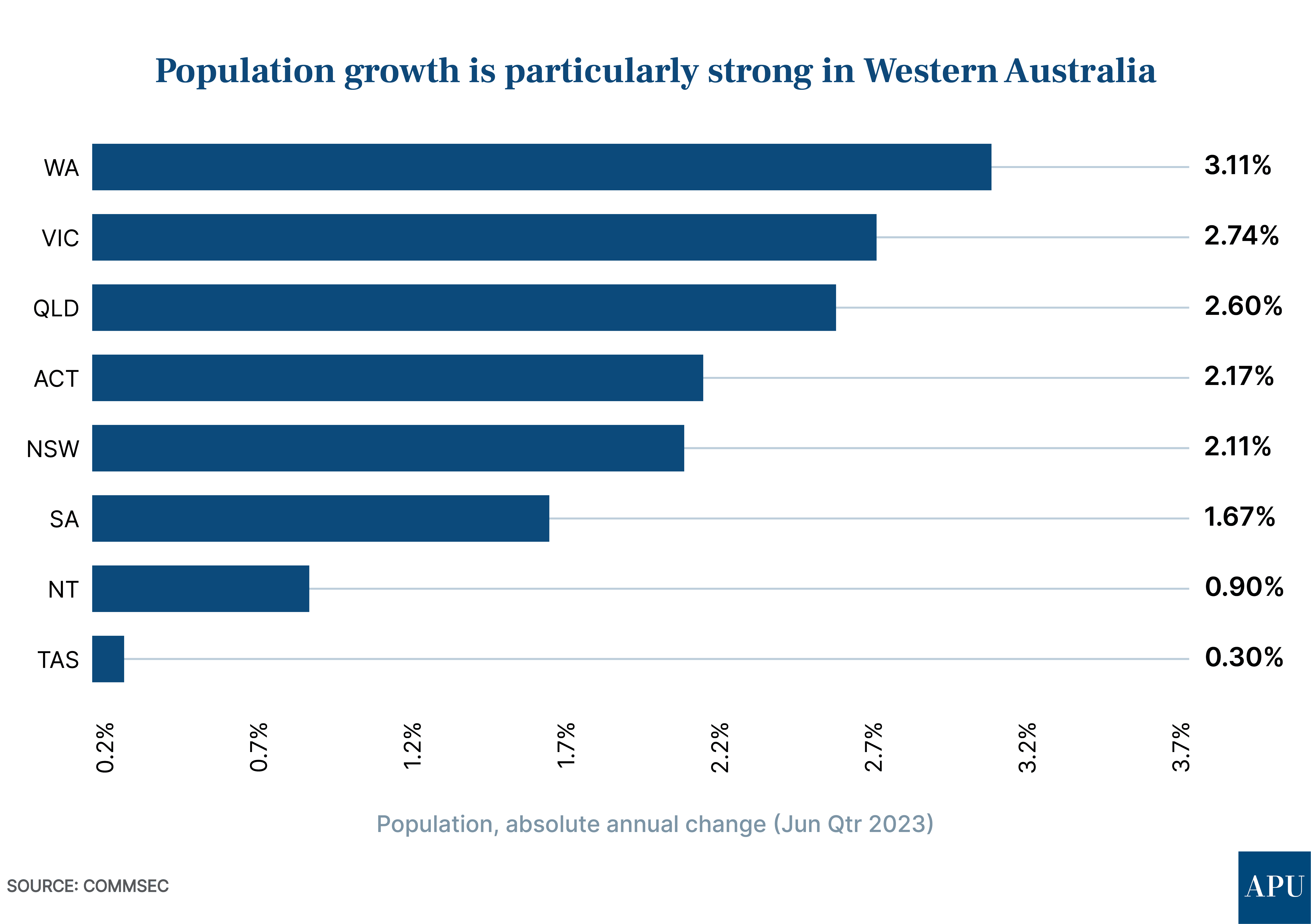

The key reason Perth values are likely to keep heading up is strong population growth.

CommSec’s latest “State of the States” report ranked Western Australia number one for population growth - in both absolute and relative terms.

“Western Australia is the strongest on relative population growth, with its 3.11% annual population growth rate 115.2% above the decade average for the year to the June quarter 2023,” the report states.

“Population growth is clearly an important driver of the broader economy, especially retail spending and housing demand.”

Perth-based investment group DPN also points out that “Perth’s skilled migrant intake is higher than the national average and is forecast to remain higher for at least the next five years.”

That tends to suggest a diversification of the Western Australia economy away from mining.

DPN also suggests that demographic trends in the West will sustain population and property price growth.

“Despite having an ageing population like the rest of Australia, more children are likely to be on the way in the short-to-medium term due to the influx of young migrant families.

“Migrants are increasingly coming to Western Australia from India, the Philippines and South Africa, and their average age is early 30s, which is lower than the average age of migrants coming to Australia in general,” DPN says.

Chronic housing shortage

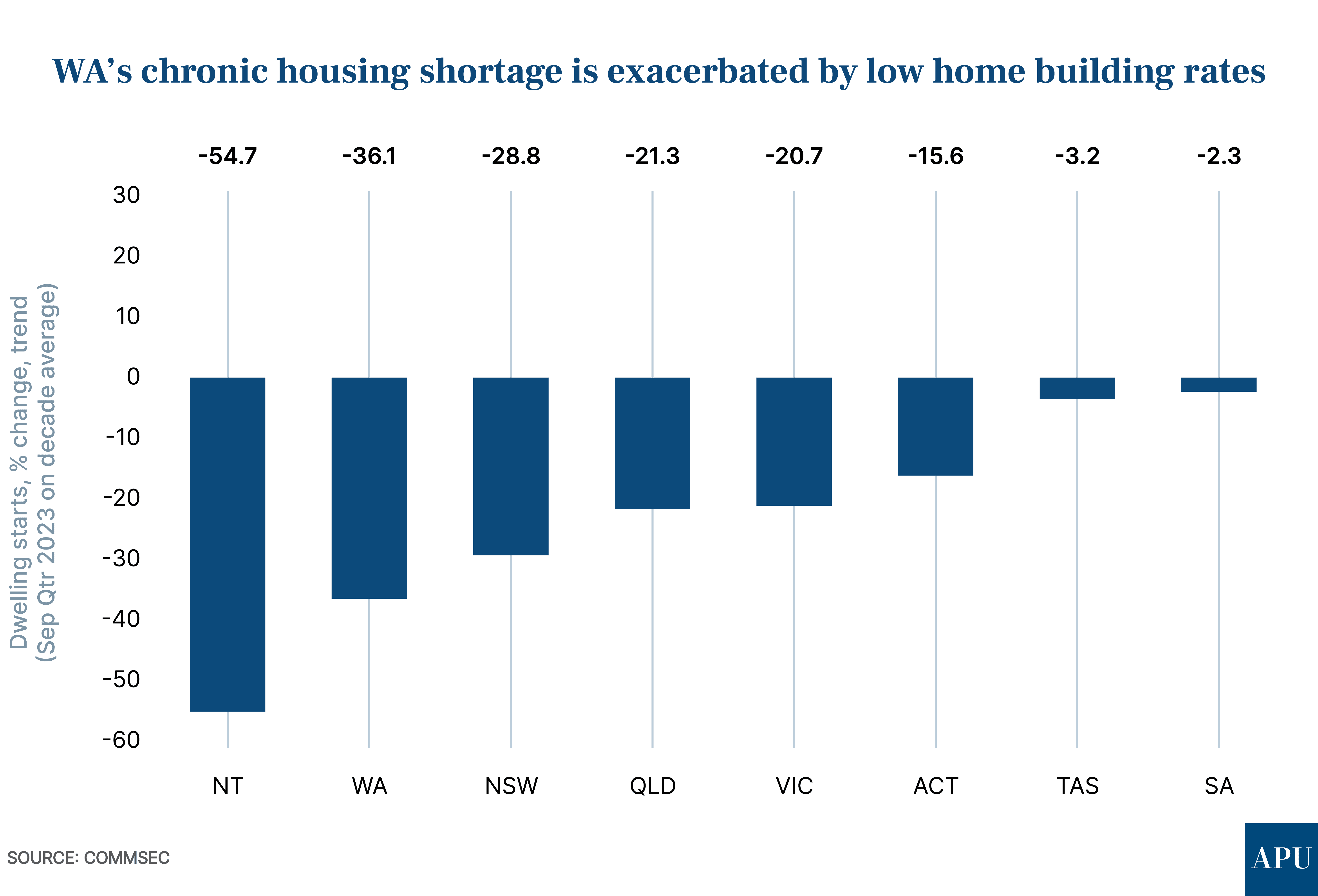

The other major factor investors should consider when looking at the outlook for Perth and Western Australia is that the current chronic housing shortage shows no sign of abating.

That’s likely to keep a floor under home prices.

While WA may have topped CommSec’s latest report when it comes to population growth, the state came a dismal second last when it came to measuring dwelling starts, a whopping -36.1% below the decade average.

PropTrack economist Angus Moore says it’s a particularly challenging time for renters in Perth with “vacancy rates sitting below 1%, and they’ve been sitting around that mark since 2021.”

PropTrack is forecasting price growth of between 5-8% in Perth this year.

“We’re not going to see the same increases as last year because prices have already grown strongly,” says Angus Moore, but notes that Perth is “still relatively affordable compared to other places, we're seeing very low unemployment, wages are growing and supply remains restricted.”

It’s worth noting that PropTrack’s forecasts are conservative, with National Australia Bank economists predicting 9.9% growth in home prices in Perth this year and ANZ 10-11%.

As of the 18th of March, CoreLogic’s Home Value Index recorded there had been 5.1% growth in Perth home prices just across the last quarter (since the 18th of December 2023).

Will that growth continue?

“Obviously this pace of growth can’t be sustained indefinitely, but a 15%+ rise in values over the calendar year doesn’t look to be out of the question,” says CoreLogic’s Research Director, Tim Lawless.

That doesn’t sound like a market suffering the effects of a slump in iron ore prices.

Stay Up to Date

with the Latest Australian Property News, Insights & Education.

.png?width=292&height=292&name=Copy%20Link%20(1).png)

SIGN UP FOR FREE NEWSLETTER

SIGN UP FOR FREE NEWSLETTER

%20(1).png)

.png)

%20Scott%20Kuru%20DPU%20145.jpg?width=1920&height=1080&name=Senate%20Inquiry%20Forced%20the%20RBA%20to%20Admit%20the%20Housing%20Crisis%20Will%20Never%20Be%20Fixed%20(It%20Was%20All%20a%20Lie)%20Scott%20Kuru%20DPU%20145.jpg)

%20Scott%20Kuru%20DPU%20141.jpg?width=1920&height=1080&name=The%20Senate%20Just%20Exposed%20Australias%20Biggest%20$80%20Billion%20Housing%20Fraud%20(Inquiry%20Launched)%20Scott%20Kuru%20DPU%20141.jpg)

%20Scott%20Kuru%20DPU136.jpg?width=1920&height=1080&name=Aussies%20Just%20Got%20Hit%20With%20Double%20Taxes%20on%20Everything%20(This%20Has%20Gone%20Too%20Far)%20Scott%20Kuru%20DPU136.jpg)

%20Scott%20Kuru%20DPU%20133.jpg?width=1920&height=1080&name=JUST%20IN%20Something%20Major%20Just%20Flipped%20Australia%E2%80%99s%20Property%20Market%20for%202026%20(No%20One%20Saw%20This%20Coming)%20Scott%20Kuru%20DPU%20133.jpg)

.jpg?width=1920&height=1080&name=Rental%20Prices%20At%20Record%20Highs%20And%20Vacancy%20Rates%20At%20All%20Time%20Lows%20(New%20Data%20Reveals).jpg)

%20%20DPU%20EP%2014.jpg?width=1920&height=1080&name=Investors%20Shutting%20Out%20First%20Home%20Buyers%20(Investors%20At%20Record%20Highs)%20%20DPU%20EP%2014.jpg)

.jpg?width=1920&height=1080&name=Darwins%20Property%20Market%20Boom%20or%20Dangerous%20Gamble%20(REVEALED).jpg)

.jpg?width=1920&height=1080&name=The%20RBA%E2%80%99s%20Rate%20Cut%20Could%20Explode%20House%20Prices%20(Here%E2%80%99s%20Why).jpg)

.jpg?width=1920&height=1080&name=Warning%2c%20You%20Might%20Be%20Facing%20Higher%20Taxes%20Soon%20(1).jpg)

.png?width=1920&height=1080&name=Rate%20Drops%20Signal%20BIGGEST%20Property%20Boom%20in%20DECADES%20(1).png)

.jpg?width=1920&height=1080&name=Labor%20vs%20Liberal%20These%20Housing%20Policies%20Could%20Change%20the%20Property%20Market%20Forever%20(1).jpg)

.jpg?width=1920&height=1080&name=QLD%20Slashes%20Stamp%20Duty%20Big%20News%20for%20Investors%20%26%20Home%20Buyers%20(1).jpg)

.jpg?width=1920&height=1080&name=Trump%20Just%20Slapped%20Tariffs%20%E2%80%93%20Here%E2%80%99s%20What%20It%20Means%20for%20Australia%20(1).jpg)

.jpg?width=1920&height=1080&name=Federal%20Budget%202025%20More%20Debt%2c%20No%20Housing%20%E2%80%93%20Here%E2%80%99s%20What%20You%20Need%20to%20Know%20(1).jpg)

.jpg?width=1920&height=1080&name=Australias%20Housing%20Crisis%20is%20about%20to%20get%20MUCH%20Worse%20(New%20Data%20Warns).jpg)

%20(1).jpg?width=1920&height=1080&name=Australias%20RENTAL%20CRISIS%20Hits%20ROCK%20BOTTOM!%20(2025%20Update)%20(1).jpg)

%20(1).png?width=1920&height=1080&name=Is%20Adelaide%20Still%20a%20Good%20Property%20Investment%20(2025%20UPDATE)%20(1).png)

.jpg?width=1920&height=1080&name=RBA%20Shocks%20with%20Rate%20Cuts!%20What%E2%80%99s%20Next%20for%20Property%20Investors%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=I%20Predict%20The%20Feb%20Rate%20Cut%20(My%20Price%20Growth%20Prediction)%20(1).jpg)

.png?width=1920&height=1080&name=Why%20Property%20Prices%20Will%20Rise%20in%202025%20Market%20Predictions%20(1).png)

.jpg?width=1920&height=1080&name=Why%20Investors%20Are%20Choosing%20Apartments%20Over%20Houses%202%20(1).jpg)

.jpg?width=1920&height=1080&name=Why%20Rate%20Cuts%20Will%20Trigger%20A%20Property%20Boom%20(1).jpg)

.jpg?width=1920&height=1080&name=Retire%20On%202Million%20With%20One%20Property%20(Using%20SMSF).jpg)

.jpg?width=1920&height=1080&name=4%20Reasons%20Why%20You%20Should%20Invest%20in%20Melbourne%20Now%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Old%20Property%20vs%20New%20Property%20(Facts%20and%20Figures%20Revealed)%20(1).jpg)

%20(1).jpg?width=1920&height=1080&name=Will%20The%20New%20QLD%20Govt%20Create%20a%20Property%20Boom%20or%20Bust%20(My%20Prediction)%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=Inflation%20Hits%20Three-Year%20Low%20(Will%20RBA%20Cut%20Rates%20Soon)%20Scott%20Kuru%20(1).jpg)

.jpg?width=1920&height=1080&name=How%20to%20Buy%20Investment%20Property%20Through%20SMSF_%20The%20Ultimate%20Guide%20(1).jpg)

.jpg?width=1920&height=1080&name=Victoria%20Slashes%20Stamp%20Duty%20Melbourne%20Set%20to%20Boom%20Scott%20Kuru%20(1).jpg)

.png?width=1571&height=861&name=Are%20Foreign%20Buyers%20Really%20Driving%20Up%20Australian%20Property%20Prices%20(1).png)

.jpg?width=1920&height=1080&name=The%20Single%20Factor%20That%20Predicts%20Property%20Growth%20Regions%20(1).jpg)

%20Scott%20Kuru%20(1).jpg?width=1920&height=1080&name=My%20Prediction%20On%20Rates%20%26%20Negative%20Gearing%20(Market%20Crash)%20Scott%20Kuru%20(1).jpg)

-1.png?width=1920&height=1080&name=Major%20Banks%20Cut%20Rates%20Will%20RBA%20Follow%20Suit%20(Sept%20Rate%20Update)-1.png)

%20Scott%20Kuru-1.png?width=1920&height=1080&name=Rate%20Cut%20Coming%20What%20New%20Zealands%20Move%20Means%20for%20Australia%20(Sept%20Prediction)%20Scott%20Kuru-1.png)

%20(1).jpg?width=1920&height=1080&name=Buy%20when%20the%20interest%20rates%20are%20high!%20(Why%20you%20must%20buy%20now!)%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Revised%20Taxes%20Due%20Aug%209%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Too%20Little%20Too%20Late%20Aug%207%20YT%20Thumbnail01%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Rate%20Drop%20In%20July%20Jun%2010%20YT%20Thumbnail02%20(1).jpg)

.jpg?width=1920&height=1080&name=Carms_Own%20a%20Property%20V6%20Jun%205_YT%20Thumbnail%20(1).jpg)

.png?width=1920&height=1080&name=Artboard%201%20(3).png)

.jpg?width=1920&height=1080&name=YT%20thumbnail%20%20(1).jpg)